Commodity Trader

Commodity Trader usually deals in buying or sell stocks, bonds, commodity futures, foreign currencies, or other securities at stock exchanges on behalf of investment dealers. To add on, this certification is beneficial for traders, research analysts, dealers, investors, treasury managers as well as students looking forward to a career in this sector. Also, commodity markets have significant growth potential with the ability to benefit from rapid Indian economic growth, government initiatives, and widening market participation.

Commodity Trader usually deals in buying or sell stocks, bonds, commodity futures, foreign currencies, or other securities at stock exchanges on behalf of investment dealers. To add on, this certification is beneficial for traders, research analysts, dealers, investors, treasury managers as well as students looking forward to a career in this sector. Also, commodity markets have significant growth potential with the ability to benefit from rapid Indian economic growth, government initiatives, and widening market participation.

Commodity Trader: Roles and Responsibilities

As a Certified Commodity Trader, you will be responsible for monitoring market positions. Along with this, you will be tracking and analyze factors that affect price movements, such as trade policies, weather conditions, political developments, or supply and demand changes. To add on, you will be responsible for identifying or pursuing investment strategies related to the green economy, including green hedge funds, renewable energy markets, or clean technology investment opportunities.

Vskills Certified Commodity Trader

The Vskills Certified Commodity Trader lays emphasis on developing relevant skills and knowledge required. Also, It enhances the candidate’s thinking and analytic ability. To add on, with this certification you will be able to get an understanding of the commodity market and practical aspects of commodities trading. The certification focuses on imparting the necessary knowledge to acquaint the candidate with the operations and functionalities of commodities and the derivatives market in India.

Benefits of the Certification

- Being a Commodity Trader is not an easy job. However, with the Vskills certification, you will develop and learn all the skills and knowledge required in this domain.

-

The certification is beneficial for traders, research analysts, dealers, investors, treasury managers as well as students looking forward to a career in this sector. Vskills Certified Commodity Trader can look forward to rewarding career opportunities with commodities exchanges, retail firms, banks, mutual funds, broking firms, FMCG companies, etc.

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

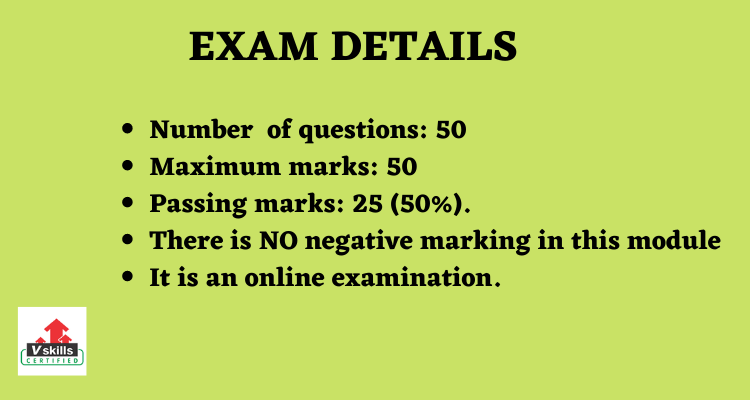

Test Details

- Exam Duration: 60 minutes

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%).

