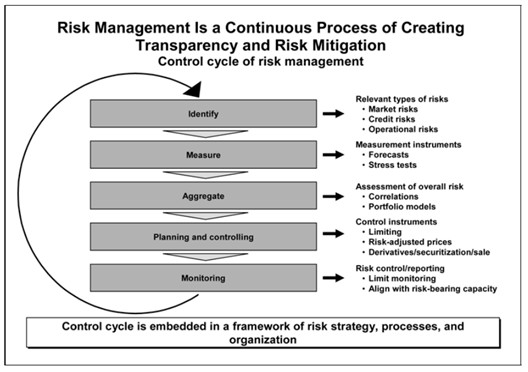

The management of risk is a continual process entailing the identification of problem areas, ascertaining the amount of backlash, correlation to other related variables, and controlling and monitoring of intended plans. Without vigilance, the effects of risk can become a heavy burden on any business. The risk management cycle contains identification, measurement, aggregation, planning and management, as well as monitoring of the risks arising in a business. Risk management is thus a continuous process to increase transparency and to manage risks. The following flow-chart clearly lays out the cycle of risk management.

Risk Management Cycle

- Identifying the types of risks: A bank’s risks have to be identified before they can be measured and managed. Typically banks distinguish the following risk categories: credit risk, market risk, operational risk. There are further types of risks, such as strategic risks, or reputational risks, which cannot usually be included in risk measurement for lack of consistent methods of quantification.

- Measure the amount of risk: The consistent assessment of the three types of risks is an essential prerequisite for successful risk management. While the development of concepts for the assessment of market risks has shown considerable progress, the methods to measure credit risks and operational risks are not as sophisticated yet due to the limited availability of historical data. Credit risk is calculated on the basis of possible losses from the credit portfolio. Potential losses in the credit business can be divided into:

- Expected losses: These are derived from the borrower’s expected probability of default and the predicted exposure at default less the recovery rate, i.e. all expected cash flows, especially from the realization of collateral. The expected losses should be accounted for in income planning and included as standard risk costs in the credit conditions.

- Unexpected losses: These losses result from deviations in losses from the expected loss. Unexpected losses are taken into account only indirectly via equity cost in the course of income planning and setting of credit conditions. They have to be secured by the risk coverage capital.

- Aggregating the risks: When aggregating risks, it is important to take into account correlation effects which cause a company’s overall risk to differ from the sum of the individual risks. This applies to risks both within a risk category as well as across different risk categories.

- Planning and controlling of risk: Risk management has the function of planning the overall risk position and actively managing the risks based on these plans. Managing should be taken to mean the selective limitation of risk positions as well as the mitigation, or possibly increase, of these positions by means of financial instruments or suitable techniques. These instruments or techniques affect the risk of the individual position and/or influence changes in the risk position in the overall portfolio as a result of portfolio effects. The most commonly utilised tools for managing risk are:

- risk-adjusted pricing of individual loan transactions

- setting of risk limits for individual positions or portfolios

- use of guarantees, derivatives, and credit insurance

- securitization of risks buying and selling of assets

- Risk monitoring: Monitoring of risk is used to study whether the risks that truly incurred lie within the prescribed range, thus ensuring an institution’s capacity to endure these risks. Going further, the effectiveness of the measures implemented in risk controlling is measured, and new impulses are generated if necessary.

Obstacles to Credit Risk Management

The task of credit risk management is difficult in developing markets because of intervening matters such as

- Government controls

- Political pressures

- Production difficulties

- Financial restrictions

- Market disruptions

- Delays in production schedules

- Frequent instability in the business environment

- Unreliable financial information

- Debt recovery is not supported by the legal framework

Deficiencies in Credit Risk Management

The common faults experienced in credit risk management are,

- Absence of written policies

- Absence of portfolio concentration limits

- Poor industry analysis

- Inadequate financial analysis of borrowers

- Credit rationing contributing to deterioration of loan quality

- Excessive reliance on collateral

- Concentration of lending authority

- Inadequate checks and balances in the credit process

- Absence of loan supervision

- Failure to control and audit the credit process effectively

Companies should maintain a desirable relationship among loans and other liabilities and capital. Loan quality is fostered by sound credit policy. A company’s credit taking objectives usually encompass,

- Regulatory environment

- Availability of funds

- Selection of risk

- Loan portfolio balance

- Term structure of liabilities

Lending Limitation

In view of the unforeseen changes in the financial conditions of companies, industries, geographical areas or whole countries, a system of limits for different types and categories of lending have to be set. While companies could adopt credit limits in different ways and at different levels the essential requirement is to establish maximum amount that may be loaned to any one borrower or group of connected borrowers and to any one industry or type of economic activity.

Loans may be classified by size and limits put on large loans in terms of their proportion to total lending. The rationale of these limits is to limit the company exposure to losses from loans to any one borrower or to a group whose financial conditions are interrelated. A system of credit limits, restricts losses to a level which does not compromise a company’s solvency.

Lending limits have to be set taking into account capital and resources. Any limit on credit has to be accompanied by a general limit on all risk assets. This would enable the business to hold a minimum proportion of assets such as cash and government securities whose risk of default is zero.

Diversification

Diversification involves the spread of lending over different types of borrowers, different economic sectors and different geographical regions. To a certain extent credit limits which help avoid concentration of lending ensures minimum diversification. The spread of lending is likely to reduce serious credit problems. Size however confers an advantage in diversification because large businesses can diversify by industry as well as region.

Lending to foreign governments, their agencies or to foreign private sector companies has added a new dimension to credit risk. Country risk involving the assessment of the present and future economic performance of countries and the stability and character of the government has to supplement credit risk assessment or the creditworthiness of individual borrower. In line with the basic principles of limitation and diversification of credit risk management, credit limit have to be set for individual countries and particular regions of the world.

Methods for Reduction of Credit Risk

Companies can reduce credit risk by,

- Raising credit standards to reject risky loans

- Obtain collateral and guarantees

- Ensure compliance with loan agreement

- Transfer credit risk by selling standardized loans

- Transfer risk of changing interest rates by hedging in financial futures, options or by using swaps

- Create synthetic loans through a hedge and interest rate futures to convert a floating rate loan into a fixed rate loan

- Make loans to a variety of firms whose returns are not perfectly positively correlated

Collateral

‘Collateral’ is an asset normally movable property pledged against the performance of an obligation. A ‘pledge’ is mortgage of a movable property which requires delivery of possession whereas hypothecation does not require delivery.

Examples of collateral are accounts receivable, inventory, banker’s acceptance, time draft like post-dated cheque accepted by importer’s bank (used by foreign traders to make payments) buildings, marketable securities and third party guarantee.

Bank can sell the collateral if the borrower defaults. While collateral reduces the bank’s risk it enhances costs in terms of documentation and monitoring the collateral.

The factors that determine suitability of collateral are,

- Standardization: Standardization helps in identifying the nature of asset that is being used as collateral.

- Durability: Durability refers to useful life or ability to withstand wear and tear. Durable assets make better collateral.

- Identification: Identification is possible, if the collateral has definite characteristics like a building or a serial number (motor vehicle).

- Marketability: Marketable collateral alone is of value to the bank if it has to sell it. Marketability must be distinguished from liquidity.

- Liquidity: Liquidity refers to quick sale with little or no loss from current value.

- Stability of value: The value of collateral should remain stable during the currency of the loan.