Purchasing function has a strategically indispensible role to play in supply chain management. It covers the sourcing end of supply chain management interfacing with the delivery end of the suppliers.

The classical definition of purchasing is : to obtain materials and/or services of the right quality in the right quantity from the right source, deliver them to the right place at the right price.

The composite definition of purchasing is : the process undertaken by the organisational unit which, either as a function or as part of an integrated supply chain, is responsible for procuring supplies of materials and services of the right quality, quantity, time and price, and the management of the suppliers, thereby contributing to the competitive advantages of the achievement of the corporate strategy.

Purchasing management thus, by definition, supports and implements the supply chain management strategies . It is one of, or maybe the most important, delivery arms of supply chain management. Often it directly delivers the cost saving, quality improvement and fulfills the supplier relationships. Purchasing function’s critical role can also be illustrated from a simplified income statement:

Total sales = Rs. 10,000,000

Purchased Service / materials = Rs. 7,000,000

Salaries = Rs. 2,000,000

Overheads = Rs. 500,000

Profit = Rs. 500,000

Suppose this is a company’s profit-loss account for the current year, and the shareholders demand the CEO to deliver double the profit in the next year. What can the CEO do with regards to those factors associated with the account? Well, assume everything else remains equal, doubling the total sales will eventually double the profit. It is equivalent to create two companies.

But the problem with this approach is that the sales volume is often constrained by the market. If the product cycle has passed the maturity and started to decline, to maintain the amount of sale would be difficult let alone to double it. Or, the company could reduce the salary by 25%, which could make Rs. 500,000 saving for the bottom line. Common sense tells that it is not feasible, and the CEO would not agree as his 25% cut would be biggest of all. Another alternative is to get rid of all the overheads costs, which also makes Rs. 500,000 saving. However, this is almost impossible to do practically, nor agreeable theoretically.

What’s left is to curtail the buyer-in goods and service by 7% which will make $500,000 savings for the bottom line. Now, just 7% cut in purchasing would result in 100% increase of profit. This is no doubt a very effective approach as the effort appears to be small and the gain is amazingly high. It is apparently the only viable and convincing choice there is to it. Who is going to do that for the company? It is the purchasing function .

This is why purchasing function is distinctly so important to the company’s profit level. It is the company’s profit leveraging point, whereby a small input can generate large output. No wonder we see many OEMs often try to enforce the supplied material cost reduction by 4-5% year on year, albeit, this may not be the best approach from the contemporary supply chain best-practice perspective.

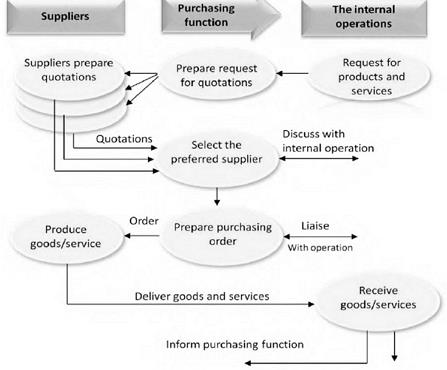

The operational processes of purchasing function can be represented by the diagram shown in figure below. It basically intermediates the company’s internal operations with the suppliers, ensuring the right suppliers are found and engaged in a process of supply and delivering the required materials, components and services that best suit the internal operations.

These are just the visible parts of purchasing function. Beyond these processes, there might more important high level strategic decisions to be made for the purchasing, through the purchasing and by the purchasing. Typically, make-or-buy decisions, supply base rationalisation, supplier development and etc.