Financing is the act of providing funds for business activities, making purchases or investing. Financial institutions and banks are in the business of financing as they provide capital to businesses, consumers and investors to help them achieve their goals.

Financial management refers to the efficient and effective management of money (funds) in such a manner as to accomplish the objectives of the organization. It is the specialized function directly associated with the top management. The significance of this function is not only seen in the ‘Line’ but also in the capacity of ‘Staff’ in overall administration of a company. It has been defined differently by different experts in the field.

It includes how to raise the capital, how to allocate it i.e. capital budgeting. Not only about long term budgeting but also how to allocate the short term resources like current assets. It also deals with the dividend policies of the shareholders.

Objectives of Financial Management

The financial management is generally concerned with procurement, allocation and control of financial resources of a concern. The objectives can be

- To ensure regular and adequate supply of funds to the concern.

- To ensure adequate returns to the shareholders which will depend upon the earning capacity, market price of the share, expectations of the shareholders.

- To ensure optimum funds utilization. Once the funds are procured, they should be utilized in maximum possible way at least cost.

- To ensure safety on investment, i.e, funds should be invested in safe ventures so that adequate rate of return can be achieved.

- To plan a sound capital structure-There should be sound and fair composition of capital so that a balance is maintained between debt and equity capital.

Functions of Financial Management

- Estimation of capital requirements: A manager has to make estimation with regards to capital requirements of the company. This will depend upon expected costs and profits and future programmes and policies of a concern.

- Determination of capital composition: Once the estimation have been made, the capital structure have to be decided. This will depend upon the proportion of capital a company is possessing and additional funds which have to be raised from outside parties.

- Choice of sources of funds: For additional funds to be procured, a company has many choices like-

- Loans to be taken from banks and financial institutions

- Public deposits to be drawn like in form of bonds.

Choice of factor will depend on relative merits and demerits of each source and period of financing.

- Investment of funds: The manager has to decide to allocate funds into profitable events so that there is safety on investment and regular returns is possible.

- Management of cash: Manager has to make decisions with regards to cash management. Cash is required for many purposes like payment of wages and salaries, payment of electricity and water bills, payment to creditors, meeting current liabilities, maintenance of enough stock, purchase of raw materials, etc.

- Financial controls: Manager has not only to plan, procure and utilize the funds but he also has to exercise control over finances. This can be done through many techniques like ratio analysis, financial forecasting, cost and profit control, etc.

Cost and Cash Flow Management

Some general principles of cost management are

- cost centers should have matching revenue sources, if at all possible

- every cost center and object should be controlled

- cost growth might be justifiable if it generates extra revenue

- general overheads should be minimized; event failures are sometimes attributable to organizations and staff who consume too much of the resource base, relative to event production

- aim to minimize fixed costs and control variable costs

- many decisions about costs have to be made in advance (e.g., how many portable toilets to rent? how many security guards? how many programs? how much food and beverage?)

- charge cost-recovery prices for variable costs

- analysis of variable costs might suggest attendance limits or some other form of capacity for the event, to avoid uncontrolled cost escalation

The essence of cash-flow management is to accurately forecast for every month (or week, if necessary) of the budgeting period, all expenditures and revenues. Create a cash-flow “calendar” showing the times at which expenditures must be made and revenue is to be realized. Potential shortfalls are thereby readily identifiable, although contingency plans are required to deal with unexpected variations.

Shortfalls are not necessarily fatal, and are often unavoidable, but the event manager must have a strategy for dealing with them. Perhaps some suppliers can be persuaded to hold off a while in their bill collecting, preferably until the event is over (this is called “back-ending”). A sponsor could be approached to advance some money. Friendly relations with a bank manager or grant-giving agency are highly desirable, as the line of credit is an important cash flow management tool. When a credit line is established the appropriate officials can withdraw cash or write checks against a pre-set limit, with pay-back according to an established and comfortable schedule. Some event managers will not commit to expenditures unless the revenue is guaranteed or the money is already in the bank.

Financing

In any type of event there are always two types of financing which are internal and external.

Internal Financing – This is basically the funds belonging to the organization itself, resulting from previous events which were profitable and from the membership fees and private funds from the organizer.

External Financing – It may come from

- Fees – From the participants and attendees in the event. It is calculated in a first draft taking as a reference a previous edition of the event or a similar one in order to foresee the income and know the fees to charge. Moreover, it is necessary to know the contribution from institutions, however rough the estimative may be, before the final fees are set. Fees tend to cover 50% of the total cost of the event.

- Institutional Help – It includes public institutions, local government and official grants. Disadvantages with this type of grants are that they require complicated forms and endless bureaucracy. Often, these grants are difficult to obtain because all costs need to be fully justified beforehand and partly or wholly returned if they do not cover the costs originally awarded for. Another important aspect of these grants is that our event should not coincide in time with similar ones, as the sponsorship might be shared with similar events going on at the same time or simply over.

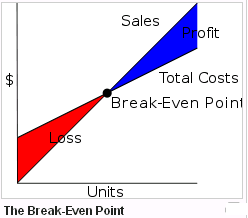

Break-Even Analysis

The break-even level or break-even point (BEP) represents the sales amount—in either unit or revenue terms—that is required to cover total costs (both fixed and variable). Total profit at the break-even point is zero. Break-even is only possible if a firm’s prices are higher than its variable costs per unit. If so, then each unit of the product sold will generate some “contribution” toward covering fixed costs.

The break-even point (BEP) is the point at which total cost and total revenue are equal: there is no net loss or gain, and one has “broken even.” A profit or a loss has not been made, although opportunity costs have been “paid,” and capital has received the risk-adjusted, expected return. In short, all costs that needs to be paid are paid by the firm but the profit is equal to 0.

For example, if a business sells fewer than 200 tables each month, it will make a loss; if it sells more, it will make a profit. With this information, the business managers will then need to see if they expect to be able to make and sell 200 tables per month. If they think they cannot sell that many, to ensure viability they could

- Try to reduce the fixed costs (by renegotiating rent for example, or keeping better control of telephone bills or other costs)

- Try to reduce variable costs (the price it pays for the tables by finding a new supplier)

- Increase the selling price of their tables.

Any of these would reduce the break-even point. In other words, the business would not need to sell so many tables to make sure it could pay its fixed costs.