Normally, you assume EBIT as constant; however, EBIT for any firm is subjected to various influences. For example, because of the fluctuations in the economic conditions, sales of a firm change and as a result, EBIT also varies. In a given period, the actual EBIT of the firm may be more or less than the anticipated. It is therefore, useful to analyze the impact of the financial leverage on EPS (and (ROE) for possible fluctuations in EBIT.

Financial Plan I does not employ any leverages. As EBIT increases, EPS also increases. In fact, EPS increases with improved EBIT under all financial plans. What is important to note is that as the financial leverage is increased, EPS is further magnified.

Financial leverage works both ways. It accelerates EPS (and ROE) under favorable economic conditions, but depresses EPS (and ROE) when the goings are not good for the firm It can be seen that EPS or ROE is lower with debt in the capital structure in the poor years. With no leverage plan, if the firm’s return on assets is positive, although low, the shareholders do obtain positive EPS or ROE.

But it becomes lower with more debt used, and even turns negative under very high leverage plan, such as Financial Plan IV. The unfavorable effect on EPS (and ROE) is more severe with more debt in the capital structure when EBIT (or r) is negative.

The reasons again lie in the relationship between the return on assets and the cost of debt. If the cost of debt is more than the return on assets, EPS (or ROE) would depress with more leverage.

For any given level of variability in EBlT (or r) the increased financial leverage increases the degree of variability in EPS (or ROE). The indiscriminate use of financial leverage without taking into account the uncertainty surrounding EBlT (or r) can lead a firm into financial difficulties. More about the risk of the financial leverage

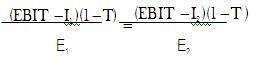

EBIT-EPS chart. One convenient and useful way of showing the relationship between EBIT and EPS for the alternative financial plans is to prepare till EBIT-EPS chart. The chart is easy to prepare since, for any given level of financial leverage, EPS is linearly related to EBIT. As noted earlier, the formula for calculating EPS is: