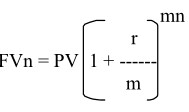

Normally interest rate is expressed for a year. In case, com-pounding is done semi-annually or quarterly or monthly or weekly, interest rate & compounding to be adjusted accordingly to alter the number of time periods. The formula FVn = (1+r)n will get altered as below:

Where m is the number of compounding per year

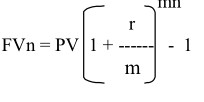

The interest rate specified on annual basis is known as the Nominal Interest Rate. If compounding done in a year is more than once, the actual rate of interest is called the

Effective Interest Rate (EIR) /Annual Percentage Rate (APR), which can be ascertained as below:

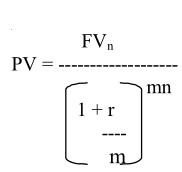

Similar to Future Value, Present Value of cash flows more than once a year can be discounted with the following formula: