AS-2 presents guidance for determining the value at which inventories are carried. It also discusses the cost formulas that are used to assign costs to inventories and any write-down thereof to net realisable value.

- Held for sale in the ordinary course of business. It means finished goods ready for sale in case of a manufacturer and for traders, goods purchased by them with the intention of resale but not yet sold. These are known as Finished Goods.

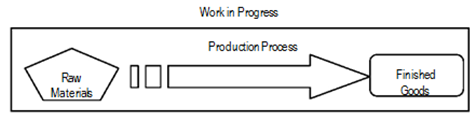

- In the process of production for such sale. These refer to the goods which are introduced to the production process but the production is not yet completed i.e. not fully converted into finished goods. These are known as Work-in-Progress.

- In the form of materials or supplies to be consumed in the production process or in the rendering of services. It refers to all the materials and spares to be consumed in the process of production. These are known as Raw Materials.

Measurement of Inventories

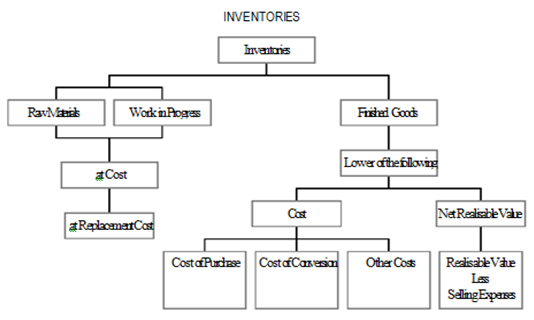

Inventories should be valued at the lower of cost and net realisable value.

Cost of goods is the summation of:

- Cost of Purchase.

- Cost of Conversion.

- Other cost necessary to bring the inventory in present location and condition.

As shown in the Inventories diagram, finished goods should be valued at cost or market price whichever is lower, in other words, finished goods are valued at the lower of cost or net realisable value.

Cost has three elements as discussed below:

- Cost of Purchase: Cost of purchase includes the purchase price plus all other necessary expenses directly attributable to purchase of stock like, taxes, duties, carriage inward, loading/unloading excluding expenses recoverable from the supplier. From the above sum, following items are deducted, duty drawback, CENVAT, VAT, trade discount, rebates.

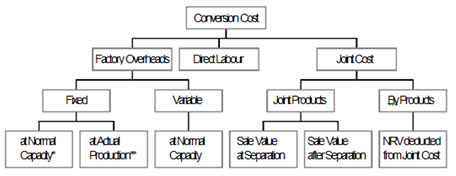

- Cost of Conversion: For a trading company cost of purchase along with other cost (discussed below) constitutes cost of inventory, but for a manufacturer cost of inventory also includes cost of conversion. Readers can recollect the calculation of factory cost calculated in Cost Accounting:

Direct Material + Direct Labour = Prime Cost

Prime Cost + Factory Variable Overhead + Factory Fixed Overhead = Factory Cost.

Direct material is included in cost of purchase and the remaining items i.e. direct labour and overheads are termed as cost of conversion.

Direct labour is cost of workers in the unit who are directly associated with the production process, in other words it is said that direct labour is the cost of labour which can be directly attributed to the units of production.

Overheads are indirect expenses. Variable overheads are indirect expenses which is directly related to production i.e., it changes with the change in production in the same proportion (increase or decrease). Fixed overheads generally remains constant, it varies only when there is some major shift in production.

Since direct labour and variable overheads are directly with the production level, it is advisable to include them in cost of conversion on the basis of normal capacity. Because any difference between normal capacity and actual production will also bring in proportionate change in projected cost and actual cost.

A single production process may result in more than one product. In case, this additional product is the intended and has a good market value, they are known as

Joint Products. The cost of conversion incurred on all the production and not identifiable separately is allocated among the products on some rational and consistent basis. If this additional product does not have good market value then they are considered as by-products. In this case the net realisable value of the by-products are deducted from the total cost of conversion to calculate the cost of conversion for main product.

Other Costs are included in the cost of inventories to the extent that they are incurred in bringing the inventories to their present location and condition.

Examples of costs that should be excluded from the cost of inventories and recognised as expenses in the period in which they are incurred are:

- Abnormal amounts of wasted materials, labour, or other production costs.

- Storage costs, unless those costs are necessary in the production process prior to a further production stage.

- Administrative overheads that do not contribute to bringing the inventories to their present location and condition and

- Selling and distribution costs.