Introduction

Service Costing or operation costing is normally used in service sector. When the service is not completely standardized, it is the cost of producing and monitoring a service. It is a method of costing applied to undertakings which provide service rather than production of commodities. Service may be performed internally and externally. Services are termed as internal when they have to be performed on inter-departmental basis in factory itself e.g. Power house services, canteen service etc. Services are termed as external when they are to be rendered to outside parties. Public utility services like transport, water supply, electricity supply, hospitals are the best example for the service costing. Thus Service costing is a method of cost accumulation which is designed to determine the cost of services. Service costing is just a variant of unit or output costing. Service costs are collected periodically like process cost. The cost of rendering the service for particular period is related to quantum of services rendered during the particular period to arrive at cost per unit of service rendered. So the principal of unit costing is used in service costing.

Meaning of Service Costing

Service costing is a method of ascertaining the cost of providing or services a service. It is also known as operation costing CIMA London, defines Service Costing as “that form of operation costing which applies where standardized services are rendered either by an undertaking or by a service cost renter with in an undertaking”.

Features of Service Costing

The main features of operating costing are as following:

- The undertaking which adopts service costing does not produce any tangible goods. These undertakings render unique services to their customers.

- The expenses are divided into fixed and variable cost. Such a classification is necessary to ascertain the cost of service and the unit cost of service.

- The cost unit may be simple or composite. The examples of simple cost units are cost per unit in electricity supply, cost per liter in water supply, cost per meal in canteen etc. Similarly cost per passenger kilometers in transport cost per patient-day in hospital, costs per room-day in hotel etc. are the examples of composite cost unit.

- Total cost is averaged over the total amount of service rendered.

- Costs are usually computed period-wise. However, in the case of utilization of vehicles, use of road-rollers etc., the costs are computed order wise.

- Service costing can be used for service performed internally or externally.

- Documents like the daily log sheet, cost sheet etc. are used for the collection of cost data.

Application of Service Costing

Service costing is very useful in determining the cost of providing servi8ces which became a base for ascertaining the price of services. Service costing is extensively used in Transport industries. Hotel industries, electricity company etc.

Service costing helps an organisation in ascertaining

- Inter-departmental service prices

- Service cost to be charged from outside clients

- Benchmarking the processes/operations

- Tracking and controlling the excess cost

Unit Costing and Multiple Costing

- Unit Costing: It refers to a costing method which is used when cost units are identical. Cost units that are identical should have identical costs. It is mainly used where a single product is the cost object. It is mainly used in mining, quarries and cement industries.

- Multiple Costing: It refers to the method of costing followed by a business wherein a large variety of articles are produced, each differing from the other both in regard to material required and process of manufacture. In such cases, cost of each article is computed separately by using, generally, two or more methods of costing.

Cost Unit

Determining the suitable cost unit to be used for cost ascertainment is a major problem in service costing. Selection of a proper cost unit is a difficult task. A proper unit of cost must be related with reference to nature of world and the cost objectives. The cost unit related must be simple i.e. per bed in a hospital, per cup of tea sold in a canteen and per child in a school. In a certain cases a composite unit is used i.e. Passenger – Kilometer in a transport company.

Examples of Cost Units in different Service Industries:

- Passenger transport Kilometer

- Goods transport Ton – Kilometer

- Hotel Per room per day

- Hospital Per bed per day

- Canteen Per item, per meal

- Water supply Per 1000 liters

- Electricity Per kilowatt

Operating costs are usually collected under following headings:

- Fixed or standard charges

- Semi-fixed or maintenance charges

- Variable or running charges.

An important feature of operating costing is that mostly such costs are fixed in nature. The operating costs may be collected for different cost units so that the relevance, and utility of cost data could be understood e.g. in hospital cost accounting; fixed charges may be apportioned in accordance with the number of available bed days but variable costs in hospitals may be ascertained in terms of occupied bed days.

Transport Costing

In transport undertakings, the cost unit is normally the tonne-km or passenger-km; but according to the nature of the undertakings, the organisation may vary the cost unit. It is selected keeping in view the needs of each concern depending upon the weight, bulk and types of goods carried and distance covered in each trip. The motor transport costing has the following objectives:

- Control of operating and running costs and avoidance of waste of fuel and other consumable material.

