Certificates are the best ways to prove and market your skills. Certifications have now become an essential part of job culture in order to keep one updated and ahead of others. Vskills certification for International Finance Analyst assesses the candidate as per the company’s need for managing financial matters of international nature. The certification tests the candidates on various areas which includes theories and strategies involving exchange rates, balance of payments¸ foreign exchange, euro-currency market, spot and forward market, currency futures and option pricing.

Today, the concept of survival of fittest rules the job market and to make yourself preferred candidate, one has to be updated in every domain. The certifications help to prove your skills to your superiors and helps you to stand out in the crowd. Let us get into detail of this valuable credential.

Roles and Responsibilities

A certified International Finance analyst is responsible for understanding theories and strategies involving exchange rates, balance of payments, foreign exchange, euro-currency market, spot and forward market, currency futures and option pricing completely and applying them in practical life.

Vskills Certified International Finance Analyst Exam?

This Course is intended for professionals and graduates wanting to excel in their chosen areas. It is also well suited for those who are already working and would like to take certification for further career progression. Earning Vskills International Finance Analyst Certification can help candidate differentiate in today’s competitive job market, broaden their employment opportunities by displaying their advanced skills, and result in higher earning potential.

Who should take this certification?

People who want to market their skills into the domain of international finance can find no better fit than this certificate. Job seekers looking to find employment in finance, international finance or accounts departments of various companies, students generally wanting to improve their skill set and make their CV stronger and existing employees looking for a better role can prove their employers the value of their skills through this certification.

Benefits of Certification

- Government Certification

- Certification valid for life

- Lifelong e-learning access

- Free Practice Tests

- Get tagged as ‘Vskills Certified’ On Monsterindia.com

- Get tagged as ‘Vskills Certified’ On

Shine.com

Shine.com

Exam Details

- Duration: 60 minutes

- No. of questions: 50

- Maximum marks: 50, Passing marks: 25 (50%).

- There is NO negative marking in this module.

- Online exam.

Certification Process

- Select Certification & Register

- Receive a.) Online e Learning Access (LMS) b.) Hard copy – study material

- Take exam online anywhere, anytime

- Get certified & Increase Employability

Certify and Increase Opportunity.

Be

Govt. Certified International Finance Analyst

Content Outline

Introduction

- The Challenge of International Finance

- Finance Function in a Global Context

- Global Financial Markets

- Taxonomy of Financial Markets

- Percentage of GDP Arising from Exports

- Getting a Grip on Globalization

Offshore Markets

- Euro or Offshore Markets: What are They?

- Evolution of Offshore Markets

- Interest Rates in the Global Money Markets

- Sample Problems

The Monetary System

- Introduction

- Objectives of IMF

- Fund’s Role of Consultation

- Sources of Funds – Quotas

- Share Capital of IMF

- Other Sources of Funds

- Fund’s Lending Operations

- Standby Arrangements

- IMF Charges

- Other Facilities

- Exchange Rates and Par Values

- International Monetary Reforms

- International Liquidity

- Need for Reserves

- Composition and Level

- Adequacy of Reserves

- Problems of Liquidity

- Augmentation of Liquidity

- Special Drawing Rights (SDR)

- SDRs in India

- India’s IMF Net Position

- Additional SDRs

Classic Systems of Exchange Rates

- The Classical Gold-standard System

- Price Adjustment under the Gold Standard

- Price Adjustment under the Gold-Exchange and Dollar Standards

Alternative Systems Of Exchange Rates

- The European Monetary System (EMS)

- Price Adjustment under the EMS

- Hybrid Systems of Exchange Rates

- Mixed Fixed and Flexible Rates

- Cooperative Intervention in Disorderly Markets

- Target Zones

Balance of Payments

- Introduction

- Balance of Payments Accounting

- Debits and Credits

- Balance of Payments Statement

- The Current Account

- The Capital Account

- Debit and Credit Entries

- Balance of Payment Crisis

Foreign Exchange Market

- Definition

- International Financial System and Foreign Exchange Market

- Foreign Sector and Foreign Exchange Market

- Banks Purchase and Sale

- Instruments of Credit Traded

- Foreign Exchange Market Components

- Gustav’s Theory

- Limitations

- Spot and Forward Rates

- Speculation

- Arbitrage

- Indian Foreign Exchange Market

- Exchange Dealers

- RBI and Exchange Market

- Floating Vs Fixed Exchange Rates

- RBI Policy Applied to Banks

- Trading by Banks

- Spot Trading Operations

- Exchange Rates in India

- Cross Currency Deals

- Mismatch – Need for Matching

- Forex Management

- Explanation of Cross Rates

- Derivative Products

- Forward Contracts

- Swaps

- Futures and the Options

- Forward Rate Agreements (FRA)

- Forward and Future Contracts

- Currency and Interest Rate Swaps

- Sodhani Committee Report ()

- Capital Account Convertibility Measures

Euro-Currency Market

- International Money and Capital Markets

- Exchange Markets vs Currency Markets

- Origins of the Euro-Currency Markets

- Dealers in the Market

- Euro-bond Markets

- Magnitude of Trade

- Euro Bond Clearing and Settlement System

- Petro-Dollar Market

International Financial Institutions

- International Finance Corporation

- The Multilateral Investment Guarantee Agency (MIGA)

