Obligor risks are studied to understand the probability of credit loss (viz. credit risk) from a single customer. The construction of a healthy credit portfolio requires careful selection of obligor risks.

Operational Risks

Operational risk is defined as the risk of direct or indirect loss resulting from inadequate or failed internal processes, people and systems, or from external events. The definition also includes legal risks resulting from regulatory actions and private settlements. Risks resulting from strategic business decisions and loss or damage of reputation are not included.

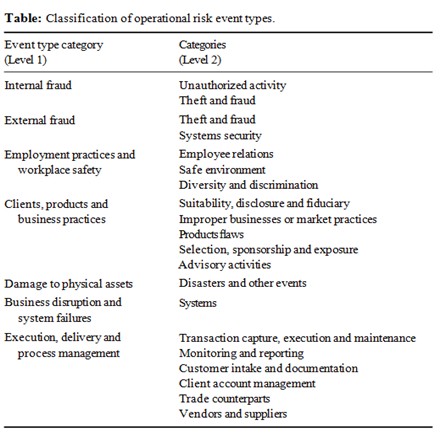

A classification of operational risk types is provided in the below table with the Basel II definition:

- Internal fraud: Losses due to acts of a type intended to commit fraud, misappropriate property or circumvent regulations, the law or company policy, excluding diversity/discrimination events, which involves at least one internal party.

- External fraud: Losses due to acts of a type intended to defraud, misappropriate property or circumvent the law, by a third party.

- Employment practices and workplace safety: Losses arising from acts inconsistent with employment, health or safety laws or agreements, from payment of personal injury claims, or from diversity/discrimination events.

- Clients, products and business practices: Losses arising from an unintentional or negligent failure to meet a professional obligation to specific clients (including fiduciary and suitability requirements), or from the nature or design of a product.

- Damage to physical assets: Losses arising from loss or damage to physical assets from natural disaster or other events. Business disruption and system failures: Losses arising from disruption of business or system failure.

- Execution, delivery and process management: Losses from failed transaction processing or process management, from relations with trade counterparts and vendors.

Examples of operational risk include a bank robbery, fraud, forgery, technology risk, hacking damage, failure of a major computer system, a human error where an equity sale order of a customer is entered as a buy order, money laundering, model errors, earthquakes, and so on.

Operational risk has a close relation with insurance risk, where the loss probabilities also depend both on the frequency and the severity of the events. The resulting risk depends strongly on the type of activity. Payment and settlement activities are considered as more risky than retail brokerage. Both frequency and severity can be reduced by increased risk management and internal controls. Increased supervision and control will certainly reduce the number of human errors. It is an important incentive of the Basel II Capital Accord to put in place a properly implemented operational risk management system that can manage and contain operational risk events at an early stage. Detailed contracts drawn up by a legal specialist, e.g., may reduce legal risk, while effective fraud detection systems can avoid large losses.

External Risks

External risks are those risks that cannot be controlled by the business itself. Such risks include natural disasters, government regulation changes, political instability, technological changes etc. In this section, two major external risks are discussed in detail: Business Cycle and Economic Variables.

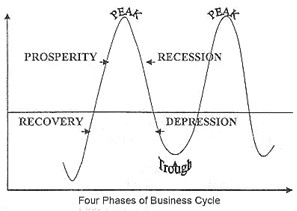

Business Cycle: The business cycle is the recurring up-and-down movements in economic activity, measured by fluctuations in real GDP and other macroeconomic variables (discussed in the next section). Business Cycle (or Trade Cycle) is categorized into four phases:-

- Prosperity Phase: When there is an increase in output, income, employment, prices and profits, it results in a higher standard of living. The features of this phase are:-

- Increase output and trade.

- Increase in demand.

- Increase in income and employment.

- Rising interest rates.

- Increase in bank credit.

- Overall business optimism.

- A high level of Marginal efficiency of capital and investment.

