It is the most widely used business performance measurement framework, introduced by Robert S. Kaplan and David P. Norton in 1992. Balanced scorecards were initially focused on finding a way to report on leading indicators of a business’s health, they were refocused to measure the firm’s strategy that directly relate to the firm’s strategy.

This is a broad business approach that translates the strategic mission of a business operation into tangible objectives and measures. These can be cascaded up and down the enterprise so that realistic and useful key performance indicators (KPIs) can be developed to support the business. These should represent a balance between external measures for shareholders and customers, and also internal measures of critical business processes, innovation and learning.

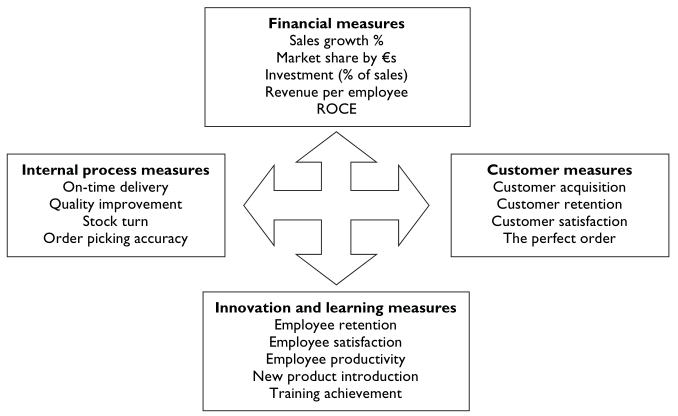

Usually the balanced scorecard is broken down into four sections, called perspectives, as

- The financial perspective – The strategy for growth, profitability and risk from the shareholder’s perspective. It focuses on the ability to provide financial profitability and stability for private organizations or cost-efficiency/effectiveness for public organizations.

- The customer perspective – The strategy for creating value and differentiation from the perspective of the customer. It focuses on the ability to provide quality goods and services, delivery effectiveness, and customer satisfaction

- The internal business perspective – The strategic priorities for various business processes that create customer and shareholder satisfaction. It aims for internal processes that lead to “financial” goals

- The learning and growth perspective – The priorities to create a climate that supports organizational change, innovation and growth. It targets the ability of employees, technology tools and effects of change to support organizational goals.

The Balanced Scorecard is needed due to various factors, as

- Focus on traditional financial accounting measures such as ROA, ROE, EPS gives misleading signals to executives with regards to quality and innovation. It is important to look at the means used to achieve outcomes such as ROA, not just focus on the outcomes themselves.

- Executive performance needs to be judged on success at meeting a mix of both financial and non-financial measures to effectively operate a business.

- Some non-financial measures are drivers of financial outcome measures which give managers more control to take corrective actions quickly.

- Too many measures, such as hundreds of possible cost accounting index measures, can confuse and distract an executive from focusing on important strategic priorities. The balanced scorecard disciplines an executive to focus on several important measures that drive the strategy.

The financial perspective concerns the relationship with shareholders and is aimed at improving profits and meeting financial targets. The customer perspective is designed to enhance customer relationships using better processes to keep existing customers and attract new ones.

The internal element is to develop new ideas to improve and enhance operational competitiveness. Innovation and learning should help to generate new ideas and to respond to customer needs and developments. A series of critical success factors is identified that relate directly to the main business perspectives. These are then used as the basis for creating the critical cost and performance measurements that should be used regularly to monitor and control the business operation in all the key areas identified.