PF is a short form for Provident Fund. This is a statutory deduction and is applicable to most employees (with some exceptions). The Government of India has specified the rules for this. According to PF rules, an employee is supposed to contribute a certain percentage of basic salary as PF. This is normally called as PF or Employee PF. Just like an employee, the employer also makes a contribution toward PF in the employee’s name. This is called as Employer PF.

In most cases, the Government (PF Board) collects this amount and keeps it in the employee’s name. After an employee retires, all the contribution made by the employee along with interest is paid back to the employee. This is handled by the PF Board and the employer or company has no role to play in it.

For example If my salary is Rs.1000/-, then I should contribute Rs. 120 as my PF. This will be go to my PF account. Along with my contribution, my employer shall also make a contribution of Rs. 120 in to my account. So every month, my PF account increases by Rs. 240 (120 from employee, 120 from employer).

Every employee is issued a number by the government. This number is called as the PF Number. (This is similar to a bank account number). An employee can use this number to check his current PF balance status. When an employee has served with another organization in the past, the employee may have an existing PF Number. The said PF Number can be used or a new one can be allocated. This flexibility has given rise to issues such as tracking closure of a PF account. To enable better tracking and closure, PF Board has determined in August 2014 to allocate Universal Account Number. Employee also needs to submit one of the specified identity documents for verification.

The Employee provident fund act provides collection of pension and deposit fund, deposit linked insurance for the employees at factories and other establishments. Employee Provident Funds and Miscellaneous Provisions Act, 1952 came into effect on 4 March 1952, by the Government of India administered by Central Board of Trustees(CBT). The employment provident fund declares status of a person as soon as he retires. All the activities are being operated by the Central provident Fund Commissioner, presided by Union Labor Minister of India. Constitution of India under “Directive Principles of State Policy” states that the State shall provide effective provision for securing the right to work, education and public assistance in cases of unemployment, old age, sickness, disablement and undeserved want.

This act is an important fragment of Labor Welfare legislation enacted by the Parliament to provide social security benefits to workers. At present, the Act and Schemes framed provide 3 types if benefits:

- Contributory Provident fund.

- Pension benefits to employees/family members.

- Insurance cover to the members of Provident Fund.

The provisions of the Employee provident fund act extend to whole of India except the State of Jammu & Kashmir and also the State of Sikkim where it has not been notified so far after its annexation with the Union of India.

Applicability

All establishments employing 20 or more persons (5(or) more for Cinema Theaters) are brought under preview of the Employee provident fund act from the very first date of setup are subjected to fulfillment of other conditions. The provisions of the Act are applicable on its own force independently. If the establishments don’t have the prescribed number of employees and are willing to obtain the benefits of this act, then they can register voluntarily with regional Provident Fund office.

Definition of wages

In the Employee and provident fund act, wages include the sum of basic and dearness allowances, cash value of food concession and retaining allowances, if any

Eligibility

- An employee at the time of joining the employment and getting salary up to Rs 6,500/-

- He/ she is eligible for membership of fund from very first date of joining a covered establishment.

Pension Fund

This is a fund that provides retirement. To avail pension benefit, the member

- Should have completed 10 years of continuous service (or) attained age of 50 years or more.

- Doesn’t receive any EPF pension.

- Will receive pension amount on a monthly basis after attaining the age of 58.

Administrative Charges

The administrative charges in the Employee provident fund act include

- Employer has to pay administrative charges at 1.10% of emoluments towards the provident fund fun charges and 0.01% towards ELDI Scheme

- Employee need not contribute anything towards these charges.

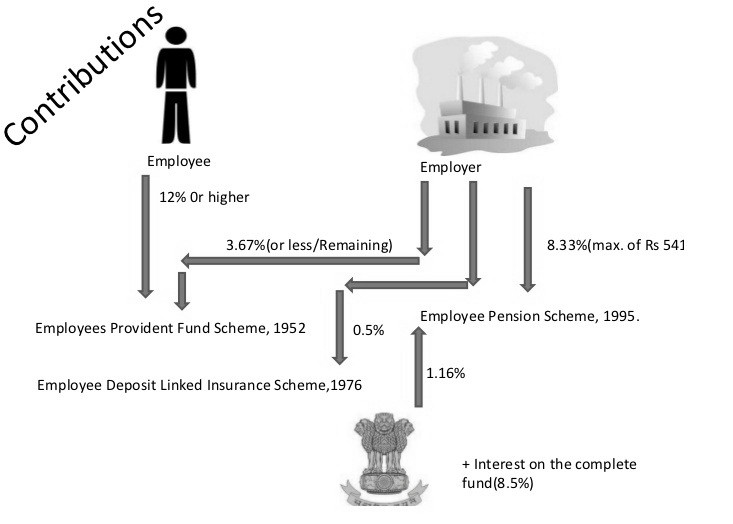

Present Rates of Contribution

| BY | CONTRIBUTION ACCOUNTS | ADMINISTRATION ACCOUNTS | |||

| EPF | EPS | EDLI | EPF@@ | EDLI @@ | |

| EMPLOYEE | 12% /10% ## | 0 | 0 | 0 | 0 |

| EMPLOYER | Difference of EE | 0.50% !! | 0 | ||

| share and | 8.33% ## | 0.5% ## | [w.e.f. 01-06-2018] | [w.e.f. 01-04-2017] | |

| Pension | |||||

| Contribution |

10% rate is applicable for

- Any establishment in which less than 20 employees are employed.

- Any sick industrial company and which has been declared as such by the Board for Industrial and Financial Reconstruction

- Any establishment which has at the end of any financial year, accumulated losses equal to or exceeding its entire net worth and

- Any establishment in following industries:-

- Jute (b) Beedi (c) Brick (d) Coir and (e) Guar gum Factories.

