Introduction

The Concept of VAT is a very popular system of Taxation which emerged in European Countries. The VAT system is adopted by most of the countries to bring about user-convenience and transparency in the entire system of taxation. The working system of VAT is simple to follow, implement and administer.

VAT stands for Value Added Tax. In this system, the tax is levied on the value of the good and charged at every level of Value addition i.e., on the Value added portion of goods at each level.

The earlier system of Taxation was allowing the levy of tax on tax. This ultimately lead to wrong assessment of Tax liability and tax evasion. The concept of VAT resolved the cascading effect of Taxes resulting in prevention of Tax evasions.

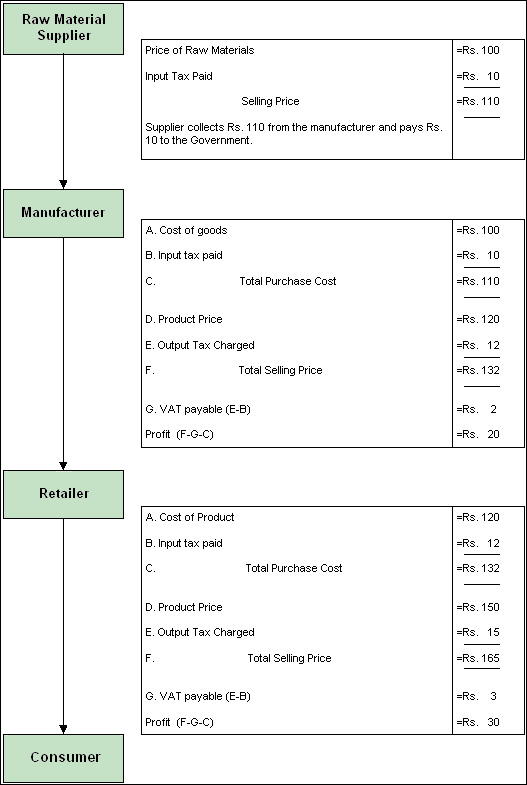

The VAT system levies tax on every level of Value addition to the product or good. At the same time the tax paid for acquiring this product or good will be allowed as tax credit and can be used for payment of VAT at the time of selling the product or good to the immediate dealer. The net effect of tax will be only on the portion of Value added by the seller. The following example clearly explains the flow of VAT system and its effect on the Selling price.

VAT Payable = Output Tax – Input Tax

Calculation of VAT

Enabling VAT Feature

To enable VAT in Tally.ERP 9,

Go to Gateway of Tally > F11: Features> F3: Statutory & Taxation

- In theStatutory & TaxationFeatures,

- SetEnable Value Added Tax (VAT) to Yes

- EnableSet/Alter VAT Details

2. Press Enter to view the Company VAT Details screen.

- In theCompany VAT Detailsscreen, specify the VAT Details and return form specific Additional Information.

- UnderVAT Details section:

- Select theState as Karnataka

- Select theType of Dealer as applicable based on the type of registration made by the dealer’s with the VAT Department. In this section, the procedure pertaining to Regular dealer is being explained. Hence, select the Type of Dealer as Regular

Then enter the addition information as mentioned in the image.