Employee compensation valuation- Companies use stock options as a form of employee compensation for a number of reasons. An option is a form of compensation, the value of which increases as the company is more successful. Thus, the incentives of an option-holding employee are aligned with those of the shareholders of the company. Also, the granting of stock options does not require immediate cash expenditure by the company. This can be important to a cash-strapped start-up enterprise trying to attract top-flight talent.

How are Stock Options Valued?

The value of a stock option depends chiefly on four variables. They are:

- The exercise price of the option

- The price of the underlying stock on the valuation date

- The remaining life of the option (time ‘til expiration)

- The volatility of the price of the underlying stock

Valuation

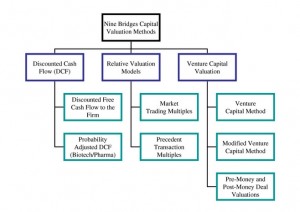

Any option will have more or less value on it depending on the following main determinants of value: volatility, time remaining, risk free rate of interest, strike price and stock price. When an option grantee is awarded an ESO giving the right (when vested) to buy 1,000 shares of the company stock at a strike price of $50, for example, typically the grant date price of the stock is the same as the strike price. Looking at the table below, we have produced some valuations based on the well known and widely used Black-Scholes model for options pricing. We have plugged in the key variables cited above while holding some other variables (i.e. price change, interest rates) fixed to isolate the impact of changes in ESO value from time-value decay and changes in volatility alone.

Apply for Compensation and Benefits Certification Now!!

http://www.vskills.in/certification/Certified-Compensation-and-Benefits-Manager