NAV

Net Asset Value (NAV) is an important concept in the world of mutual funds. It is essentially the value of one unit of a mutual fund scheme. NAV is calculated by dividing the total value of the assets held by the fund by the total number of units outstanding. The assets of the fund include all the securities that it has invested in, such as stocks, bonds, and other financial instruments. The NAV of a mutual fund is calculated at the end of each trading day and reflects the changes in the value of the fund’s assets over that day.

The NAV of a mutual fund is a key indicator of its performance. When the NAV of a mutual fund increases, it means that the value of the fund’s assets has increased, and the investor’s investment has appreciated. On the other hand, if the NAV of a mutual fund decreases, it means that the value of the fund’s assets has decreased, and the investor’s investment has depreciated. Investors can use the NAV of a mutual fund to track the performance of their investment and make informed decisions about buying or selling units of the fund.

It’s important to note that the NAV of a mutual fund does not necessarily reflect the returns that an investor will receive. The returns from a mutual fund depend on the performance of the underlying assets and the fund manager’s strategy. Additionally, the NAV of a mutual fund is only a snapshot of its value at a particular point in time and may not accurately reflect the fund’s long-term performance. Nonetheless, the NAV remains a crucial metric for investors to track the performance of their mutual fund investments.

In mutual funds, net assets represent the unit-holders’ funds in the scheme. If all the scheme’s assets are realised, and the scheme’s dues other than to unit-holders are paid out, what remains is the net assets of the scheme. This amount, divided by the number of units, is the Net Asset Value (NAV) per unit.

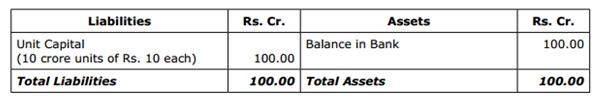

The concept can be easily understood, considering the balance sheet of a scheme viz. listing of its assets and liabilities.

If for example, a close-ended scheme mobilised Rs. 100 crore during its NFO, it would have issued 10 crore units of Rs. 10 each. The scheme’s balance sheet would be:

NAV of the scheme at this stage would be Rs. 100 crore/10 crore units i.e. Rs. 10 per unit.

If the scheme invests Rs. 80 crore in equity shares, the market value of the investments would be Rs. 80.25 crore at the end of the day.

Apply for Mutual Funds Analyst Certification Now!!

https://www.vskills.in/certification/mutual-funds-analyst