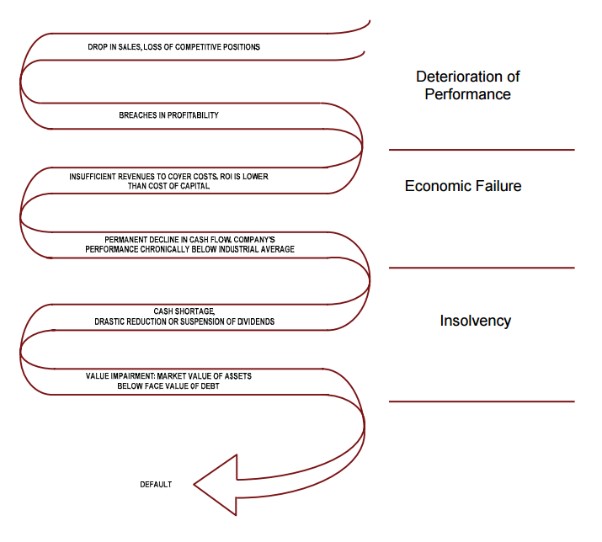

Financial distress is characterized by a sharp decline in the firm’s performance and value. It has two important characteristics: Moving down the spiral from one phase to another the sharp decline accelerates, whereas the length of each stage becomes shorter and shorter. The length of insolvency depends on the maturity structure of the firm’s debt, whereas default is dependent on the date of maturity followed by renegotiation and turnaround or liquidation and is, therefore, the shortest stage of financial distress. The biggest challenge in financial distress is to recognize adverse processes as early as possible in order to gain more time for response. The figure below illustrates the run of the downward spiral in financial distress.

This is a condition which a corporate enters when all their expectation go hay-way due to various reasons. This affects all the stakeholders of the corporate like shareholders, bondholders, creditors, agents, employees and one and all. So, as a financial manager you have know about various aspects about the option available to the corporate during its financial distress.

The various options available to corporate during their financial distress can be listed as follows:

- Reorganization

- Restructuring

- Merger

- Acquisition

- Takeover