Mergers and acquisitions analysts are responsible for analyzing industry prospects by gathering information about growth, competitors, and market share possibilities. They also review company fundamentals and financial statements as well build a mosaic to help upper-level managers make decisions on a deal.

They conduct research on prospective firms and prepare customized presentations for business executive teams. Moreover, they also contact prospective mergers and acquisitions and prepare appointments for prospective businesses to meet with corporate leadership and senior management. Further, they keep track of key metrics and ensure that the data collected is accurate. Lastly, they work both with internal and external technology teams to define associated systems and business processes.

Vskills Certified Merger and Acquisition Analyst: Overview

Vskills Merger and acquisition analyst certification will provide a brief overview of the techniques and practices involved in the process of mergers and acquisitions. And, it will help candidates to learn the working of mergers and acquisitions work. Moreover, this course will impart students with an invaluable foundation in strategies, regulations, closing a deal, pricing, and valuation. This certification validates the candidates knowledge on various concepts that include selecting acquisition targets, valuation, and capability to handle complex processes. These processes may include identifying acquisition strategies, closing the deal, thinking through integration issues, etc.

Vskills being India’s largest certification providers gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Course Outline for Certified Merger and Acquisition Analyst

Certified Merger and Acquisition Analyst covers the following topics –

Introduction to M & A

- Understanding Key terms

- Motivation behind M&A

- Fundamental of M&A

- Types of M&A Deals

- Stages in M&A

- Challenges of M&A deals

Seller’s perspective

- Selling Process and Decision Path

- Preparing for sale

- Preparation mistakes

- Understanding seller’s objective

- Post closing plans

Buyer’s perspective

Corporate Restructuring

- Meaning and Scope of restructuring

- Modes of corporate restructuring

- Planning, formulation and execution of corporate restructuring strategies

Management Process

- Risk Management

- Assumption Management

- Dependency Management

- Quality Management

- Cost Management

- Stakeholder Management

- Communications Management

- Issue Management

Legal Regulations

- Companies Act, 1956

- Competition Act, 2002

- Foreign Exchange Management Act, 1999

- SEBI Takeover Code, 1994

- Indian Income Tax Act, 1961

- SEBI (Buy-back of Securities) Regulations, 1998

- SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997

- SEBI (Delisting of Securities) Guidelines, 2003

Cross Border mergers and acquisition

- Trends and Pattern

- Reasons for Cross border deals

- Intensity of cross border deals

- Value involvement and route of acquisition

- Inbound and Outbound Cross Border M&A

Corporate demerger and reverse merger

- Concept and modes of demerger

- Demerger and voluntary winding up

- Procedural aspects of reverse merger

- Tax aspects and relief’s policies

Due diligence

Pricing and Valuation

- Key concepts of pricing

- Valuation overview

- Factors influencing valuation

- Methods of valuation

- Challenges in valuation

Funding Mergers and Takeovers

Negotiation and Bidding

Post Merger Integration

Post Acquisition Review

Post closing issue

Mergers and Acquisitions Career Path

From afar, investment banks’ mergers and acquisitions (M&A) divisions seem to be highly appealing to job-seeking graduates. At the graduate level, M&A is also one of the most challenging areas to enter into. Let us look at Mergers and Acquisitions Career Path.

