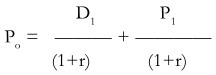

When an investor expects to hold the equity share for one year, the price of the equity share will be

Where

Po = current price of the equity share

D1 = dividend expected a year hence

P1 = price of the share expected a year hence

r = rate of return required on the equity share

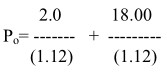

Illustration:

Uranus Ltd.’s equity share is expected to provide a dividend of Rs. 2.00 and fetch a price of Rs.18.00 a year hence. What price would it sell for now if the investors’ required rate of return is 12%?

The current price will be

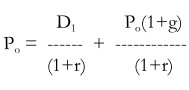

If the price of the equity share is expected to grow at a rate of g per cent annually, the current price being Po becomes Po(1+g) a year hence and hence we get

On simplifying, we get,

Given the current market price and forecast values of dividend and share price, the expected rate of return is equal to

R= D1/Po + g