- A Global Cooperative

- The IMF’s Financial Policies and Operations

Spot and Forward Market

- Organization of the Foreign Exchange Market

- The Mechanics of Spot Transactions

- The Forward Market

Currency Futures and Options Markets

- Futures Contracts

- Basic Differences Contracts Futures Between Forward and

- Advantages and Disadvantages of Futures Contracts

- Arbitrage between the Futures and Forward Markets

Options Prices

- Option Pricing and Valuation

- Reading Currency Futures and Options Prices

Swaps and Interest Rate Derivatives

- Interest Rate and Currency Swaps

- Interest Rate Swaps

- Exhibit: Classic Swap Structure

- Economic Advantages of Swaps

- Interest Rate Forwards and Futures

- Forward Rate Agreement

- Eurodollar Futures

Management of Foreign Exchange Risk

- What is Exchange Risk?

- Translation Exposure

- Transaction Exposure

- The Exposure Problem

- Tools and Techniques of Foreign Exchange Risk Management

Management of Translation Exposure

- The Monetary/Non-monetary Method

- Temporal Method

- The Current/Non-current Method

International Financial Management

- Working Capital Management

- Portfolio Management

- Transfer Pricing

- International Taxation

- International M&A

Preparation Guide for Certified International Finance Analyst

There is no end to number of resources that can be used for preparation. You must be very careful while choosing the resources as this will determine how well will you be performing in the exam. let us look at handful of resources –

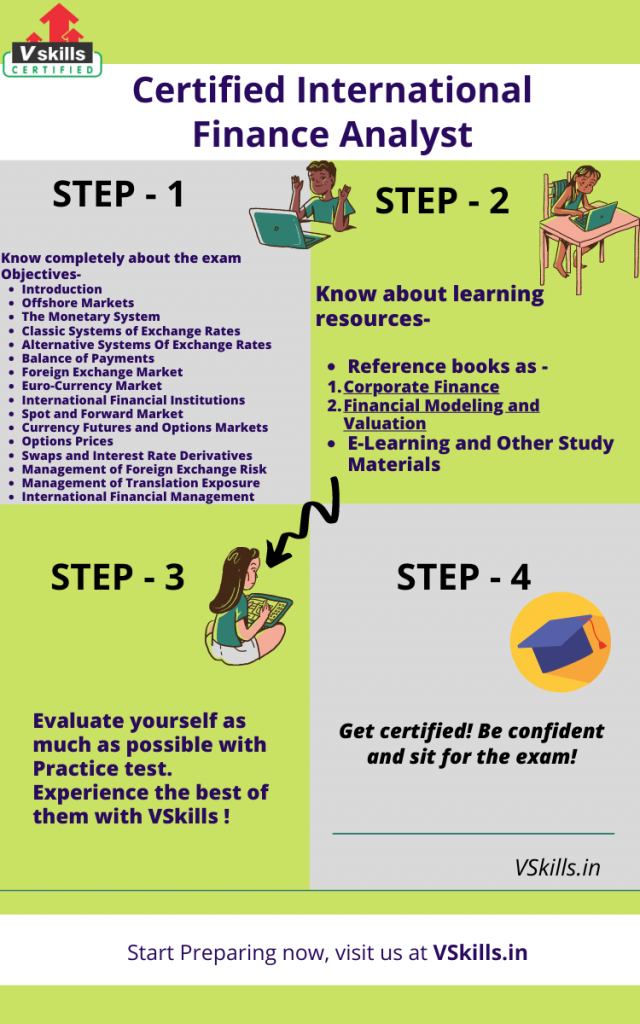

Step 1 – Review the exam objectives

Knowing about the objectives of the exam is very important as the whole exam is going to revolve around the objectives. The first and foremost thing before you start preparing is to get well versed with the objectives of the exam. This exam has different modules which will test your knowledge thoroughly in this domain and will make you job ready after you gain this certification.

Refer – Certified International Finance Analyst Brochure

Step 2 – Hitting the books

You can find multiple books online or can refer to libraries and bookstores. There are even fantastic books online that can be very useful in preparation. Books are the best valued resources and first resource that comes to our mind when we thin of preparing for any exam. Some books that you can refer are –

- Corporate Finance – The Ultimate Guide to Financial Reporting, Business Valuation, Risk Management, Financial Management, and Financial Statements

- Financial Modeling and Valuation – A Practical Guide to Investment Banking and Private Equity

Step 3 – E-Learning and Study Materials

They are prepared by the experts of the subject matter and are reliable enough. Learning for the exam can be fun if you have right set of resources matching your way of studying. Vskills offers you its E-Learning Study Material to supplement your learning experience and exam preparation. This online learning material is available for lifetime and is updated regularly. You can also get the hardcopy for this material, so, you can prefer either way in which you are comfortable.

Refer – Certified International Finance Analyst sample chapter

Step 4 – Evaluate yourself with Practice Tests

Make sure that you have practiced enough before taking the written exam. practicing more and more will help in identifying the weak portions and remove the loopholes in your preparation. This is the best way to judge how well you are prepared. You can try a free practice test now! Practicing more and more will even make you confident and you will feel less strange on the day of the examination.

International Finance Interview Questions

Checkout these latest online interview questions on International Finance to prepare for any job interview. The questions are created by domain experts, to help you to overcome the job interview obstacle.