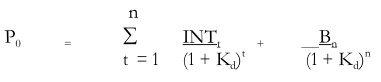

Redeemable preference shares (that is, preference shares with finite maturity) are also issued in -practice. A formula similar to above Equation can be used to compute the cost of redeemable preference share:

The cost of preference share is not adjusted for taxes because preference dividend is paid after the corporate taxes have been paid. Preference dividends do not save any taxes. Thus, the cost of preference share is automatically computed on after-tax basis. Since interest is tax deductible and preference dividend is not, the after-tax cost of preference is/ substantially higher than the after-tax cost of debt.