- Recession Phase: After reaching the peak, the path down toward depression is termed as Recession Phase. Here, the economic activities become slow. As the demand starts falling, the overproduction and future investment plans slow down as well. There is a steady decline in the output and the relevant profits. This reduces investment and the banks and the people try to get greater liquidity, and therefore credit also contracts. Because of falling business activity, income stops and unemployment increases. The increase in unemployment causes a sharp decline in income and aggregate demand.

- Depression Phase: In continuation to recession, there is a fall in the standard of living and depression sets in. The features of this phase are :-

- Decrease in volume of output.

- Decrease in income and increase in unemployment.

- Decline in consumption and demand.

- Fall in interest rate.

- Contraction of bank credit.

- Negative business sentiment.

- Fall in Marginal efficiency of capital and investment.

- Recovery Phase: The phase following depression where expansion begins is termed as Recovery or Revival During this time, there are expansions and there is a rise in economic activities. As the demand starts going up, production increases. This results in an increase in investment. There is an increase in output, income, employment, prices and profits. The business sentiment starts to improve and investment grows which brings about the recovery of the economy. With this, the banks expand credit and business expands. There is an increase in employment, production, income and aggregate demand, prices and profits start rising, and business expands. The revival turns into the prosperity phase again.

Economic Variables

- Inflation: This is an event in which there is a rise in the general level of prices of goods and services in an economy over a period of time. When this happens, each unit of currency buys lesser goods and services. As a result, inflation also causes erosion in the purchasing power of money. There are many different factors that determine the rate of inflation.

- Cost-push inflation arises when external factors have an adverse impact on the supply of goods or services (disruptions to the flow of oil or other commodities, impact of bad weather on the supply and availability of food, which cause prices to rise).

- Demand-pull inflation takes place in strong economies with strong demand for goods and services. This causes their prices to rise. A strong economy often results in shortages of labour in particular sectors and results in higher wages causing faster inflation.

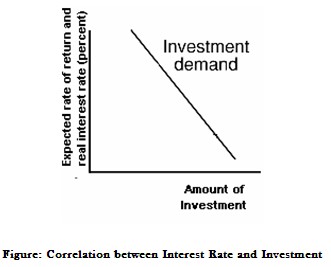

- Interest Rate: An interest rate is the cost that a borrower pays a lender for borrowing a principal sum for a period of time. The rate a percentage payable per annum on the amount borrowed. There are numerous interest rates with differences in rates depicting many factors. These include:

- the time period of a loan

- its terms and conditions and flexibility

- whether the loan is unsecured

- if the loan is secured the strength of the security used as backing for a loan

- the risk assessment of the borrower which takes account of financial circumstances and credit history

- the purpose of the loan and viability of any business or investment plans or proposals

- whether the interest rate is fixed for the term of the loan or floats (changes) as economic and financial circumstances change the currency of the transaction.

Interest rates on individual loans show the level of risk involved. The higher the risk the more lenders expect for their money. Hence, interest rates are structured with interest rates rising as the perceived level of risk increases. For instance, financial institutions will levy farmers a higher interest rate for unsecured loans such as overdrafts than for loans backed by an asset such as land.

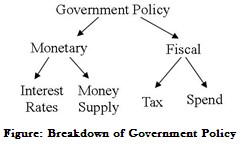

- Monetary policy: It is the process by which the central bank controls the money supply, by using its authority to change short-term interest rates. The purpose is to ensure economic stability by targeting a good rate of economic growth to promote employment and ensure low inflation. The RBI is responsible for conducting monetary policy. The RBI’s main role is to control inflation, maintain full employment, and promote economic prosperity.

- Exchange rates: An exchange rate between two currencies is the rate at which one currency is exchanged for the other. There are many factors that determine the exchange rate of a particular currency. In most cases, these factors include economic conditions, the rate of inflation, the level of interest rates, and the balance of payments.

Changes in international commodity prices have an adverse effect on the exchange rates of the currencies of particular countries and this is the case in India with its large agricultural sector having a major impact on economic prospects and the balance of payments.

- Fiscal policy: This policy is the used for government spending and revenue (tax) decisions to influence economic conditions and the economic outlook. It is used in conjunction with monetary policy, the other major lever of economic policy.

