In 2008, the world economy witnessed the largest crisis of its time. It began in the United States with mortgage dealers who issued mortgages with terms unfavourable to borrowers (often families and individuals who did not qualify for ordinary home loans). These “subprime mortgages” carried low interest rates in the early years that grew to double-digit rates in later years. Many of these schemes had prepayment penalties that made it expensive to refinance. These negative features were ignored by inexperienced first-time home buyers.

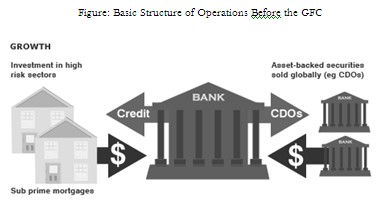

Below is the series in which the credit related business took place within the institutions.

- Mortgage lenders did not just hold the loans to receive a monthly cheque from the mortgage holder. Frequently these loans were sold to a bank or to Fannie Mae or Freddie Mac (two government-chartered institutions created to buy up mortgages and provide mortgage lenders with more money to lend).

- Fannie Mae and Freddie Mac then sold the mortgages to investment banks that would bundle them with hundreds or thousands of others into a “mortgage-backed security” that would provide an income stream comprising the sum of all of the monthly mortgage payments.

- The security would then be segregated into perhaps 1,000 smaller securities that would be sold to investors, often misidentified as low-risk investments.

- The insurance industry also participated by trading in “credit default swaps” (CDS)—in effect, insurance policies stipulating that, in return for a fee, the insurers would assume any losses caused by mortgage-holder defaults.

- This insurance, however, turned quickly into speculation as financial institutions bought or sold credit default swaps on assets that they did not own.

Approximately $900 billion in credit was insured by these derivatives in 2001, but the total soared to $62 trillion by the beginning of 2008. Everyone profited as long as housing prices kept rising. Mortgage holders with inadequate sources of regular income could borrow against their rising home equity. The agencies rated and ranked securities according to their stability as being “safe” which they were not.

When the housing bubble burst, more and more mortgage holders defaulted on their loans. At the end of September, about 3% of home loans were in the foreclosure process, an increase of 76% in just a year. Another 7% of homeowners with a mortgage were at least one month past due on their payments, up from 5.6% a year earlier. By 2008 the mild slump in housing prices that had begun in 2006 had become a free fall in some places. What ensued was a crisis in confidence: a classic case of what happens in a market economy when the players—from giant companies to individual investors—do not trust one another or the institutions that they have built.