A prime broker is the gateway to a wide range of products and services provided by an investment dealer to hedge funds, institutions and family offices. Prime brokers traditionally provided four core services:

- Clearing, settlement and custody

- Margin financing

- Securities lending

- Consolidated reporting

Increasingly, however, new products and services are being added to the mix, such as fund administration, risk analytics, and capital introduction. These additional services, discussed below, are designed to further assist hedge fund managers to launch, grow and efficiently manage their fund’s operational, financing and reporting requirements.

As hedge funds continue to expand their role in today’s capital markets, prime brokers globally are quickly revamping their products and services to meet hedge funds’ increasing requirements. A prime broker’s core services include clearing, settlement and custody, margin financing, securities lending and consolidated reporting. Today, this means providing a core service where hedge funds can access a wide range of markets and products, such as equities, fixed-income securities, commodities and currencies, as well as derivative products including options, futures and swaps.

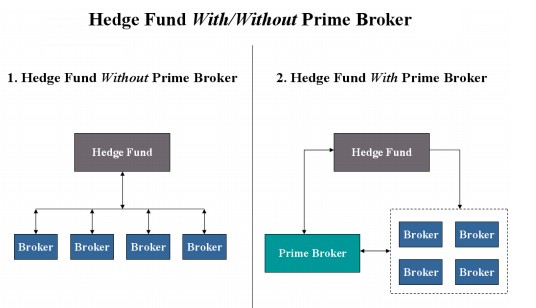

In broad terms, the prime broker acts as a conduit between hedge funds and the marketplace. The prime broker typically provides clearing on behalf of the fund, may finance transactions, provide securities lending for short sales, and also provide custody services. A prime broker enables hedge fund managers to trade with multiple brokers and consolidates their securities and cash balances in one master account.

This master account enables the prime broker to provide consolidated reporting, margin financing and efficient back-office processing. Since these services require significant capital investment, the majority of hedge funds outsource these services to a prime broker.

The prime broker’s relationship with hedge funds is relatively new. From the first U.S. hedge fund in 1949 until the early 1970s, money managers’ custody requirements were generally met by traditional custodians offering fully-financed custody, while margin accounts were provided by broker-dealers. As service requirements increased, broker-dealers began offering specialized services. Initially these services included acting as a money manager’s back-office by providing clearing and settlement services in addition to margin financing and securities-lending services.

As competition among industry players grew with client requirements, prime brokers began to add a variety of services. Today, global prime brokerage revenues are in the billions, and this burgeoning industry appears set to continue growing in the coming years.

In addition to the essential core services outlined above, prime brokers provide an increasingly broad offering, with many new products and services, such as.

- Risk and Performance Analytics: Some prime brokers have formed strategic alliances with risk management services, such as the Risk Metrics Group or Bear Measurisk, and provide hedge funds with access to daily risk analysis, performance analysis and reporting.

- Capital Introduction: Many prime brokers offer to introduce their hedge fund clients to potential investors and new sources of capital through their private banking and asset management businesses.

- Derivative Support: Many prime brokers provide their hedge fund clients access to their derivatives desk for trading and risk management ideas.

- Enhanced Leverage: Many prime brokers offer their hedge fund clients lines of credit that can be used for leverage.

- Research: Most prime brokers provide their hedge fund clients with full access to their in-house research reports.

- Fund Administration and/or Trustee Services: Some prime brokers offer outsourced hedge fund administration and trustee services.

The term “prime broker” is becoming a misnomer. While many hedge funds historically used only one prime broker, there is a growing trend among hedge funds to use more than one prime broker, as they seek best execution in a wide range of services and products. This is especially true among large, multi-strategy hedge funds that may tap into the unique competitive advantages of each prime broker. There are over 30 prime brokerage service providers globally, with most of them based in the U.S. While prime brokerage services in Canada are similar to those in the U.S., Canada has different regulatory and clearing procedures. One key difference is that Canada does not facilitate broker-to-broker settlements. Unlike the Depository Trust Company (DTC) in the U.S., the Canadian Depository for Securities Ltd. (CDS) does not operate on a broker-to-broker basis. Also, there are different regulatory capital requirements between Canada and the U.S. as different securities-lending conventions apply.

