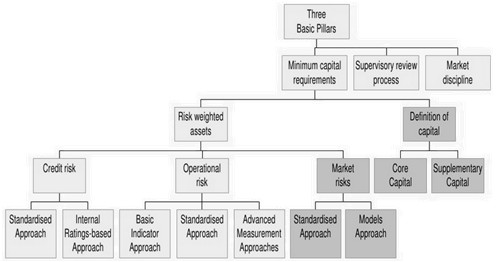

The new capital adequacy accord is based upon 3 mutually reinforcing pillars:

- Minimum capital requirement: This is a quantitative approach to minimum capital requirements.

- Supervisory review and market discipline: Banks should have a process for assessing their overall capital adequacy; supervisors will review this process and require additional capital if necessary.

- Reporting and Market Discipline: Market participants should have better access to information regarding the credit standing of banks.

The scope defines the circumstances in which the capital requirement for a credit exposure which has been hedged by the purchase of credit protection may be reduced in recognition of double default effects. The BCBS has considered restricting scope along the following dimensions:

- Protection providers: The BCBS considers it important that protection providers be of high credit quality and sufficiently transparent.

- Obligors: a corporate exposure should adhere to the Revised Framework

- A form of protection (e.g. guarantees, credit derivatives, insurance contracts)

- Dilution of risk.

The BCBS has sought to develop operational requirements for the double default framework that minimise the possibility of an excessive correlation between the creditworthiness of an eligible protection provider and the obligor of the underlying exposure due to their performance being dependent on common economic factors beyond the systematic risk factor.