In some cases, Sage will recommend going straight to a quantitative study-usually a Web survey. Sage will sometimes recommend a telephone methodology, depending on the universe that is being served. Occasionally, we will recommend starting with qualitative research if neither Sage nor the client has strong hypotheses about potential models to test.

For segmentation, the quantitative sample needs to be large. After all, people from different types of organizations need to be surveyed to identify meaningful differences. Ultimately, the size of the sample will depend on the universe that is being served. For example, do you potentially serve all businesses or just small businesses? Do you serve businesses or consumers (or both)? Are the companies you serve U.S. only or global organizations? Because our clients serve a variety of markets, we have done segmentation studies with samples as small as 300 and samples as large as 1,000 or more.

Market Segmentation

Segmentation Advice Market segmentation is typically used for one of the purposes listed below. For your segmentation project to be successful Sage recommends that you pick one as your primary focus-as with any type of market research; lack of focus is a significant risk factor.

- Product-focused segmentation-to find sales targets (“slam dunks”) for a specific product or service.

- Company-focused segmentation-to discover customer groups that are aligned with your company’s overall strengths/strategic directions

- Customer-focused segmentation-to analyze a broad population for the purpose of identifying new or emerging opportunities based on needs and attitudes.

Product-focused segmentation is tactical-that’s not a bad thing. In fact, it can be very effective for many companies. For example, Sage once did this type of project that not only identified customer groups that would be most likely to buy the client’s product, but also challenged assumptions about how widespread demand would be. In this case, it wasn’t happy news. However, it was an important reality check that led to more realistic forecasts and identified how to make the product appeal to additional customer groups.

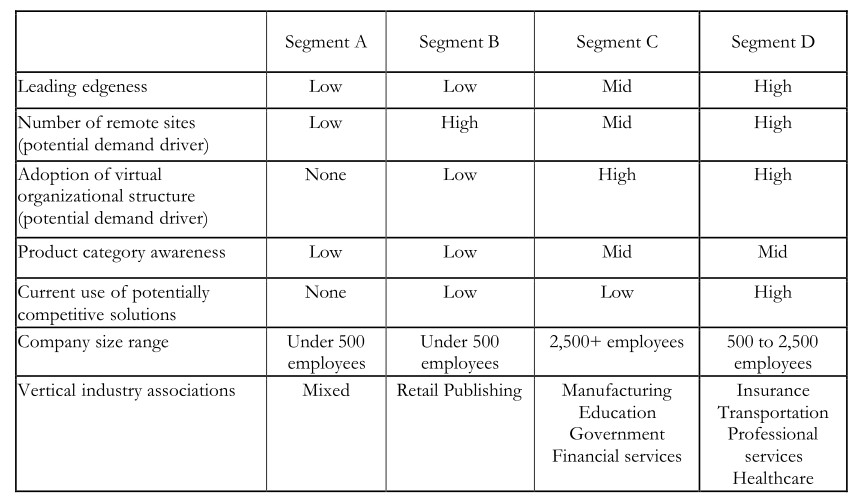

The second type of segmentation-company-focused segmentation-divides a market based on the fit with your company’s profile. Examples of this include dividing a market based on awareness of your brand, existence of needs that align with your technical strengths, or fit with your distribution strategy. The third type of segmentation project is more strategic. This type of “needs-based” segmentation goes beyond preparing for marketing a point product. Rather, it delivers input for aligning with broader customer needs. The output of such a project is the identification of customer segments, usually 4 to 8 (but sometimes more). This method groups members into the segments based on naturally occurring combinations (the following table shows a simple, generalized model). This type of segmentation is used to understand with which customer groups our client should be developing long-term relationships.

Ultimately, these three approaches are not mutually exclusive. Still, prioritizing an approach will ensure that upon project completion, you will have a model that meets your needs.

Segmentation for Actionable Results – Segmentation is a highly actionable type of research. The table below shows some specific actions that are a direct result of segmentation analysis.

| Findings | Results in Action |

| A customer group exists that values strengths you possess, but their awareness and perceptions of your brand are weak. | Start a targeted brand awareness campaign, and emphasize relevant needs proactively. |

| A customer group exists that has needs you can meet, but they are satisfied with their current suppliers. | Monitor on an ongoing basis to see if Satisfaction changes occur. This group may simply be a lower priority for now. |

| A customer group with which you have a strong presence has emerging needs you are not currently able to address. | Get cracking on development or partnership efforts. Prepare to take proactive steps to keep loyalty/preference for the brand strong. |

| A customer group exists which has unmet needs you can address, but they have low/no awareness of your product category. | Consider a longer-term effort through awareness and educational campaigns. Knowing that market education can be a lengthy process, make a go/no go decision about allocating resources to target this potential, but longer-term opportunity. |

Segmentation is extremely actionable data, and it can deliver a competitive advantage. While your competition uses a shotgun approach to sales and marketing, you can use your segmentation model to finely hone your product, marketing, and sales efforts. You can identify your near-term opportunities, as well as customer groups that represent a longer-term potential.

Segmentation models also lead to exciting marketing opportunities in these days of e-marketing. Different customer groups can be targeted with different Web sites or personalization techniques.