Calculating Initial Margin

Let’s learn more about calculating initial margin. Exchange uses the SPAN system for real-time initial margin computation. Initial margin requirements are based on 99.95% VaR over a one-day session.

For members, the initial margin requirements are:

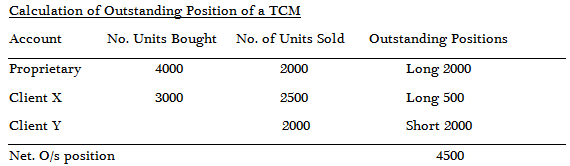

- For client positions: Client positions are netted for each individual client and grossed for all clients combined at the member level with no set-offs between clients themselves.

- For proprietary positions: These positions are netted at member level with no set-offs between client and proprietary positions.

This is explained through an example: A trading member has proprietary and client-level positions in a `July 2012 gold futures contract. On the proprietary account, 4000 trading units are bought and 2000 trading units are sold in one trading session. On the account of client X, 3000 trading units are bought at the beginning of the day and 2500 units are sold an hour later. And on account of client Y, 1000 trading units are sold. Hence, by looking at the table below, it is understood how the initial margin will be calculated. Fed regulations currently require that initial margin is set at a minimum of 50% of a security’s purchase price. But exchanges can set initial margin requirements higher than the Fed minimum.