Service Tax is a indirect tax imposed on specified services (taxable services) provided by a service provider (Company, Individual, Firm etc.).

Service Tax was first brought into force with effect from 1 July 1994. All service providers in India, except those in the state of Jammu and Kashmir, are required to pay a Service Tax in India.

Initially only three services were brought under the net of Service Tax and the tax rate was 5%. Gradually more services came under the ambit of Service Tax.

Enabling Service Tax in Tally

To enable Service Tax:

Go to Gateway of Tally > F11: Features > F3: Statutory & Taxation

- SetEnable Service Tax to Yes.

- EnableSet/Alter Service Tax Details to Yes to enter the Company Service Tax Details.

Company Service Tax Details

The Company Service Tax Details screen is where you will enter the Company’s Service Tax details.

- Service Tax Registration No.– Enter the Registration Number allotted to you by the Service Tax Department (before the Circular No. 35/3/2001-ST dated 27-08-2001).

- Date of Registration– Enter the Date of Registration of Service Tax for your service.

- Type of Organisation– In this field select the type of your organisation from theList of Organisations menu

Enable Service Tax Round Off: By default this option will be set to Yes. If this option is Yes, Service Tax will get rounded off to nearest Rupee and round off will happen for each Tax Head. If you don’t want round off (for every Tax Head), set this option to No.

In this case ABC company does not want round off hence this option is set to No.

- Assessee Code– Enter the Service Tax Assessee Code of the Company.

- Premises Code– Enter the Premises code/Location code. It is the identification number provided to the Service Taxpayers.

- Is Large Tax Payers– This field is set toYes/No if the assessee is a Large Tax Payer. This is determined by the amount of tax paid by the assessee.

- Large Tax payer Unit– Enter the name of the unit where the large tax payers pay tax. Tally.ERP skips Large Tax Payer Unit when the option Is Large Tax Payer is set to No.

- Range

- Code– Enter the code of the range of your company

- Name– Enter the name of the range under which your company falls.

- Division

- Code– Enter the code of the division in which your company falls.

- Name– Enter name of the division under which your company falls.

- Commissionerate

- Code– This is the code of the Commissionerate of Service Tax under which the address of your registered premise is located.

- Name– This is the name of the Commissionerate of Service Tax under whose range the address of your registered premise falls.

Completed Company Service Tax Details screen appears as shown

12. PAN/Income – Tax No.– Enter company’s PAN Number.

Completed Statutory & Taxation Features screen appears as shown

- PressEnterto save.

Service Tax Purchase Ledger

ABC Company is a Service Organisation which purchases and sells services.

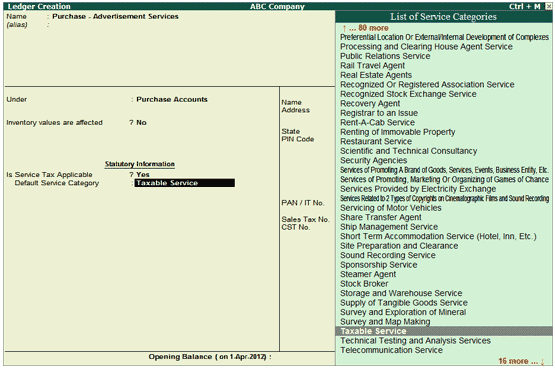

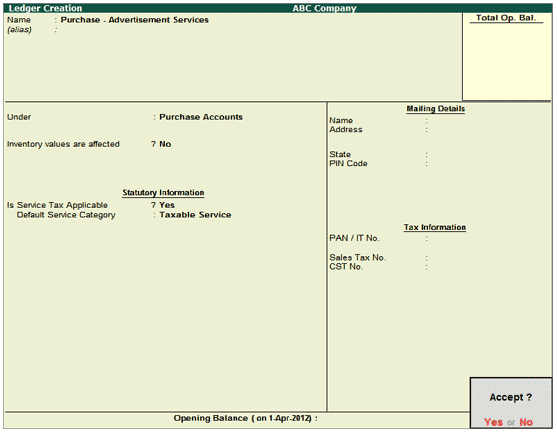

To create the Service Purchase Ledger

Go to Gateway of Tally > Accounts Info. > Ledgers > Create

- Enter theName of the service purchase ledger you wish to create, for e.g., Purchase- Advertising Services.

