Among the various financial risks that a company or a bank comes across, the most important are liquidity risk and credit risk. Credit risk is an inherent part of a commercial bank’s intermediary operations. Credit is the primary source of business for a bank and it is based on this that a bank’s quality and performance are judged. Many financial institutions and banks have suffered in the recent past as a result of poor loan quality. The credit risk management process of a bank is believed to be a good indicator of the quality of the bank’s loan portfolio. Banks are successful when the risks they take are reasonable, controlled and within their financial resources and competence.

Credit risk involves the risks that come with a borrower not fulfilling his/her obligations on time. Even when all the assets of a balance sheet match up exactly with all the liabilities, the only risk remaining on it would be credit risk. Credit risk exposure is measured by the current mark to market value. The magnitude of credit risk depends on the likelihood of default by the counter party the potential value of outstanding contracts the extent to which legally enforceable netting arrangements allow the value of offsetting contracts the value of the collateral held against the contracts.

Principles in Credit Risk Management

A company has to follow three key principles in its credit risk management which are selection, limitation and diversification.

Selection

The first requirement is to whom to lend. This is usually based on customer’s request. A model loan request would be in terms of filing all the information required which elicit information about the amount of loan, purpose of loan, repayment and collateral. Information on the organization of the business, trade area and other banking relationships would be required.

The 6 C’s of Credit

The evaluation of the loan request by the bank involves the 6 C’s of credit.

- Character (borrower’s personal characteristics such as honesty, attitudes about willingness and commitment to pay debts): Even though the loan is for the business, the person responsible for paying back the loan is the borrower. It is the borrower’s reputation that the bank will be considering. If one have missed payments or defaulted on a loan or declared bankruptcy in the past, it does not disqualify the person from getting a loan. But trying to hide these facts can destroy character in the eyes of the banks.

- Capacity (the success of business): The banks will look at your business’s balance sheet and cash flow statement to see how much a business can afford to borrow. They will also ask for financial statements to see what kind of debt can be handled. Most small business loans tend to be based on the individual’s or company’s ability to repay the loan, not on the cash flow of the business. Loan officers tend to consider loan applications more favorably if: (a) introducing a new product or service with an obvious demand; (b) there is little competition; (c) your market is composed of small independent businesses; and (d) a lower rate of failure in your type of business.

- Capital (financial condition): most banks require that one should put up a percentage of the loan (just as one would for car loans or buying a house), usually 20 percent.

- Collateral: Collateral represents a repayment source in the worst case scenario. Most banks require that the loan be 100 percent collateralized. This means that the business has to have enough collateral to cover 100 percent of the loan amount. If a loan for Rs.50lacs is needed, then a car, equipment, building, and inventory must to possessed that add up to Rs. 50 lacs.

- Conditions (economic condition): The condition and terms of the loan are another factor where the amount needed, time period and purpose are recognized.

- Compliance (laws and regulations)

Most common risk metric is the adequacy of loan loss provisions and the size of the loan loss reserve in relationship to the total exposures of the bank. Allowance for loan losses creates a cushion of credit losses in the bank’s credit portfolio. Primarily it is intended to absorb the bank’s expected loan losses. Historically credit decisions were made in a case by case basis.

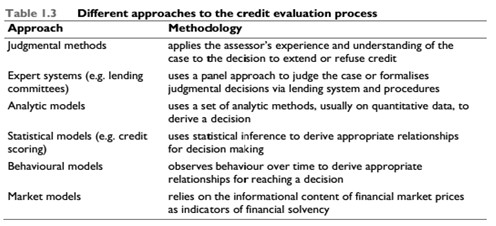

Growing sophistication and automation of lending and the increasing complexity of credit products have spawned the development of computational approaches to credit assessment and evaluation of individual retail and commercial borrowers.

Introduction of bank-wide credit risk software has accelerated in part driven by regulatory pressures, as regulators demanded improved analysis and oversight of the risk assessment process.

Estimating Credit Losses

- Probability of Default (PD): The likelihood that the borrower will fail to make full and timely repayment of its financial obligations.

- Exposure At Default (EAD): The expected value of the loan at the time of default.

- Loss Given Default (LGD): The amount of the loss if there is a default, expressed as a percentage of the EAD.

- Recovery Rate (RR): The proportion of the EAD the bank recovers

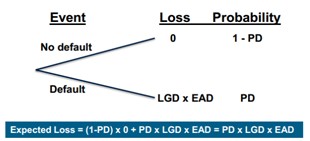

Banks are expected to hold reserves against expected credit losses which are considered a cost of doing business. The most basic model of expected loss considers two outcomes: default and non-default.

In the event of non-default, the credit loss is 0. In the event of default, the loss is loss given default (LGD) times the current exposure (EAD).

Statistical approaches are used to estimate the distribution of possible loss values. For individual products in default, loss amounts are not deterministic due to uncertainty about LGD and collateral value. For a portfolio of credit products with defaults, loss amounts are also uncertain due to correlation of defaults between products.

Credit loss distributions tend to be largely skewed as the likelihood of significant losses is lower than the likelihood of average losses or no losses. Active loan portfolio management embracing diversification of exposures across industries and geographic areas can reduce the variability of losses around the mean.

Unexpected Loss represents the minimum loss level for a given confidence level a UL(a) is the maximum loss a bank will suffer a% of the time.