- Cost of running own vehicles may be compared with hired or other forms of transport.

- Facilitates quotation of hiring rates to outside parties who ask for the transport service.

- Cost of running a vehicle may be compared with that of another similar vehicle.

- Cost of idle vehicles and lost running time are easily obtained.

- Since transport department is treated as separate department, the cost of services rendered to other departments can easily be determined.

Composition of costs

The total costs consist of: (i) Standing charges; (ii) Running charges; (iii) Maintenance charges.

Standing charges

- Licence duty and insurance;

- Garage costs and administrative expenses;

- Wages of drivers and conductors;

- Depreciation;

- Tax; etc.

Running (variable) costs:

- Petrol or diesel;

- Oil;

- Grease; etc.

Maintenance charges

- Repairs and maintenance;

- Cost of tyres, tubes, batteries, etc.;

- Garage charges;

- Overhauling of vehicles;

The number of cost units is calculated as follows in transport costing:

Number of vehicles x capacity x distance travelled x days x passengers (or weight carried)

Accumulation and control of costs in transport costing are achieved through a daily log sheet and operating cost sheet. A daily log report is prepared for each vehicle and filled in by the drivers. This is a document which contains information regarding each journey. The details shown in the log book enable the management to make suitable allocation of vehicles to avoid waste or idle running capacity. The records also provide data for the proper allocation of costs and in this respect, these may be compared with the production details available in a manufacturing concern.

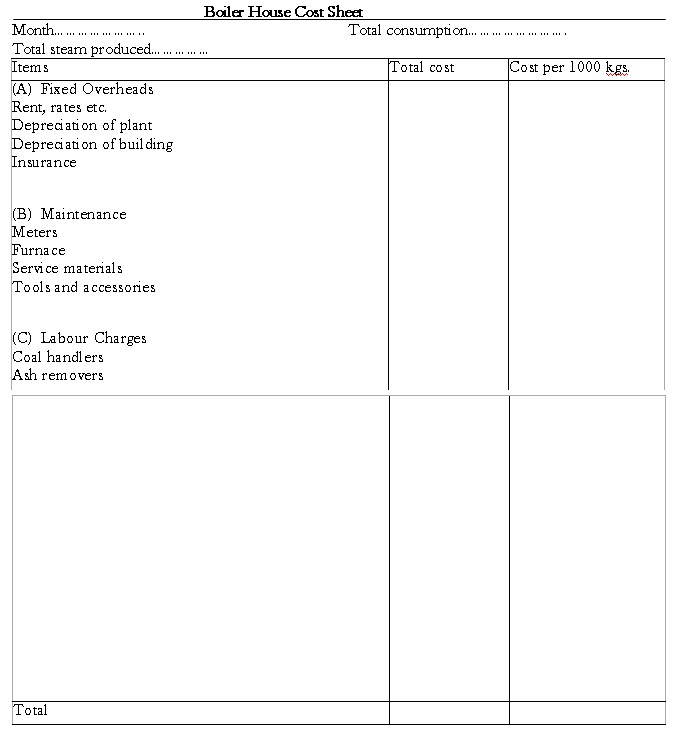

Boiler House Costing

Operating costing is also applied in those undertakings engaged in steam production. In large firms, a boiler house is a service department providing services to production departments. The total costs are obtained for producing steam. A cost unit is generally in terms of kilograms.