- SelectPurchase Accounts as the group name in the Under

- SetInventory values are affected to

- SetIs Service Tax Applicable to Yes.

- InDefault Service Category field select Taxable Service from the List of Service Categories.

- PressEnter to save

Service Tax Sales Ledger

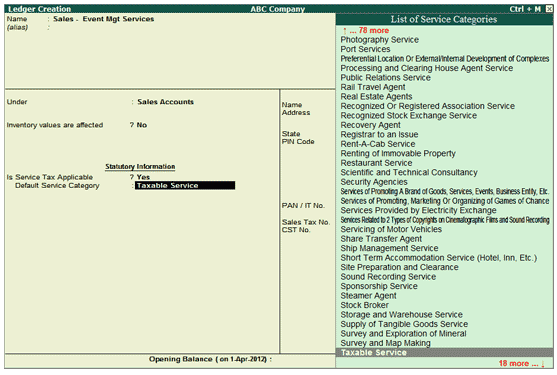

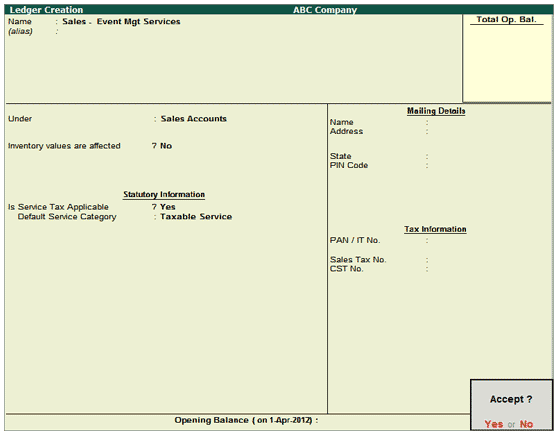

To create the Service Sales Ledger

Go to Gateway of Tally > Accounts Info. > Ledgers > Create

- Enter theName of the service sales ledger you wish to create, for e.g., Sales- Event Mgt Services.

- SelectSales Accounts as the group name in the Under

- SetInventory values are affected to No.

- SetIs Service Tax Applicable to Yes.

- InDefault Service Category field select Taxable Service from the List of Service Categories.

- PressEnter to save.

Service Tax Ledgers

On all the taxable services, three heads of taxes are applicable. They are, Service Tax @ 14%, Swachh Bharat Cess @ 0.5% and Krishi Kalyan Cess @ 0.5%

Single Tax ledger to account both Input service Credit and Output Service Tax of all the service Categories.

Tax Head based Tax Ledgers

Three separate ledger to account both Input service Credit and Output Service Tax of all the service Categories based on the Tax Heads.

Example:-

Service Tax @14%

Swachh Bharat Cess @0.5%

Krishi Kalyan Cess @ 0.5%

Service Tax – Purchase Ledger

ABC Company is a Service Organisation which purchases and sells services.

To create the Service Purchase Ledger

Go to Gateway of Tally > Accounts Info. > Ledgers > Create

- Enter theName of the service purchase ledger you wish to create, for e.g., Purchase- Advertising Services.

- SelectPurchase Accounts as the group name in the Under

- SetInventory values are affected to No.

- SetIs Service Tax Applicable to Yes.

- InDefault Service Category field select Taxable Service from the List of Service Categories.

- PressEnter to save.

Service Tax – Sales Ledger

To create the Service Sales Ledger

Go to Gateway of Tally > Accounts Info. > Ledgers > Create

- Enter theName of the service sales ledger you wish to create, for e.g., Sales- Event Mgt Services.

- SelectSales Accounts as the group name in the Under field

- SetInventory values are affected to

- SetIs Service Tax Applicable to Yes

- InDefault Service Category field select Taxable Service from the List of Service Categories.

- PressEnter to save.