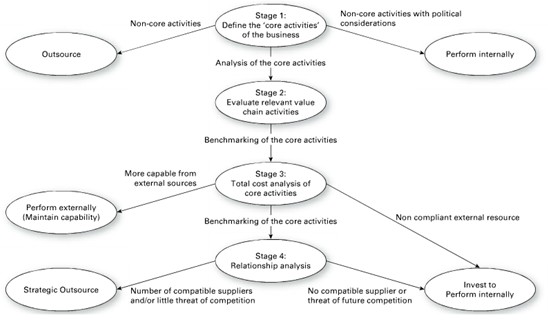

The model by McIvor (2000), shown in Figure 14.1, provides a process companies should adopt when deciding whether to outsource. McIvor suggests that the main areas which need to be assessed are whether the activity is core to the business, whether there are political considerations, whether potential cost savings are significant enough to make outsourcing viable and, finally, whether there are capable and compatible partners in the market. Vitasek (2010) goes on to say that companies which value the warehousing operation and have specific expertise internally should keep this operation in house. To those companies which lack the expertise and where the operation is not seen as core to the business, outsourcing is a distinct option.

Figure 12.1: The Outsourcing Decision

While making the decision, the manager should try to find out if the outsourcing company is fulfilling any of these benefits.

- Take advantage of the benefits provided from a best-in-class operations

- Improve business’s customer fulfillment and distribution services

- Distribution centers and warehousing services that are closer to ports and clients

- Operations that are up and running in an expedited way

- Industry-specific services that require little to no customization

- Flexibility in managing business and supplier changes

- The ability to easily and quickly add short or long-term capabilities

- Flexibility and scalability of third party operations – ability to adjust your distribution and warehousing needs based on demand

- Respond to strategic business changes quickly with minimal or no capital expense – i.e. change providers or networks or regions

- Capital cost avoidance and seamless integration of data from 3PL WMS to internal systems for real-time visibility of your inventories and customer service

- Value-add services (e.g. labeling, bundling, kitting, and other special packaging needs) to meet your specific and changing requirements

- Lower costs while improving customer service

- To take advantage of the warehousing company’s “other services” buying powers