Every year, spending and tax changes are detailed in government. Individual taxes may be newly established, eliminated, or changed to improve the economic efficiency or to improve particular sectors. The fiscal policy is however concerned with overall revenue and spending decisions which have the objective of ensuring an environment conducive to economic prosperity.

A primary focus of the annual budget is on the bottom line. This is the surplus or deficit that is created from total government revenue and spending. When conditions of the economy are weak, then the government increases its own spending, cuts taxes, and incur budget deficits in order to provide economic stimulus. This was the course of action implemented by many global governments to help to minimise the detrimental impact of the global economic crisis in 2008.

Industry Risks

Industry Life Cycle

The industry life cycle model, presented by Michael Porter, says that the industry is the most significant entity of the business environment.

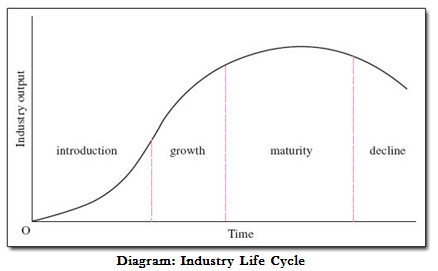

The model of the industry life cycle represents an industry through the stages of birth, growth, maturity and decline. The industry life cycle is a systematic way of viewing patterns of structural changes across various industries. The changes in pattern the cycle is brought about by industry output changes. This change in industrial structure is driven by the interplay between consumer demand and technology throughout the industry life cycle. Price and non-price factors are of varying importance at different phases of the life cycle. Costs are of crucial importance to the firm at each phase of the industry life cycle but firms are driven to focus on costs in different ways at different phases.

The model of the industry life cycle shown below shows the curved line which traces the total output of a typical industry change over time. The total output of the industry is measured along the Y axis, and the X axis is the passage of time.

- Introduction Stage: This is the most expensive phase for new innovations. The size of the market is small, and sales are low. The cost of research and development, testing, and marketing can be high, especially in a competitive sector.

- Growth Stage: This phase is fuelled by a strong growth in sales and profits. As the industry starts to benefit from economies of scale in production and the profit margins will increase. This allows businesses to invest more funds to maximize the potential of this growth stage.

- Maturity Stage: Here, the industry is established and the aim is to maintain the market share. During this time, the most competition takes place within the industry and businesses invest wisely. The industry also considers any modifications or improvements to the production processes which might provide a competitive edge.

- Decline Stage: The market soon starts to shrink in size due to saturation or because the consumers start finding alternatives to the commodities or services. While this decline may be inevitable, it may still be possible for industries to make profits by switching to less-expensive production methods and cheaper markets.

Financial Risks

Banks take positions on the market for investments or to hedge their positions partially to reduce risk. The market positions via cash or derivative products make the bank vulnerable to large and unexpected adverse market movements. Classical sources of market risk are large movements in equity prices, foreign exchange rates, commodity prices and interest rates:

- Equity risk: Stock prices are volatile and can show significant fluctuations over time. The equity risk on the portfolio denotes the possible downward price movements of the equity in the portfolio. The main products subject to equity risk are common stocks (voting and non-voting), convertible securities, commitments to buy or sell equities and derivative pr

- Currency risk: Currency risk arises from price changes of one currency against another. It occurs when making investments in different currencies, especially when making cross-border investments. When a European bank invests in US stocks, the risk arises from equity risks on the stocks, but also from exchange rate risk on the euro/dollar rate. Gold is either seen as a commodity or as a currency. In terms of volatility, it behaves more like a currency. Currency risk is applicable to products and commitments in a foreign currency. The currency risk is perceived lower in fixed-currency regimes than floating regimes, but even in such cases devaluations or revaluations that change the parity value of the currencies and changes from fixed to floating regimes represent currency risk.

- Commodity risk: Commodity risk arises from uncertain future market price changes of commodities. A commodity is a physical product that can be traded on the secondary market. Examples of commodities are agricultural products (grains, cattle), precious metals (silver, copper) and minerals (iron ore, gas, and electricity). Prices depend significantly on changes of supply and demand. Commodity markets can be less liquid than interest rate and currency markets, which makes the risk management of commodities more complex.

