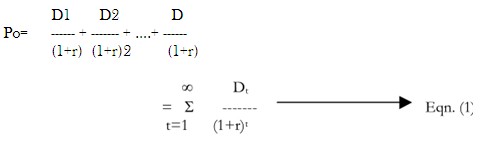

Since equity shares have no maturity period, they may be expected to bring a dividend stream of infinite duration.

Hence the value of an equity share will be

Where

Po = price of the equity share today

D1= dividend expected a year hence

D2 = dividend expected 2 years hence

D¥ = dividend expected at the end of infinity

r = expected return

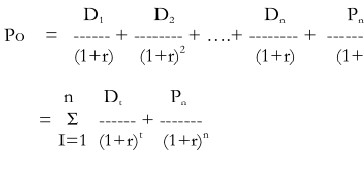

An investor who plans to hold it for n years and sell it therefore for a price of Pn will get his equity share having a value.

For practical applications it is helpful to make simplifying assumptions about the pattern of dividend growth as follows:

- The dividend per share remains constant forever, implying that the growth rate is nil (the zero growth model)

- The dividend per share grows at a constant rate per year forever ( the constant growth model)

- The dividend per share grows at a constant extraordinary rate for a finite period, followed by a constant normal rate of growth forever thereafter .

- The dividend per share, currently growing at an above normal rate, experiences a gradually declining rate of growth for a while. Therefore, it grows at a constant normal rate