Not greatly different in principle from the simple projection of past sales in time-series analysis, a statistical procedure for studying historical sales data. This procedure involves isolating and measuring four chief types of sales variations: long-term trends, cyclical changes, seasonal variations, and irregular fluctuations. Then a mathematical model describing the past behavior of the series is selected, assumed values for each type of sales variation are inserted, and the sales forecast is ‘cranked out.”

For most companies, time-series analysis finds practical application mainly in making long-range forecasts. Predictions on a year-to-year basis, such as are necessary for an operating sales forecast, generally are little more than approximations. Only where sales patterns are clearly defined and relatively stable from year to year is time-series analysis appropriately used for short-term operating sales forecasts.

One drawback of time-series analysis is that it is difficult to “call the turns”. Trend and cycle analysis helps in explaining why a trend, once under way, continues, but predicting the turns often is more important. When turns for the better are called correctly, management can capitalize upon sales opportunities; when turns for the worst are called correctly, management can cut losses.

Moving Average Method

Are used to allow for market place factor changing at different rates and at different times, with this method both distant past and distant future have little value in forecasting. The moving average is a technique that attempts to “smooth out”.

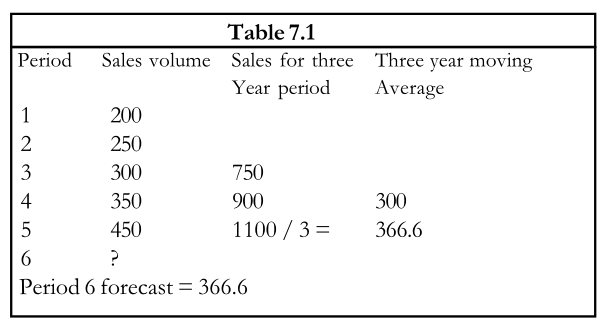

The different rates of change for the immediate past, usually past three to five years. The forecast is the mean of these past periods and is only valid for one period in future. The forecast is updated by eliminating the data for the earliest period and adding the most recent data.

Take for Example in the following table 7.1 .The sales volumes for periods 3 , 4, 5 are totaled and divided by 3 to derive the mean of 366.6 which is the period 6 forecast. If the company operates in the stable environment a short 2 or 3 years average will be most useful. For a firm in an industry with cyclical variation, the moving average should use data equal to length of cycle.