Yet another model that has given importance to the dividend policy of the firm is the Gordon Model. Myron Gordon used the dividend capitalization approach to study the effect of the firms’ dividend policy on the stock price.

Assumptions

The following are the assumptions based on which Gordon based the dividend policy model for firms: –

- The firm will be an all-equity firm with the new investment proposals being financed solely by the retained earnings.

- Return on Investment ( r ) and the cost of equity capital (ke ) remain constant

- Firm has an infinite life.

- The retention ratio remains constant and hence the growth rate also is constant ( g = br)

- k > br i.e., cost of equity capital is greater than the growth rate.

Gordon model assumes that the investors are rational and risk averse. They prefer certain returns to uncertain returns and thus put a premium to the certain returns and discount the uncertain returns. Thus, investors would prefer current dividends and avoid risk. Retained earnings involve risk and so the investor discounts the future dividends. This risk will also affect the stock value of the firm.

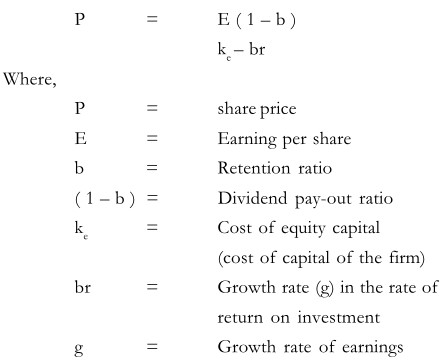

Gordon explains this preference for current income by the bird- in-hand argument. Since, a bird-in-hand is worth two in bush, the investors would prefer the income that they earn currently to that income in future which may be or may not be available. Thus, investors would prefer to pay a higher price for the stocks, which earn them current dividend income and would discount those stocks, which either postpones / reduce the current income. The discounting will differ depending on the retention rate (percentage of retained earnings) and the time. Gordon’s dividend capitalization model gave value of the stock as

So, Gordon correlated that the firm’s share value is positive with the payout ratio when re > ke and decreases with an increase in the pay-out ratio when r > ke. Thus, firms with rate of return greater than the cost of capital should have a higher retention ratio and those firms, which have a rate of return less than the cost of capital, should have a lower retention ratio.

The dividend policy of firms which have a rate of return equal to the cost of capital will however not have any impacts on its share value.

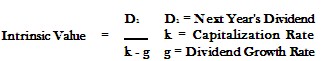

The constant-growth DDM (aka Gordon Growth model) assumes that dividends grow by a specific percentage each year, and is usually denoted as g, and the capitalization rate is denoted by k.

The constant-growth model is often used to value stocks of mature companies that have increased the dividend steadily over the years. Although the annual increase is not always the same, the constant-growth model can be used to approximate an intrinsic value of the stock using the average of the dividend growth and projecting that average to future dividend increases.