- There is NO negative marking in this module

- It is an online examination

Course Outline

Introduction to Commodity Markets

- Commodity Exchanges in India

- Global Commodity Markets

- History of Commodity Derivatives in India

- Policy Initiatives

- Structure of the Indian Commodity Market

- Parties of a Commodity Exchange & Trading

- Latest Development

- Benefits of Commodity Markets

Commodity Exchange Markets

- The Role of Commodity Exchanges

- List of Commodity Exchanges in India

- Types of Commodities Traded in India

- Active Commodities & Contracts on MCX

- Active Commodities & Contracts on the NCDEX

Segments in Commodity Markets

- OTC Markets

- Exchange Traded Commodities

- Spot Markets

- Difference between Spot Vs Forward Transaction

- Exchange Traded Vs. OTC

Derivatives

Commodity and Financial Derivatives

- Physical settlement

- Delivery & Assignment

- Warehousing

- Forward Contracts

- Introduction to Futures

- Pricing Commodity Futures

Hedging and Speculation

- Methods of Hedging

- Short Hedge

- Long Hedge

- Hedge Ratio

- Advantages and Disadvantages of Hedging

- Speculation: Bullish Commodity, Buy Futures

- Advantages and Disadvantages of Speculation

Introduction to Options

Trading

- Futures Trading System

- Entities in the Trading System

- Commodity Futures Trading Cycle

- Order Types and Trading Parameters

- Order Entry on the Trading System

- Margins for Trading in Futures

- Charges

- Hedge Limits

Clearing and Settlement

Risk Management & Margining

Electronic Spot Exchange

Regulatory Framework

- Rules Governing commodity derivatives exchanges / participants

- Rules Governing Trading & Clearing on the Exchange

- Rules Governing Investor Grievances, Arbitration

- Implications of VAT

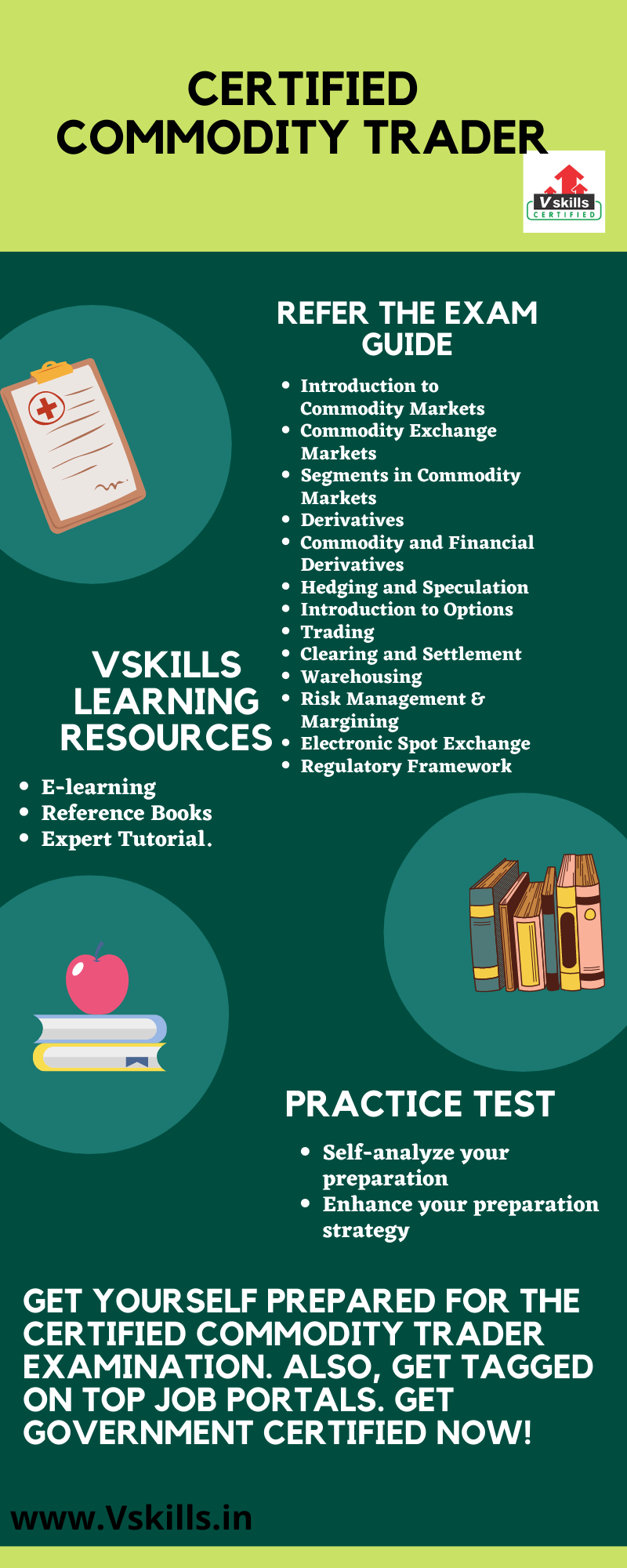

Preparatory Guide for Certified Commodity Trader

It is important to follow a proper exam guide and structure when comes to preparing for an examination. Therefore, for the Vskills Certified Commodity Trader, In conclusion, we have curated a preparation guide to ease your preparation. Let’s get started:

Study Resource: Exam Objectives

Before preparing for any examination, it is important to know the exam related details and topics. This will help candidates to easily start preparing for the exam. Also, for the Vskills Certified Commodity Trader, the exam topics to refer to are:

- Introduction to Commodity Markets

- Commodity Exchange Markets

- Segments in Commodity Markets

- Derivatives

- Commodity and Financial Derivatives

- Hedging and Speculation

- Introduction to Options

- Trading

- Clearing and Settlement

- Warehousing

- Risk Management & Margining

- Electronic Spot Exchange

- Regulatory Framework

Refer: Vskills Certified Commodity Trader Brochure

Study Resource: Vskills E-Learning

For the Vskills Certified Commodity Trader examination, our team has provided online study material. Also, this online material for this is regularly updated. Furthermore, e-learning is bundled with hard copy material which helps candidates to improve and update the learning curve for superior and better opportunities.

Refer: Vskills Certified Commodity Trader Sample Chapter

Study Resource: Reference Books

Books are man’s best friend. It is important to prepare for the right books. To ease out your hunt for books we have provided a list of books which you can refer to:

- Higher Probability Commodity Trading

- 36 Strategies for Striking it Rich in Commodity Trading

Study Resource: Practice Test

After studying for the examination, it is important to practice sample papers. Practising sample test will help you analyze your weak areas and strengths. Moreover, you will be able to improve your answering skills that will result in saving a lot of time. So, make sure to find the best practice sources.

Job Interview Questions

If you are preparing for a role in Biopharmaceutical, then you must checkout these online interview questions to crack the job interview with ease. Try for free Now !