The determination of break-even point of a firm is an important factor in assessing its profitability. It is a valuable control technique and planning device in any business enterprise. It depicts the relation between total cost and total revenue ay at the level of a particular output. If an entrepreneur is aware of the product cost and its selling price, he can plan the volume of his sale in order to achieve a certain level of profit. The break-even point is determined as that point of sales volume at which the total cost and total revenue are identical. This will facilitate you address the following questions: –

- How do expenses (cost) behave in relation to volume of production / sales?

- What minimum sales are to be achieved to reach the point of no profit – no loss?

- How profits are sensitive to variations in sales?

- What is the quantum of business risk of unit?

- Whether the expansion or diversification reducing the business or not?

The amount of sales revenue should be readily available on your income as “Net Sales”. Net sales revenue is all sales revenue (often called gross revenue) less any sales returns and allowances or sales discounts. If the business is brand new and there is no income statement yet, a projected sales figure will need to be used.

Definition

The simple definition of a break-even point is the volume of sales needed for a business to generate zero profit.

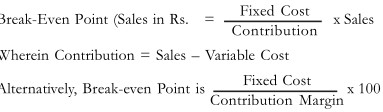

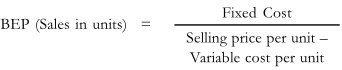

Therefore a decline in break-even point annually is a good sign of improvement. Further, you may also need the cost data to be converted into per unit basis, because you would like to know at what stage of units of production break-even can be had. For this, Break- Even Point in units (in terms of capacity utilization) can be computed as under:

In another way, A break-even analysis shows, you when you’ve started to make a profit. One useful tool in tracking your business’s cash flow will be break-even analysis. It is a fairly simple calculation and can prove very helpful in deciding whether to make an equipment purchase or just to know how close you are to your break-even level. Here are the variables needed to compute a break-even sales analysis:

- Gross profit margin all holdings will be lost anyway. If managed early enough, a

- Operating expenses (less depreciation)

- Total of monthly debt payments for the year (annual debt service)

Since we are dealing with cash flow and depreciation is a non-cash expense, it is subtracted from the operating expenses. The break-even calculation for sales is:

Break-even Sales = (Operating Expenses + Annual Debt Service) / Gross Profit Margin

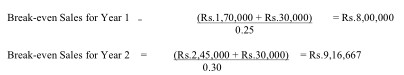

Let’s use ABC Clothing as an example and compute this company’s break-even sales for Years 1 and 2:

It is apparent from these calculations that ABC Clothing was well ahead of break-even sales both in Year 1 (Rs.1 million sales) and Year 2 (Rs.1.5 million).

Break-even analysis also can be used to calculate break-even sales needed for the other variables in the equation. Let’s say the owner of ABC Clothing was confident he could generate sales of Rs.7,50,000 and the company’s operating expenses are Rs.1,70,000 with Rs.30,000 in annual current maturities of long-term debt. The break-even gross margin needed would be calculated as follows:

Now, you can use ABC Clothing to determine the break-even operating expenses. If we know that the gross profit margin is 25 percent, the sales are Rs.750,000 and the current maturities of long-term debt are Rs.30,000, we can calculate the breakeven operating expenses as follows:

Break-even operating expenses = (0.25 x Rs.7,50,000) – Rs.30,000 = Rs.1,57,500

Another question that arises in you mind is, how can you figure out what will be the breakeven point? The answer for the same is breakeven point. Every company has one, though many are rather clueless as to what it is. For many, it’s not even considered until that embarrassing meeting when the banker or investor gets that serious look in his or her eye and inquires about the company’s breakeven point.

To perform the break-even analysis behavioral classification of cost is required. On the basis of behavioral classification cost can be divided into variable, fixed and semi-variable cost.

The cost that varies according to changes in volume of sales is called variable cost. Cost of raw material, spares, power and fuel, factory wages and other manufacturing expenses are examples of variable cost.