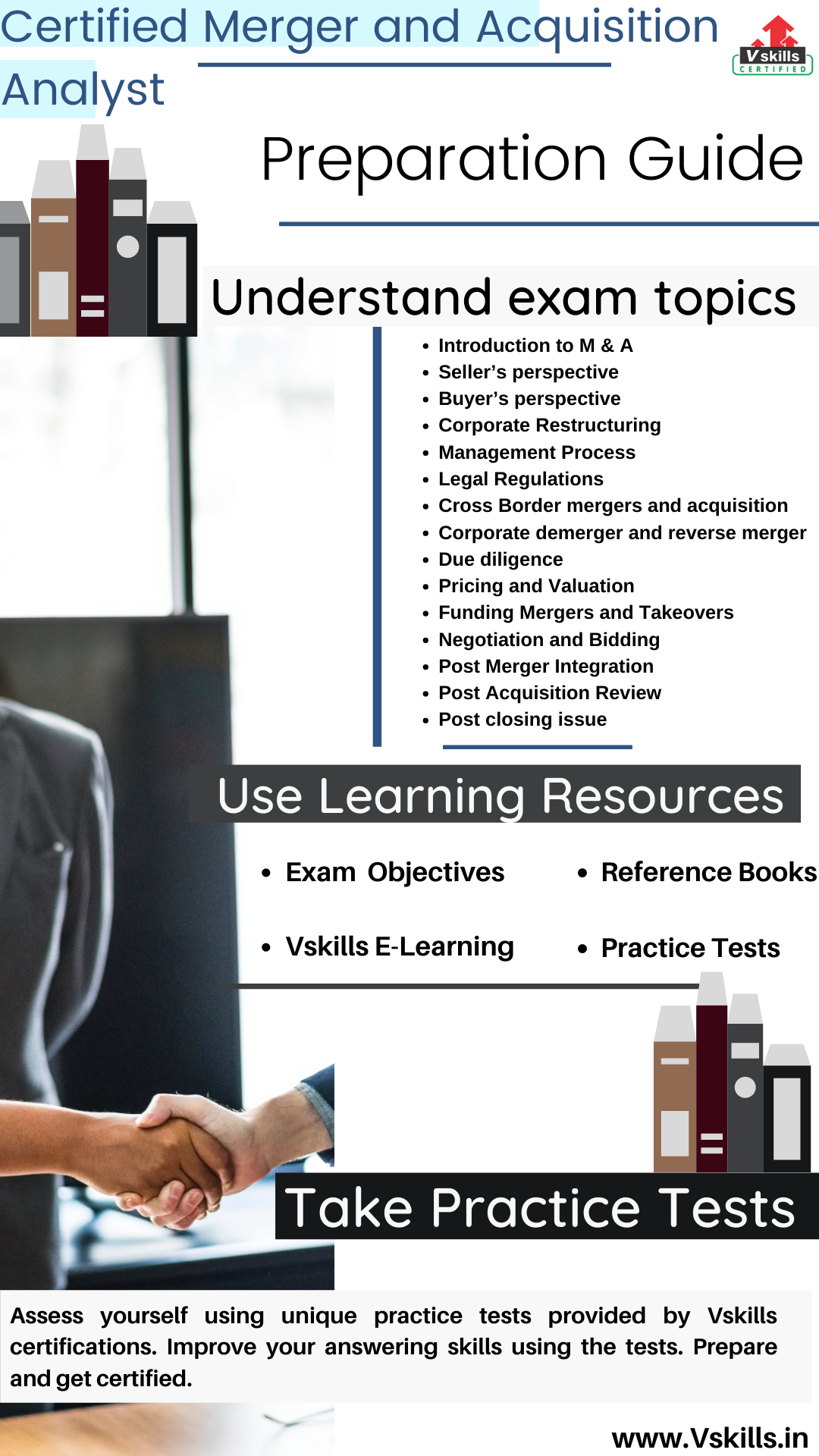

Preparation Guide for Vskills Certified Merger and Acquisition Analyst

Before starting preparing for the examination, candidates should get all the exam related resources. This is done so that the candidates can start preparation in a proper manner. Moreover, doing this will not only help them understand things better but it will also help them to quickly complete the syllabus. Further, this will provide an advantage to better understand the concepts. However, in the Certified Merger and Acquisition Analyst exam preparation guide, we will discuss some of the most important resources to help you prepare well for the exam.

Study Resource: Exam Objectives

For any exam, understanding exam objectives provide a huge benefit to candidates during the preparation time. So, before starting preparing, the first task should be to get all the exam-related details that include the important contents and its resources. Doing this will help candidates to understand things more accurately. For the Certified Merger and Acquisition Analyst the topics include:

- Introduction to M & A

- Seller’s perspective

- Buyer’s perspective

- Corporate Restructuring

- Management Process

- Legal Regulations

- Cross Border mergers and acquisition

- Corporate demerger and reverse merger

- Due diligence

- Pricing and Valuation

- Funding Mergers and Takeovers

- Negotiation and Bidding

- Post Merger Integration

- Post Acquisition Review

- Post closing issue

Study Resource: Vskills E-Learning

Vskills Certified Merger and Acquisition Analyst provides candidates access to prepare for the exam using the online learning material for a lifetime. The online material for this is regularly updated. Moreover, the e-learning that is provided comes with hard copy material for helping candidates to improve and update the learning curve for getting better opportunities.

Refer: Certified Merger and Acquisition Analyst Sample Chapter

Study Resource: Books for Reference

While preparing reference books can provide an advantage to learn and understand things more accurately. For the Certified Merger and Acquisition Analyst exam, there are various books available which you can find online or in libraries. Some of the books are as follows:

- Mergers & acquisitions from A to Z Book by Andrew Sherman

- Mergers & Acquisitions Integration Handbook Book by Scott C. Whitaker

Study Resource: Practice Test

After completing the topics for the Certified Merger and Acquisition Analyst exam, candidates should start assessing using practice tests. Using practice tests will help them for better preparation. By examining and assessing yourself with these tests candidates will know about their weak areas and improve them.

Prepare for Job Interview

Preparing for a role in Merger and Acquisition, then you must checkout these interview questions to prepare for the upcoming interview, these can prove handy in clearing the job interview, checkout for free !