GSTN – Goods & Services Tax Network

Before we start learning the concept of GSTN let us first understand what is GST? It is very hard to make a layman understand What is GST, so here we define GST in simple language.

GST is a two-in-one tax that will replace multiple levies on goods by the centre and states (like central excise duty, state VAT, CST on interstate sales, entry tax). The two-in-one will be Centre GST (CGST) and State GST (SGST).

Let us now move to GSTN

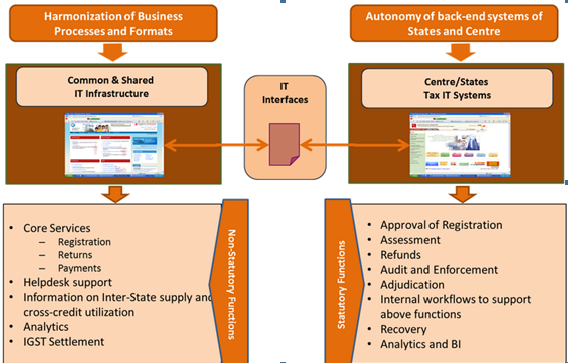

Goods and Services Tax Network (GSTN) is a not-for-profit, non-Government Company to provide shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders. The key objectives of GSTN are to provide a standard and uniform interface to the taxpayers, and shared infrastructure and services to Central and State/UT governments.

STRUCTURE OF GST

Empowered Group on IT Infrastructure for GST with following members

- Member (B&C), CBEC

- Additional Secretary (Revenue), DoR

- DG (Systems), CBEC as Member-Secretary

- FA, Ministry of Finance,

- Member Secretary, Empowered Group of State Finance Ministers,

- Member Technology Advisory Group for Unique Projects (TAGUP)

- Commercial Tax Commissioners of Maharashtra, Assam, Karnataka, West Bengal and Gujarat.