You must be remembering Profit and Loss Account gives the results of the operations of the firm during a specific period, in the form of profit or loss. Profit and Loss Account gives more detailed report on the retained income shown in the Balance Sheet. By comparing the income statements of successive periods, it is possible to observe the growth or otherwise of the firm

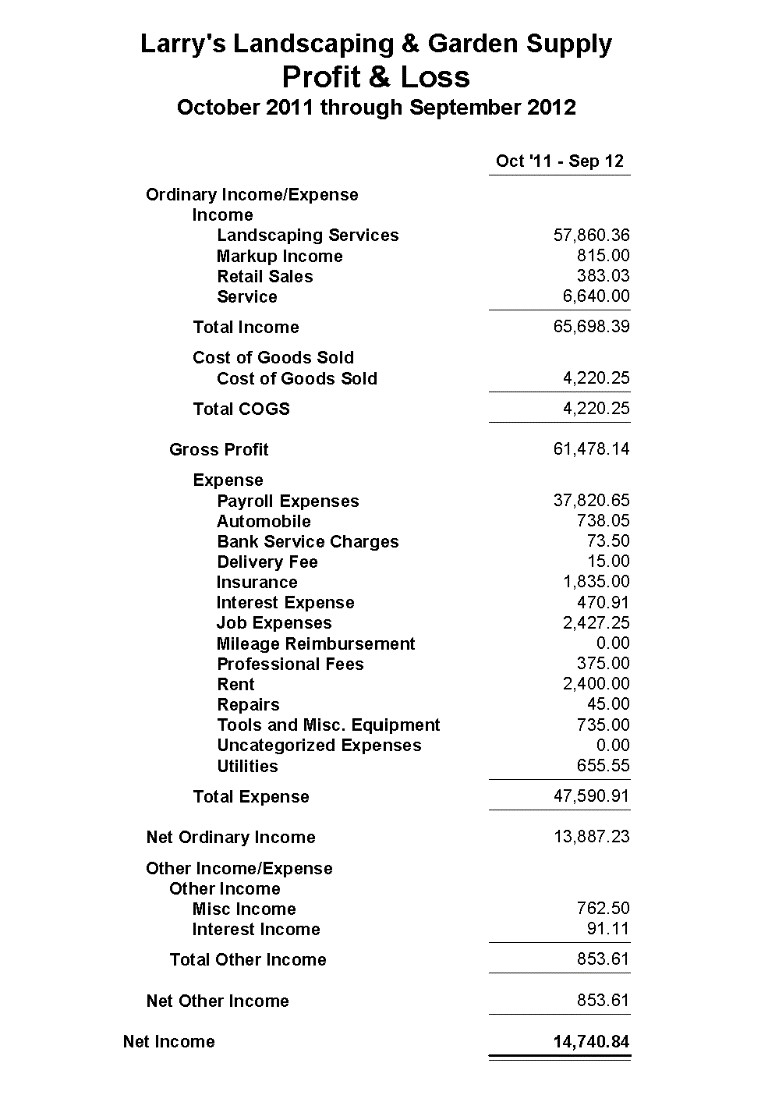

The income statement, or profit and loss (P&L) statement, shows the net income for the business during the accounting period. It includes income generated, the operating and overhead costs, depreciation on assets, gains or losses on disposal of capital assets and income and expenses. It can be prepared on a cash or accrual basis. The accrual approach provides a true picture of the profitability of the business for that period by accounting for changes in the value of inventories, payables and receivables.

Items of Profit & Loss Account may be related to Corporate Finance Topics in the following manner:

Items of Profit & Loss Account Corporate Finance Topics

Net Sales Revenue Risk

Cost of Goods Sold

- Stocks

- Wages and Salaries

- Other Manufacturing expense

Gross Profit Gross Profit Margin

Operating Expenses

- Selling and Administration Expenses

- Depreciation Depreciation Policy Operating Profit

Non-operating Surplus / Deficit

Profit Before Business Risk and Reward

Interest and Tax

Interest Financial Risk

Profit Before Tax

Tax Tax Planning

Profit After Tax Return on Equity

Dividends

Retained Earnings Dividend Policy