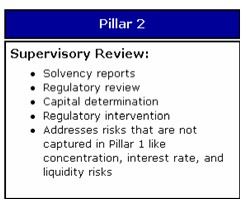

This process dictates that supervisors evaluate a bank’s assessment of its own risks and determine whether that assessment seems reasonable. It is not enough for a bank or its supervisors to rely on the calculation of minimum capital under the first pillar. Supervisors should provide an extra set of analysts to verify that the bank understands its risk profile and is sufficiently capitalized against its risks.

The second pillar is based on four key principals:

- Banks’ own assessment of capital adequacy

- Supervisor’s review of banks’ capital adequacy

- Capital above regulatory minimums

- Supervisory intention.

This pillar encourages banks to better use risk management techniques and have adequate capital to support all risks. The focus here is completely internal and not regulatory or capital.