- Interest rate risk: The price of some investments depends on the interest rate. Interest rates are expressed as levels or as the difference with respect to a chosen benchmark or reference rate (e.g., government rate, LIBOR or swap rate). The difference (yield spread) can be due to credit quality (credit spread), liquidity (liquidity spread), tax reasons (tax spread) or the maturity (term spread).

A particular example are bonds with a fixed rate for a given time period. When interest rates move up from 4% to 6%, a bond with a coupon of 4% is less interesting and loses value. The loss is higher if the remaining life time or maturity of the bond contract is longer. On the other hand, if the interest rate decreases, bond prices will move up. A standard interest rate risk measure is the duration, which is the cash flow weighted maturity. It indicates how prices change when all interest rates on different maturities move up by 1%. The interest rate risk is specifically important for debt securities and interest-related products in the trading book. Not only the level of the interest rate induces risk, but also changes of interest rates between various products (e.g., firm vs. government bond spreads) and at different maturities.

Interest rate risk is also present on the bank’s assets and liabilities, which is often treated separately from the interest rate changes causing price changes. A standard measure for market risk is value at risk (VaR). This is the maximum loss on the portfolio within a given time horizon with a given small probability. Market risk is typically expressed on a period of days to weeks. In contrast to credit risk with a much lower frequency and that is typically measured on a yearly basis, market prices are much more frequently available, which allows for a more frequent verification of the risk measure.

For some products like bonds, one may wonder whether they are subject to credit risk or market risk specifications. One makes a split up in the trading book and banking book risk management and rules.

- The trading book of the bank consists of positions in financial instruments and commodities that are held with the intent of trading or to hedge other elements of the trading book.

- The trading book is subject to market risk measurement and management standards.

- The trading book positions are frequently and accurately valued and are actively managed.

- Trading book positions are held for short-term resale or with the aim to benefit from actual or expected short-term price movements.

The banking book typically refers to positions that are held to maturity and is subject to credit risk management rules. The banking book positions correspond to the role of financial intermediary of the bank. A bond held for short-term trading is booked on the trading book; a bond held to maturity on the banking book. Explicit rules exist that define the difference between the trading and banking book to avoid regulatory arbitrage and cherry picking of the most convenient risk measurement approach.

The bank is also exposed to sources of risk other than credit, market and operational risk. These three types of risk are explicitly treated in the first pillar of the Basel II Capital Accord. Nevertheless, pillar 2 demands that banks have sufficient capital to cover all types of risk, without making explicit which types of risk these can be. Other types of risk include:

Liquidity risk: Liquidity risk is the risk that a bank will not be able to efficiently meet both expected and unexpected current and future cash flows and collateral needs without affecting daily operations or the financial condition of the firm.

Liquidity problems arise when there are differences at future dates between assets and liabilities in the balance sheet. Such gaps need to be anticipated to ensure the cost of funding at normal cost and to avoid extreme high funding costs by “last minute actions.” The positive liquidity gaps (assets-liabilities) need to be funded timely to avoid excessive costs due to emergency funding. Negative gaps involve interest rate risk. The liquidity risk gap analysis is done for each period in time. It indicates for each period whether there will be large cash outflows that need action.

For assets and liabilities with fixed cash flows, the liquidity risk gap analysis is a rather straightforward exercise for the current assets. More difficult are the projections on future loan productions and funding availabilities. Important issue is products with uncertain cash flows like revolving credits, off-balance sheet credit lines and savings deposits. The latter are especially important for banks with important retail activities due to the size it represents on the balance sheet.

These uncertainties make liquidity gap analysis a complex exercise. Loans may grow faster than deposits and banks need to be able to have either sufficient borrowing capacity or sell other, liquid assets. New products can have different characteristics as well: internet depositors may change easily and rapidly large amounts of deposits to other investment types.

Extreme liquidity risk is the risk that the liquidity position is reduced by unforeseen events, like damage to the bank’s reputation, reputation contagion, macroeconomic circumstances, monetary policy changes.