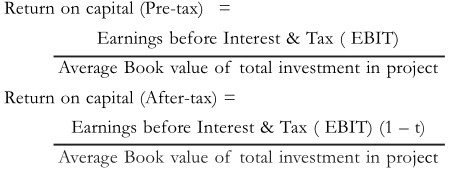

The expected return on capital on a project is a function of both total investments required on the project and its capacity to generate operating income. Return on capital is calculated both pre-tax and after-tax.

So,

Decision Rule:

If return on capital exceeds the cost of capital, the project is viewed as good.

A company’s cost of capital is the company’s cost of funding. Depending on the company’s capital structure, the cost of capital will incorporate its cost of debt as well as its cost of equity.

Cost of debt refers to the cost of raising funds through debt financing.

Cost of equity refers to the company’s cost of raising funds through equity offerings.