Configuring TCS Feature

To configure statutory setup for Tax Collected at Source

To enable TCS in Tally.ERP 9:

Go to Gateway of Tally > F11: Features > F3: Statutory & Taxation.

- In the Company Operations Alteration screen:

- SetEnable Tax Collected at Source to Yes

- EnableSet/Alter TCS Details to Yes

- Enable Set/Alter TCS Detailsto Yes.

- PressEnterto view Company Deductor/Collector Details.

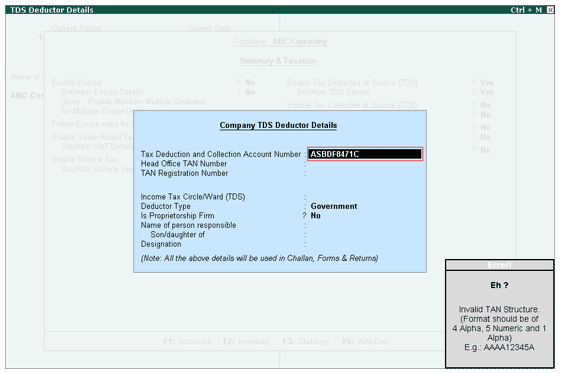

In the Company Deductor/Collector Details screen:

- Enter theTax Deduction and Collection Account Number. The Tax Deduction and Collection Account Number (TAN) is a 10-digit alphanumeric number, issued by the Income Tax Department (ITD) to the collectors

If the format of the TAN number is not correct, then Tally.ERP 9 will display you the error message as shown below

- Head Office Tax Deduction and Collection Account Number: In this field enter the head office Tax Deduction and Collection Account Number if any.

- TAN Registration Number: Enter the TAN Registration number in this field.

- Enter theIncome Tax Circle/Ward (TCS). This is issued by the Income Tax Department.

- Select theCollector Type from the List of Company Type.

- Is Proprietorship Firm:Set this option to Yes if the concern is a proprietorship firm.

- Enter theName of person responsible for filing the TCS returns. If the concern is a proprietorship concern, then the name of the person responsible will appear instead of the Company Name in the TCS forms and returns generated using Tally.ERP 9.

- Son/Daughter of: In this field, enter the name of the parent of the person responsible for filing TCS returns.

- Enter theDesignation of the person responsible for filing of the TCS returns.

- PressEnter to Accept.

- SetEnable Value Added Tax (VAT)and Set/Alter VAT Details to Yes, as VAT is levied on the sale of TCS Nature of Goods.

- PressEnterto accept and save.

Creating Party Ledger

To create Party Ledgers for Sundry Debtors:

Go to Gateway of Tally > Accounts Info > Ledgers > Create

- In in theNamefield, enter the name of the buyer company e.g. Chandra Timbers.

- In theUnderfield, select Sundry Debtors option from the List of Groups.

- If required, setMaintain balances bill-by-bill?to Yes. Enter details in the Default Credit Period, if applicable. By default, the Inventory Values are affected? field is set to No.

- SetIs TCS Applicableto Yes?

In the TCS Details screen

1. In the Buyer/Lessee field select the Collectee Type from the List of Collectee Types.

2. Set Is Lower/No Collection Applicable? to No.

3. Set Ignore Surcharge Exemption Limit to No.

4. Enter party Mailing Details and Tax Information

- PressEnterto accept and save

Creating Sales Ledger and Output VAT Ledger

To create Sales Ledger:

- Go toGateway of Tally > Accounts Info > Ledgers > Create

- Enter a name for the sales account in theName

- In theUnder field, select Sales Accounts from the List of Groups.

- SetInventory Values are affected? to Yes.

- SetUsed In VAT Returns to

- InVAT/Tax Class screen, select VAT/TAX Class Sales @ 12.5% from the List of VAT/TAX Class.

- Set the optionUse for Assessable Value Calculation to No

- PressEnter to accept and save.

Output VAT Ledger

To Create Output VAT Ledger

- Go toGateway of Tally > Accounts Info > Ledgers > Create

- Enter a name for theOutput VAT account in the Name

- In theUnder field, select Duties & Taxes from the List of Groups.

- InType of Duty/Tax field, select VAT from Types of Duty/Tax.

- Select theVAT/Tax Class Output VAT @ 12.5% from the List of VAT/Tax Class.

- PressEnter to accept and save.

Creating TCS Ledger

To create a TCS Ledger:

- Go toGateway of Tally > Accounts Info > Ledgers > Create

- In theLedger Creation screen, enter the name of the TCS ledger in the Name

- In theUnder field, select Duties & Taxes from List of Groups.

- SelectTCS from Types of Duty/Tax in the Type of Duty/Tax

- Select theNature of Goods/ Contract/ License/ Lease from the List of TCS Types.

- SetInventory Values are affected? to No.

- PressEnter to accept and save.

Creating a Payment Voucher

In Tally.ERP 9, from Release 2.0 the Tax/Duty payments can be recorded using S: Stat Payment Button.

To record TCS Payment using the auto fill of statutory payment

Go to Gateway of Tally > Accounting Vouchers > F5: Payment

In F12: Configure (Payment Configuration)

- EnsureUse Single Entry mode for Pymt/Rcpt/Contra is set to Yes

- Enter theDate____

- PressAlt + Sor click on S: Stat Payment to view Statutory Payment screen.

- InStatutory Paymentscreen

- Type of Duty/Tax: In this field select the Tax/Duty Type towards which tax payment entry is being recorded. Here we are recording TCS duty payment entry, hence selectTCS from the Type of Duty/Tax

- Auto Fill Statutory Payment: Set this option toYES to auto calculate and fill the duty payable to the Government. Set this option to NO, if the user wants to manually select the duty ledger and duty bills. ABC Company wants to auto fill tax details in payment voucher, hence the option Auto Fill Statutory Payments is set to Yes.

- On setting the optionAuto Fill Statutory Payments to Yes, based on the Duty/Tax Type selected Tally.ERP 9 displays the appropriate statutory payment fields to fill the details.

- Select theTCS @ 2.5% Ledger from the List of TCS Ledgers and enter.

- SelectBuyer/Lessee Status from Deductee/Collectee Status and enter. This lets you prepare separate challans as it is mandatory for different types of Collectees.

- Enter theTo Date to select the period for generation of TCS Challan.

. Press Enter to save the Statutory Payments.

5. TCS Ledger with TCS Details will be displayed in the payment voucher.

. Select the State Bank of India Ledger from the List of Ledger Accounts in Account field..

7. Set the option Provide Details to Yes and enter the Challan Details.

8. Press Enter to accept and save.

Statutory Reports TCS

Statutory Reports are reports required in government prescribed formats for the purpose of filing returns. TCS statutory reports in Tally.ERP 9 are dynamically generated; Print and file a report. An e-Filing TCS return is supported using the export feature.

To view Statutory Reports:

Go to Gateway of Tally > Display > Statutory Reports > TCS Reports

TCS Reports menu displays the following options.

- Print Form 27D

- ETCS Forms

- Print Form 27B

TCS Payables Reports

To view TCS Payable

Go to Gateway of Tally > Display >Statements of Accounts > TCS Outstandings > TCS Payables The TCS Payables report is displayed as shown