You are aware that the main objectives of final accounts are ascertainment of profit and financial soundness of the firm. These financial Statements are helpful in decision-making to a great extent. They help us to understand the financial position and profitability of the business. Analysis of financial statements enables more relevant information for decision-making. Understanding the past is a pre requisite for anticipating the future. Analysis of financial statements means treatment/s of any / all of the following:

- Breaking financial statements into simpler ones

- Classifying & comparing the components and establishing the significance of figures

- Study of relationship among the various financial factors in a single set of statements

- Study of trends of financial factors as shown in two or more set of statements

- Regrouping and rearranging of figures.

Analysis is the process of fact-finding and breaking down complex set of facts or figures into simple elements. Interpretation means grasping the sound and unsound relationships and explaining the real significance of the simplified components.

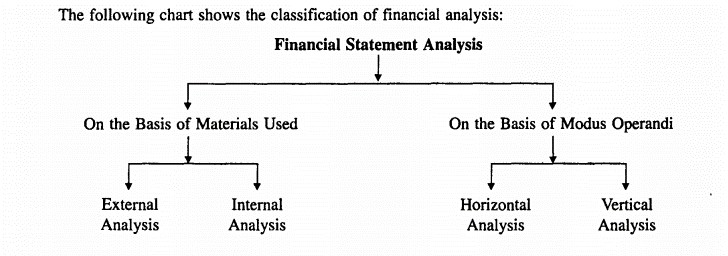

When the outside users of financial statements analyse, they will have to rely only on the information contained in the published annual reports and financial statements. This External Analysis is of limited purpose since the external people do not have easy access of detailed accounting records and information.

When the financial statements are analysed and interpreted by the internal persons of the organization, they have an easy access to the detailed records as well. They use other managerial reports also in order to formulate policies, establish objectives, evaluate performance and take corrective actions and appropriate actions i.e. Planning and Control. The analysis helps in assessing internal matters of efficiency and external matters of investment etc.

Financial statements are based on historical accounting information, which reflects the transactions and other events that have affected the firm. Managers and other users of the firm’s financial statements are interested in the future. The objective of financial statement analysis is to use historical accounting data to help in predicting how the firm will fare in the future. The aspects of an organization’s future performance that are of most interest depend on the needs of the user. A manager in the firm would be interested in the company’s overall financial strength, its income and growth potential, and the financial effects of pending decisions. A potential lender, such as a bank loan officer, would be concerned primarily about the firm’s ability to pay back the loan. Potential investors would be interested not only in the company’s ability to repay its loan obligations, but also its future profit potential. Potential customers would want to assess the firm’s ability to carry out its operations effectively and meet delivery schedules. Thus, the needs of the analyst dictate the sort of financial statement analysis that is most appropriate.