Incoterms are a set of simple three letter codes which represent the different ways international shipments may be organized. They allow sellers and buyers from different cultures and legal systems to decide at what point the ownership and the obligation to pay for freight, insurance and customs costs transfer from one to the other.

Incoterms were introduced in 1936 and they have been updated six times to reflect the developments in international trade. The latest revisions are sometimes referred to as Incoterms 2000. The Incoterms informs the buyer what is included in the purchase price since the costs of transportation, insurance and customs are split between the buying and the selling parties. The Incoterms determine the mutual responsibilities between the buyer and the seller in the contract and does not indicate the distribution of responsibilities among the consignor, the carrier and the consignee.

Incoterms are invaluable and a cost-saving tool. The exporter and the importer need not undergo a lengthy negotiation about the conditions of each transaction. Once they have agreed on a commercial term as CIF, they can sell and buy the goods without discussing who will be responsible for the freight, cargo insurance and other costs and risks.

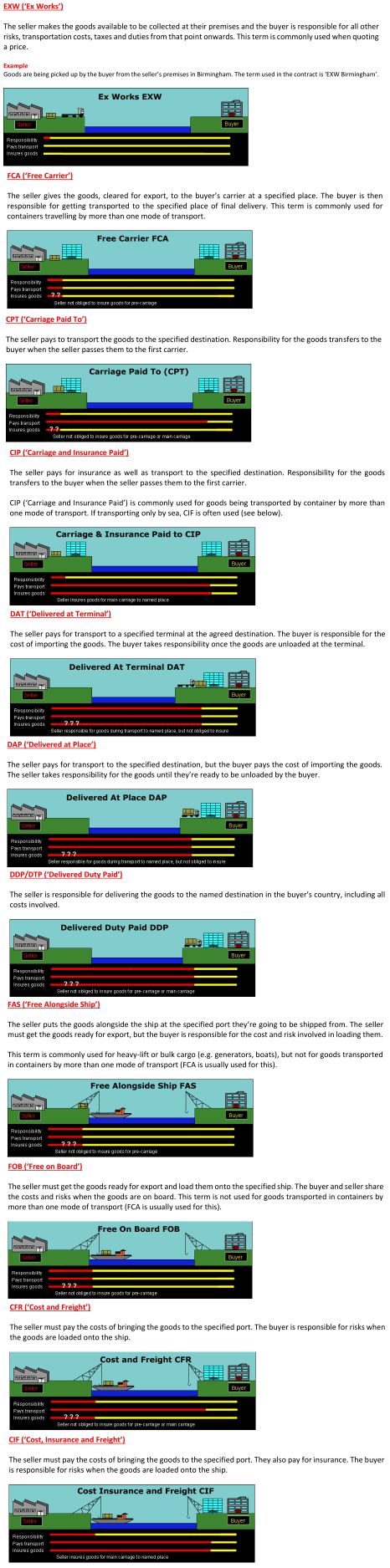

Representation of Incoterms

There are thirteen Incoterms that are used by businesses and are used in four different areas.

Group E: used where the seller does not want to arrange transport.

EXW – Ex Works

EXW means Ex Works and is followed by a named place, for example EXW Dallas. EXW means the seller’s responsibility is to make the goods available at the seller’s premises. The seller is not responsible for loading the goods on the vehicle provided by the buyer, who then bears the full cost involved in bringing the goods from there to the desired destination.

Group F: used where the seller can arrange some transport within his/her own country.

FCA – Free Carrier

FCA means Free Carrier and is followed by a named place, for example FCA Brownsville. FCA means the seller fulfills its obligation to deliver when it has handed over the goods, cleared for export, into the charge of the carrier named by the buyer at the named place. If no precise point is indicated by the buyer, the seller may choose within the place or range stipulated where the carrier shall take the goods into its charge.

FAS – Free Alongside Ship

FAS means Free alongside Ship and is followed by a named port of shipment, for example FAS New York. FAS means the seller is responsible for the cost of transporting and delivering goods alongside a vessel in a port in his country. As the buyer has responsibility for export clearance, it is not a practical incoterm for U.S. exports. FAS should be used only for ocean shipments since risk and responsibility shift from seller to buyer when the goods are placed within the reach of the ship’s crane.