A prime broker’s legal entity structure greatly affects the risk its insolvency poses to its customers. U.S. prime brokers are required to register as broker-dealers under the Securities Exchange Act of 1934, as amended (34 Act) and to join, and comply with the rules of, self-regulatory organizations. For U.S. prime brokers, segregation of customer assets, hypothecation, securities possession/control, and minimum net equity are all regulated under the 34 Act. Customers of U.S. prime brokers holding assets in the United States may be protected by the Securities Investor Protection Act of 1979, as amended (SIPA), which established the Securities Investor Protection Corporation (SIPC).

Factors to Consider When Selecting a Prime Broker

Undertaking a new prime brokerage relationship can be a demanding task for a start-up hedge fund seeking to set up its first account, or for an established hedge fund seeking to diversify its prime broker relationships. In addition to starting up a close relationship with a new crucial business partner, selecting a prime broker is important for practical reasons. With a new prime broker/hedge fund relationship, both parties may need to integrate technologies, review and complete documentation and establish operational processes with their back offices.

The following are some of the key criteria that hedge funds should consider when selecting a prime broker.

- Business Understanding: A prime broker must understand its own business and how it facilitates and works directly with the hedge fund business. It should provide services efficiently and consistently on a day-to-day basis without interruption, while understanding the needs of its clients.

- Client Service: A prime broker’s client service team must be knowledgeable. Quality daily servicing is especially vital for start-up hedge funds that do not have a robust back-office infrastructure. The prime broker should understand the hedge fund’s strategy to facilitate daily requirements and provide cost efficient and effective solutions to the fund. These services may range from controlling failed trades to sophisticated margining scenarios and complex corporate action resolutions.

- Trading Confidentiality: A prime broker should ensure that a hedge fund’s positions will not be communicated to other divisions within the firm. A hedge fund must be confident that only prime brokerage staff has access to its trading activity and positions. The prime brokerage desk must have an “information barrier” in place, and information should only be shared on a need-to-know basis.

- Securities Lending: To facilitate those clients who short sell securities, a prime broker should have deep, internal access to a supply of securities with competitive rates and strong relationships with outside lenders.

- Flexibility in Decisions: A prime broker must have flexibility in terms of its financing alternatives and reporting capabilities. A prime broker should be able to adapt to its clients’ individual requirements in these two crucial areas, assuming all regulatory concerns are adhered to.

- Robust Technology: A prime broker’s technology must be robust and perform day-to-day functions efficiently and without a fail. While other services, such as performance and risk attribution, are useful, the core service of reporting trades and positions must be consistently available, which means that the prime broker must have a well-tested disaster recovery plan in place.

- Back-office and Front-office Integration: A prime broker’s back-office technology, such as risk and settlement systems, should be seamlessly integrated into front-office solutions. Traditionally prime brokers segmented their businesses along product lines, such as equities, fixed-income securities, commodities and foreign exchange, with different technology platforms and databases servicing each silo. But the key to servicing today’s hedge fund market is to provide seamless processing of trades across multiple asset classes and products simultaneously.

- Capital Introduction: A prime broker must be clear about how its capital introduction programs may assist a hedge fund’s efforts in raising capital.

- Access to the Firm: A prime broker serves as a window to the firm. The capabilities of the entire organization should be considered in determining a prime brokerage relationship.

- Margining Facilities: A prime broker should offer competitive margin financing facilities that enable the hedge fund to maximize its capital usage. For example, “cross margining” across multiple securities (within regulatory guidelines) is now the market standard.

- Reporting: Daily reporting should be easy to understand, accurate and provide all necessary information and data for the hedge fund to use effectively.

- Commitment to Business: Senior management of the firm must be fully committed to the prime brokerage business.

- Fees: For many hedge funds, the prime broker’s fees are one of the most important criteria. The hedge fund should assess the prime broker’s charges for its services including trade execution, clearance charges, stock lending costs and financing rates.

An effective prime broker may assist a hedge fund in a variety of ways and, in turn, this support may affect the hedge fund’s performance. A good prime broker is more than just a service provider – it is a key resource that a hedge fund must depend on, day in and day out. Today, a successful prime broker must consistently maintain the quality of its core services, and also innovate with new products and services to meet its clients’ changing requirements. As hedge funds continue to play a growing role in global capital markets, and as institutional investors increase their allocations to hedge funds, the prime brokerage business is well positioned to continue to provide innovative solutions.

Apply for Hedge Fund Certification Now!!

http://www.vskills.in/certification/Certified-Hedge-Fund-Manager