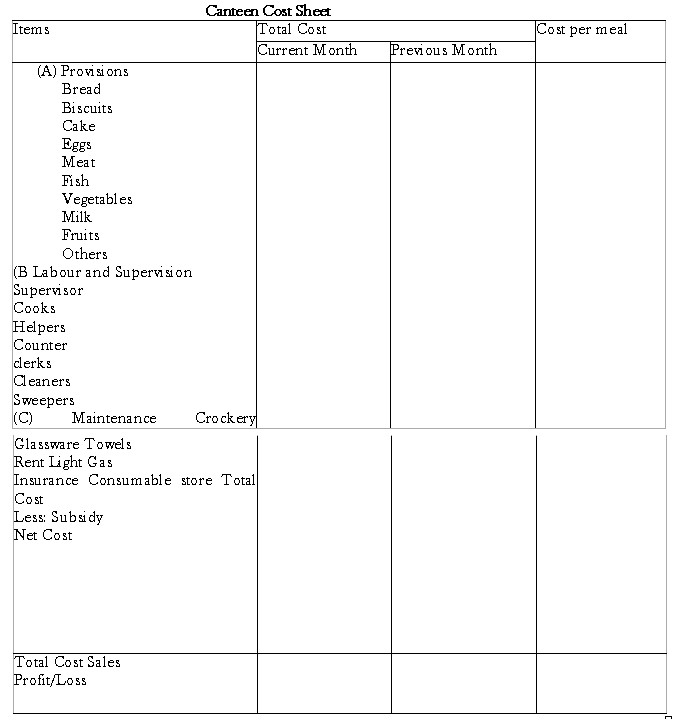

Canteen Costing

In most organizations, canteen facilities are provided at subsidy so that food and other items can be provided at minimum price. The costs are accumulated on a cost sheet which gives the total cost incurred. From the total cost, the subsidy is deducted to arrive at the net-cost of operating the canteen. After comparing the net cost with the sales proceeds profit or loss is calculated.

Hospital Costing

The main purpose of hospital costing is to ascertain the cost of providing medical services. For costing purposes hospital service can be divided into the following categories:

- Out-patient department

- Casualty or emergency

- Wards

- Medical service departments, such as, Radiotherapy, X-ray, Pathology etc.

- General Service departments, such as, power, heating, lighting, catering, laundering, medical records and administration.

- Other service departments, such as, dispensary, transport etc.

Following units are used in hospital costing:

Out-patient department – per out patient

Casualty – per patient

Wards – per patient – bed per day

Radiotherapy – per course of treatment per day or per person.

Laundry – per 100 articles laundered.

For ascertaining cost figures, a hospital operating cost sheet is prepared.

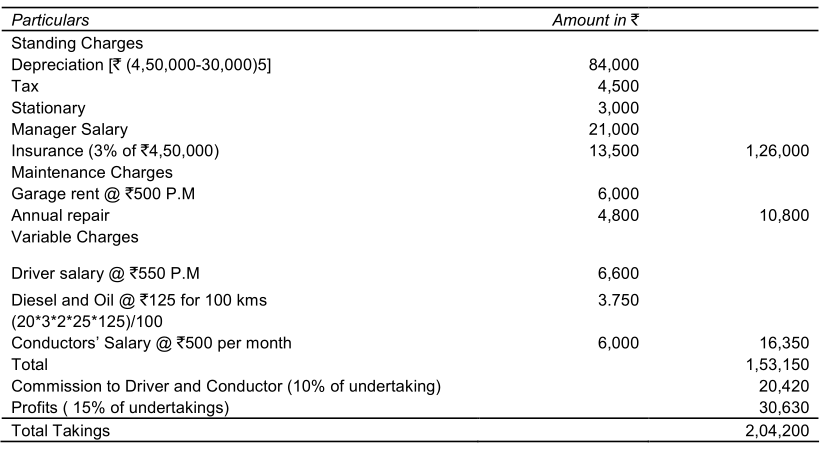

Illustration 2

The under given data is supplied by Fair deal travel services, from the following information calculate fare for passenger KM

The cost of the Bus 4,50,000

Insurance charges 3 % p.a.

Annual tax 4500

Garage rent 500 p.m.

Annual repairs 4800

Expected life of the bus 5 yrs

Value of scrap at the end of 5 years 30,000

Route distance 20 km long

Driver’s salary 550 p.m

Conductor’s Salary 500 p.m.

Commission to Driver & conductor (shared equally) 10 % of the takings

Stationary 250 p.m.

Manager-cum-accountant’s Salary 1750 p.m.

Diesel and Oil (for 100 kms) 125

The bus will make 3 rounds trips for carrying on the average 40 passenger’s in each trip. Assume 15 % profit on takings. The bus will work on the average 25 days in a month.

Solution

Operating Cost Statement

Total No. of Km run in a Year = 3 x 2 x 20 x 25 X 12 = 36,000 km

Total No. of passenger km per annum: 36,000 x 40 = 14,40,000

Fare for passengers km = Passenger Km = (Total Fare ) / Passenger Km= 2,04,200 = 0.14180