FOB – Free On Board

FOB means Free on Board and is followed by the named port of shipment, for example FOB Baltimore. With FOB the goods are placed on board the ship by the seller at a port of shipment named in the sales agreement. The risk of loss of or damage to the goods is transferred to the buyer when the goods pass the ship’s rail, i.e. off the dock and placed on the ship. The seller pays the cost of loading the goods.

Group C: used where the seller can arrange and pay for most of the freight charges up to the foreign country.

CFR – Cost And Freight

CFR means Cost and Freight and is followed by a named port of destination, for example CFR Sydney. CFR requires the seller to pay the costs and freight necessary to bring the goods to the named destination, but the risk of loss or damage to the goods, as well as any cost increases, are transferred from the seller to the buyer when the goods pass the ship’s rail in the port of shipment. Insurance is the buyer’s responsibility.

CIF – Cost, Insurance And Freight

CIF means Cost, Insurance and Freight and is followed by a named port of destination, for example CIF Miami. CIF is similar to CFR with the additional requirement that the seller purchases insurance against the risk of loss or damage to goods. The seller must pay the premium. Insurance is important in international shipping, more than domestic US shipping, because U.S. laws generally hold a common carrier to be liable for lost or damaged goods.

CPT – Carriage Paid To

CPT means Carried Paid To and is followed by a named place of destination, for example CPT Kansas City. CPT means that the seller must pay the freight for the carriage of the goods to the named destination. The risk of loss or damage to the goods and any cost increases transfers from the seller to the buyer when the goods have been delivered to the custody of the first carrier, and not at the ship’s rail.

CIP – Carriage And Insurance Paid To

CIP means Carriage and Insurance Paid To and is followed by a named place of destination, for example CIP Boston. CIP has the same incoterm meaning as CPT, but in addition the seller pays for the insurance against loss of damage.

Arrival (Group D): used where the seller can pay for most of the delivery charges to the destination country

DAF – Delivered At Frontier

DAF means Delivered At Frontier and is followed by a named place, for example DAF El Paso. DAF means that the seller’s responsibility is complete when the goods have arrived at the frontier but before the customs border of the country named in the sales contract. This buyer is responsible for the cost of the goods to clear customs.

DES – Delivered Ex Ship

DES means Delivered Ex Ship and is followed by a named port of destination, for example DES Vancouver. DES means the seller shall make the goods available to the buyer on board the ship at the place named in the sales contract. The cost of unloading the goods and associated customs duties are paid by the buyer.

DEQ – Delivered Ex Quay

DEQ means Delivered Ex Quay and is followed by a named port of destination, for example DEQ Los Angeles. DEQ means the seller has agreed to make the goods available to the buyer on the quay at the place named in the sales contract.

DDU – Delivered Duty Unpaid

DDU means Delivered Duty Unpaid and is followed by a named place of destination, for example DDU Topeka. The seller has to bear the costs involved in shipping the goods as well as the costs and risks of carrying out customs formalities. The buyer pays the duty and has to pay any additional costs caused by its failure to clear the goods for import in time.

DDP – Delivered Duty Paid

DDP means Delivered Duty Paid and is followed by a named place of destination, for example DDP Bakersfield. The seller has to pay the costs involved in shipping the goods as well as the costs and risks of carrying out customs formalities. The seller pays the duty and the buyer has to pay any additional costs caused by its failure to clear the goods for import in time. DDP should not be used if the seller is unable to obtain an import license.

Incoterms 2010

Below are the 11 rules from the Incoterms® 2010 edition, as mandated by ICC

Rules for any mode or modes of transport

- EXW – Ex Works

- FCA – Free Carrier

- CPT – Carriage Paid To

- CIP – Carriage And Insurance Paid To

- DAT – Delivered At Terminal

- DAP – Delivered At Place

- DDP – Delivered Duty Paid

Rules for sea and inland waterway transport

- FAS – Free Alongside Ship

- FOB – Free On Board

- CFR – Cost and Freight

- CIF – Cost, Insurance and Freight

Transfer of Property

INCOTERMS provide a useful tool for buyers and sellers in international trade to specify their respective rights and responsibilities in widely understood and accepted shorthand.

It should be noted that incoterms do not deal with transfer of property rights but rather a transfer of responsibility. As laws on property conveyance differ among countries, a contract may conveniently include indication in this regard but only after determining what is permissible by law. Usually sellers hold their domain and the property until the price of the purchased goods is settled in full.

INCOTERMS Illustration