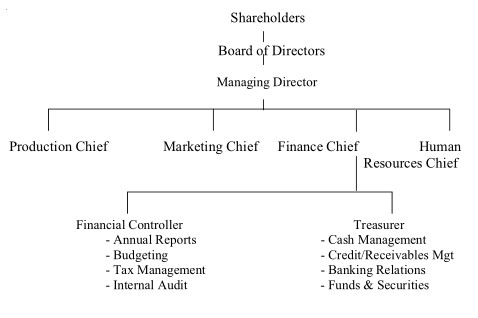

You are aware about organizing the activities of an organization as well as organizing the activities within a function. Since Finance function is very vital for every type of organization, it is necessary to set up a sound and efficient organization. The organization varies depending upon the nature, size of the organization, though we cannot have a standard organization for all the enterprises, we can structure the basic aspects for a corporate as below:

Share holders determine the following while approving the Articles of Association and the bye –laws:

- The amount and kind of capital

- Rules governing issue and transfer of stock

- Powers of directors to declare a dividend, choose a bank, create reserves

- Sale of firm’s assets

- Plans for reorganization, liquidation, consolidation and mergers etc.

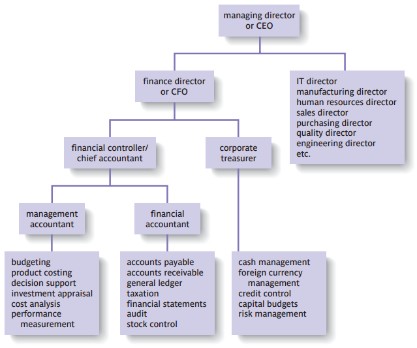

The board of directors of a limited company includes a managing director (or CEO – chief executive officer), and a number of functional executive directors and may include one or more professionally qualified accountants, one of which may be the finance director. The directors of the company necessarily delegate to middle managers and junior managers the responsibility for the day-to-day management of the business. It is certainly likely that this body of managers, who report to the board of directors, will include a further one or more qualified accountants responsible for managing the finance function.

The traditional structure of the finance function in a medium to large sized company (see Figure) splits responsibilities broadly between accounting and finance, both being the responsibility of the finance director (or CFO – chief financial officer). Accounting is managed by the financial controller (or chief accountant), and cash and corporate finance may be managed by a corporate treasurer (or financial manager), and they both report to the finance director. Historically, the IT function (information technology or data processing) has also been the responsibility of the finance director in the majority of companies. This is because the accounting function was the first major user of computers for payroll and then accounting ledgers, financial reporting, budgeting, financial information, etc.

Board of Directors approve the financial policy, declare dividends and translate the aspiration of shareholders into specific goals and objectives and select & appoint the senior officers.

The Controller is concerned primarily with the Planning, Accounting and Control activities. The Treasurer is responsible mainly for financing, management of cash & receivables and investment activities.

The organization of financial function depends on the needs of each organization. The financial needs of each organization vary from the other. In some organization working capital requirements may be more, as in the case of manufacturing organizations as compared to service organizations. In some organization the gestation period may be longer before they start generating revenues and earn profits.