Multi-Strategy Fund

This fund typically is owned and managed by one investment firm or a large institutional investment company and uses various strategies under a common organizational umbrella. Previously, multi-strategy funds (MSFs) represented multiple investment teams pursuing a similar trading strategy, but diversified Multi-strategy funds are gaining in number and popularity. Because investing directly into single-strategy funds is beyond the prudent reach of most individuals, fund of funds and multi-strategy funds will remain the primary access vehicles for most non-institutional investors.

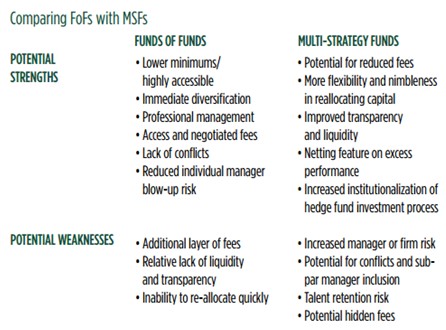

The following is a summary of the potential strengths and weaknesses of each structure.

Potential Strengths – Fund of Funds

- Accessibility: Fund of funds offer investment minimums of $100,000–$1 million, hence they are accessible to many high net-worth investors.

- Diversification: Because most fund of funds shoot for consistent, low-volatility return through the use of multiple managers and multiple strategies, investors can achieve a satisfactory level of diversification within a single fund. It is not uncommon for a fund of funds to employ 20–25 underlying managers within a given fund.

- Professional management: Many fund of funds managers have significant experience in the held and provide a professional level of due diligence, manager selection, asset allocation, and risk management that individual investors achieve themselves.

- Access and negotiated fees: Many funds of funds have successfully negotiated access to managers otherwise closed to new investors, sometimes at reduced fees. The power of the collective assets of the fund of funds gives it a negotiating ability beyond the capabilities of most individual investors.

- Lack of conflicts: Because most fund of funds managers are independent of the underlying managers they select, they have the ability to pick and choose the best underlying managers or an appropriate mix of managers to generate a certain risk/return profile.

- Reduced blow-up risk: Because of their diversified underlying managers, the blow up of any given individual manager, or serious underperformance of any particular strategy, typically will not bring down the overall fund of funds.

Potential Weaknesses- Fund of Funds

- Additional layer of fees: Many Funds of funds were generating double-digit returns in the turbulent bear market of 2000–2003 and investors gladly paid the double layer of Fund of funds fees. Today, however, many if not most Funds of funds are anticipating mid–high single-digit returns into the foreseeable future. In this environment investors may pay more attention to fees as they consider the appropriate way to invest in hedge funds.

- Lack of liquidity and transparency: Many Funds of funds distinctly lack transparency into the strategies underlying the overall fund. This mix of managers represents the “special sauce” the Fund of funds manager is bringing to the table, and many managers are reluctant to reveal its ingredients. In addition, because the underlying managers may have strict redemption or liquidity terms, many Funds of funds must offer similarly strict liquidity terms to their investors.

- Inability to reallocate quickly: Most Funds of funds has core holdings in a relatively small number of underlying managers supplemented by smaller satellite holdings. In addition, the underlying managers frequently have restrictive liquidity and redemption terms. As such, Fund of funds managers typically does not engage in frequent reallocation of their underlying funds, and they may be unable to react to changing market trends.

Potential Strengths- Multi-Strategy Funds

- The potential for reduced fees: Because Multi-strategy funds typically charge only a single layer of fees that incorporates the cost of the underlying managers, there is the potential for an overall reduced fee structure for investors, especially if the fund offers a netting arrangement on performance fees.

- Flexibility and nimbleness: Because the underlying funds in a multi-strategy fund are owned and controlled by a single arm, they may have the ability to more quickly reallocate investments within the various funds, and they also may have more control over the overall investment profile of the fund.

- Improved transparency and liquidity: Because of the common ownership structure, Multi-strategy funds typically will offer improved transparency into the make-up of the underlying strategies. Previously, most Multi-strategy funds pursued multiple strategies within a specific market space and as such were not really an apples-to-apples alternative to a diversified fund of funds.

In the past one to two years, however, many large institutional firms (banks, insurance companies, etc.) have formed or purchased multiple single-strategy hedge funds for the purpose of being able to offer a diversified multi-strategy fund to investors. These firms are responding, in part, to the rapid growth in institutional demand for hedge funds, particularly among pension plans. Most of the growth will come from pension plans, endowments, and foundations. These institutional investors most likely will prefer a diversified multi-strategy fund structure to a more traditional fund of funds structure because of the increased ability to reallocate capital more quickly and to reduce overall fees.

