Staff accountants, financial analysts, and administrative assistants can further their careers by becoming Accounting Managers, Senior Accountants, Treasury Managers, and Controllers with a GAAP qualification.

Let us know about Scope and Career Opportunities in GAAP!

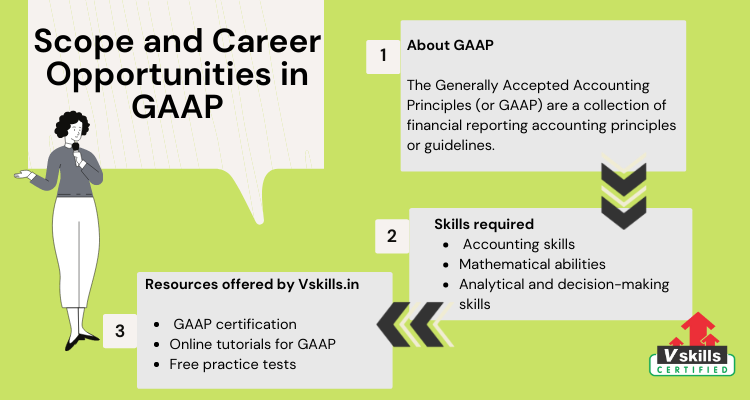

About GAAP

The Generally Accepted Accounting Principles (or GAAP) are a collection of financial reporting accounting principles or guidelines. An organization’s financial reports and statements should follow industry standards to guarantee openness and uniformity, which GAAP ensures. Despite the fact that there is no global GAAP standard and that it varies by nation, organizations should follow the local requirements.

Benefits of GAAP

- Organizations can get an accurate view of their revenue using GAAP. You will be able to predict patterns that were previously unknown to you.

- GAAP (Generally Acknowledged Accounting Concepts) is a widely accepted international standard for accounting principles. This will assist an organization in gaining the trust of potential investors.

- When financial statements follow standardized accounting rules, it is simpler for potential investors to compare them.

Key Skills

Accounting skills — In order to get the full benefits of GAAP, you must have strong accounting abilities.

Mathematical abilities – A strong understanding of mathematics is essential in accounting, and GAAP is a set of accounting rules.

Analytical and decision-making skills — As an accountant, you must have strong analytical and decision-making abilities.

Career Opportunities

Financial Analyst – Financial analysts analyze the performance of bonds and equities in order to give financial recommendations to organizations and individuals. A senior accountant or finance manager is usually in charge of this role. Investment analyst, securities analyst, risk analyst, and portfolio manager are all similar professional titles.

Financial Accountant -Financial accountants help businesses invest and improve their entire financial operations by maintaining meticulous records and analyzing data. Financial accountants work as part of an organization’s accounting or financial team, assisting management in tracking current trends and forecasting future needs. A senior accountant or financial manager is usually their boss.

Controller – Controllers work in corporations, NGOs, and government agencies, and report to the chief financial officer or another senior leader. The scope of a controller’s tasks vary greatly depending on the company’s size and accounting office. Finance managers, directors of accounting, financial controllers, and comptrollers have comparable responsibilities and objectives.

Financial Manager – Financial managers are in charge of managing a range of accounting activities inside a company, the most essential of which is to keep track of earnings, losses, assets, and liabilities in the general ledger. Finance directors, chief financial officers, and other senior executive roles frequently report to financial managers. Accounting managers, financial analysis managers, and financial planning managers have comparable tasks to those of financial managers.

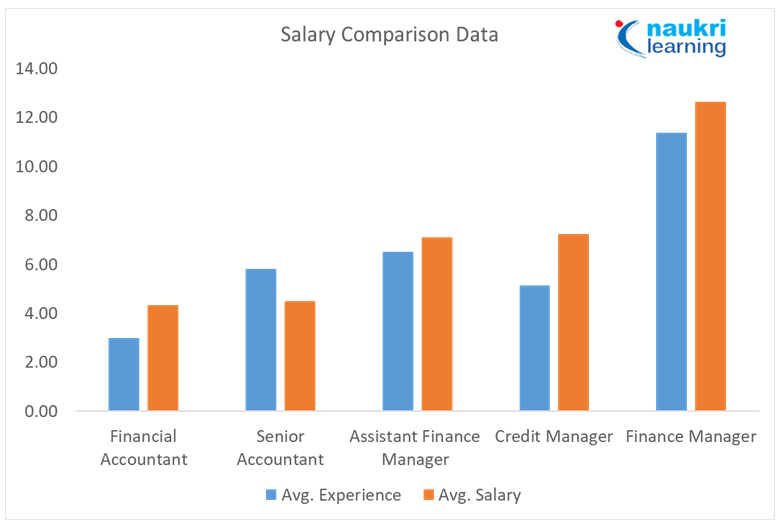

Salary Insights and Scope

If you acquire a position with the federal government, you can’t ask for anything more. When you work for other companies, your pay might range from $55000 to $73000. According to a Naukri.com poll, 67 percent of recruiters prefer certified applicants and are ready to pay more for them.

GAAP Career opportunities will always be in demand. GAAP is significant since it aids in the preservation of financial market trust. Investors would be less willing to accept information provided to them by firms if GAAP were not in place because they would have less faith in its integrity. We could see fewer transactions if we don’t have that trust, which might lead to greater transaction costs and a weaker economy. GAAP also aids investors in their due diligence by making it easier to compare firms on a “apples to apples” basis.

Resources for learning GAAP

Before you can become an expert in desired areas, you must first build a solid base. Before you can move on to practical teaching, you’ll need to have the right applied skills. To gain better understanding of the domain, you can use the following tools:

- Firstly, Online Tutorials for GAAP

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Here are some examples of how you can improve your abilities:

- Freelancing

- Internships

- Apprenticeship programs

The above steps will help you to get this domain started. It’s a long way to go, however. You can take an advanced course to reach a new level of skills.

Vskills also offers free practice tests and online tutorials to supplement the learning process.

Discover the career opportunities and other prospects of Career in GAAP. Hurry up and start preparing now with Vskills.in!