## Contribution is rounded to the nearest rupee for each employee, for the employee share, pension contribution and EDLI contribution. The Employer Share is difference of the EE Share (payable as per statute) and Pension Contribution.

!! Monthly payable amount under EPF Administrative charges is rounded to the nearest rupee and a minimum of Rs 500/- is payable. Note:- If the establishment has no contributory member in the month, the minimum administrative charge will be Rs 75/-

@@ In case Establishment is exempted under PF Scheme, Inspection charges @0.18%, minimum Rs 5/- is payable in place of Admin charges. In case the Establishment is exempted under EDLI Scheme, Inspection charges @ 0.005%, minimum Re 1/- is payable in place of Admin charges.

Under EPF

- The contributions are payable on maximum wage ceiling of Rs. 15000/-

- The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.

- To pay contribution on higher wages, a joint request from Employee and employer is required [Para 26(6) of EPF Scheme]. In such case employer has to pay administrative charges on the higher wages (wages above 15000/-).

- For an International Worker, wage ceiling of 15000/- is not applicable.

Under EPS

- Contribution is payable out of the employer’s share of PF and no contribution is payable by employee.

- Pension contribution not to be paid:

- When an employee crosses 58 years of age and is in service (EPS membership ceases on completion of 58 years). When an EPS pensioner is drawing Reduced Pension and re-joins as an employee.

In both the cases the Pension Contribution @8.33% is to be added to the Employer Share of PF. (Pension contribution is not to be diverted and total employer share goes to the PF). In case an employee, who is not existing EPF/EP member joins on or after 01-09-2014 with wages above Rs 15000/- In these cases the pension contribution part will be added to employee share, EPF.

- In all other cases Pension Contribution is payable. A member joining after 50 years age, if not a pensioner does not have choice of not getting the Pension Contribution on grounds that he will not complete 10 years of eligible service. The social security cover is applicable till he/she is a member.

- For International Worker, higher wage ceiling of 15000/- is not applicable from 11-09- 2010.

Note:- In case an existing EPS member (as on 01-09-2014)whose Pension contribution was paid erstwhile EPS wage ceiling of 6500/- contribution to contribution above Rs 15000/- wage ceiling from 01-09-2014 he will have to give a fresh consent and an amount of 1.16% on wages above 15000/- will have to be contributed by him in pension Fund (A/C No 10) through the employer.

Under EDLI:

- Contribution to be paid on up to maximum wage ceiling of 15000/- even if PF is paid on higher wages.

- Each contribution is to be rounded to nearest rupee. (Example for each employee getting wages above 15000, amount will be 75/-)

- EDLI contribution to be paid even if member has crossed 58 years age and pension contribution is not payable. This is to be paid as long as the member is in service and PF is being paid.

Rate of Pf Contribution since 22.09.1997 onwards, has the rate of 10% and enhanced rate 12%, for

- Establishment paying contribution @ 8.33% to 10%

- Establishment paying contribution @10% to 12%

EPF administrative charges payable by the employers of un-exempted establishments since 01.06.2018 onwards, has the rate of 0.50%, reckoned on total pay on which contributions are payable. Minimum Administrative charges payable per month per establishment is Rs. 500/-.

EPF inspection charges payable by the employers of exempted establishments since 01.08.1998 onwards has the rate of 0.18%, on total pay on which contributions are payable.

Annual Account Statement

After end of each period of contribution, annual statements of accounts will be sent by PF department to each member last employed. The statement of accounts in fund will show

- Opening balance of contribution with interest of both employer and employee

- Total contributions and interest earned during the year by both employee and employer.

Withdrawal of Employee Provident and Pension Fund

- A member is eligible to apply for withdrawing his provident and pension fund only after 2 months from date of resignation, provided that he/she is not employed during the said 2 months.

- The member should submit Form 19 & 10C to withdraw his provident fund dues on leaving the service/retirement (get it signed by previous employer and submit it to provident fund office).

- Withdrawals are exempted from tax if the employee has rendered continuous service for more than 5 years.

Advances of PF account

Members are eligible to withdraw monies as advances from their PF accounts for purposes like marriage, education, medical treatment etc. This is tax and interest free.

Marriage:

- Only to one’s self, son, daughter, brother & sister.

- A maximum of three times in the entire service.

- Marriage Invitation card is to be submitted along with a form as a proof for marriage through employer.

Education:

- Only to one self, son and a daughter.

- An authentic certificate indicating the fees payable from the educational institution.

For Medical Treatment:

- Only to one self, wife, son, daughter, dependent father & mother.

- Doctor of the hospital vouches that a surgical operation or hospitalization for 1 month or more is/was necessary.

- In case of TB or leprosy etc, a specialist doctor should provide the certificate.

Compliance Checklist under EPF Act

| Provisions | Compliance |

| Employer and Employee’s PF dues | 15th of following month |

| Payment of Pension Fund | 15th of following month |

| Payment of Insurance Fund | 15th of following month |

| Detail of employees | Detail of employees enrolled as members PF fund, within 1 month of coverage in the prescribed form |

| Nomination Form | Immediately on Joining the fund in the prescribed form |

| Addition of members | Detail of newly enrolled members within 15 Days of following month in the prescribed form |

| Deletion of member | Detail of members left service during the monthbefore21st of following month in the prescribed form |

| Details of contribution | Detail of employees and employer’s contribution by 25th of the following month in the prescribed form |

| Detail of wages and contribution | For each member details shall be given By 30th April every year |

| Yearly Consolidated statement of contribution | To be forwarded yearly along with Form 3A |

| Return of ownership of the establishment | Within 15 days on coverage and whenever there is a change in ownership |

| Transfer of PF | Form 13 needs to file |