Potential Weaknesses- Multi-Strategy Funds

- Increased manager risk: With a multi-strategy fund, the investor may get diversification of underlying strategies but he/she is still placing a large bet on a single hedge fund shop, because all of the underlying funds are owned or controlled by that shop. Lack or loss of risk control within that single firm could have severe negative consequences for the investor.

- Potential for subpar managers: As with any closed architecture investment offering, once a particular hedge fund is owned or controlled by the firm offering the multi-strategy fund, that firm now is conflicted with respect to the underlying funds. There is a disincentive and perhaps an inability to remove an underperforming manager. This typically is less the case with an independent Fund of funds manager. Furthermore, expertise in a particular strategy does not necessarily translate into expertise in other strategies, so a single-strategy fund that evolves into a more diversified multi-strategy fund may or may not be selecting the “best of breed” managers along the way. This can be viewed as similar in nature to the risk of style drift for a long-only manager.

- Talent retention: Successful hedge fund managers by nature tend to be idiosyncratic and independent, and they frequently are ex-proprietary traders from large investment houses who struck out on their own to pursue a particular trading strategy or shake free of a corporate environment. These managers are not threatened by fund of funds, which merely are large investors in their funds, but becoming part of an institutionally-owned multi-strategy fund may not be something many of the better managers seek.

- Hidden fees: Both fund of funds and multi-strategy funds have operational costs associated with running their respective offerings, and these fees may or may not be passed through to the end investor. Multi-strategy funds, however, may have an additional cost not readily apparent to the investor—the internal cost of capital allocated to the fund by the sponsoring investment firm.

For example, an investment bank needs to make resource allocation decisions between competing areas of the firm, and those decisions will be based in part on the expected return on allocated capital. Investors should find out whether or not that cost of capital is being passed through to them before deciding that a given multi-strategy fund really is the less expensive alternative.

There is no precise best choice when deciding between a diversified fund of funds and a diversified multi-strategy fund. Both the structures have strengths and weaknesses and both will continue to grow as the demand grows for accessible hedge investments.

One can, however, make some defensible predictions about the evolution of the marketplace.

Multi-strategy funds will grow at a faster pace than fund of funds. This is a function of the respective of the total number of the two structures and the corresponding complexity in maintaining comparable growth as size increases, as well as the changing nature and demands of the investor.

Institutional asset flows into hedge funds are expected to match or exceed private investor asset flows within the next few years. This represents a fundamentally new type of money for managers, with different risk–return expectations, different tax status, different requirements on corporate governance and institutionalization of operations, and different expectations with respect to fees.

In addition, more large institutional investment firms are entering the hedge fund game, and they will be targeting a wider array of potential investors. These trends favour the growth of multi-strategy funds over Fund of funds. Fund of funds fees will come down. Pressure to lower Fund of funds fees will come primarily from two sources.

- Increased competition and

- Lower expected returns.

As more multi-strategy funds enter the market offering a single layer of fees, Fund of funds will be forced to follow suit or risk pricing themselves out of the market.

Secondly, for many fund of funds managers, the days of double-digit returns are history due to increased efficiency and less excess return potential in the underlying markets as well as lower volatility and lower expected risk premia. With 7-percent to 10-percent gross returns, investors increasingly will be unwilling to pay high management and performance based fees. Multi-strategy fund fees may be higher but already will incorporate the underlying manager fees (perhaps 1.50%-2%) with no performance fee.

In a highly competitive marketplace that is not anticipating especially high overall returns, investors may turn from “performance alpha” to “fee alpha.” Again, if one believes in the maxim that “the average investor generates average results,” then many investors may not have confidence that a Fund of funds can generate sufficient performance alpha to justify a higher fee structure.

Under this scenario, a multi-strategy fund offering comparable market returns at a lower cost would be more attractive. In other words, investment consultants know they cannot control market performance, but they do have control over the fees and, to a certain degree, taxes. In a low-return environment, it will be tempting for these consultants to control fees rather than chase performance.

In a different perspective, the decision between fund of funds and multi-strategy funds is similar to the decision between active versus passive management. If one believes active management can add value, then that active management justifies a higher fee. Fund of funds managers will prefer this route, because they will believe they can generate superior performance and show a differentiated offering to existing and prospective clients. Consultants who want to give a competitive offering but not spend their time trying to find the best fund in an increasingly efficient industry may choose the multi-strategy fund route. At the end of the day, both strategies can play a role in a well-designed portfolio.

Apply for Hedge Fund Certification!

https://www.vskills.in/certification/certified-hedge-fund-manager