Managing a portfolio of products is a key factor in creating a sustainable competitive advantage. Portfolio planning can be applied to the types of products / markets served and the stage of products in their lifecycles. Risk spreading is an important element of portfolio planning which goes beyond marketing planning.

Some companies deliberately provide a range of products which – quite apart from their potential for cross selling – act in contrasting manners during the business cycle. For a company to put all of its efforts into supplying a very limited range of products to a narrow market segment is potentially dangerous. Over reliance on this one segment can make the survival of the organization dependent upon the fortunes of this one segment and its liking for its product. (This has already been discussed in detail in lesson 37 – Brand Architecture and Brand portfolio)

Portfolio Position Analysis

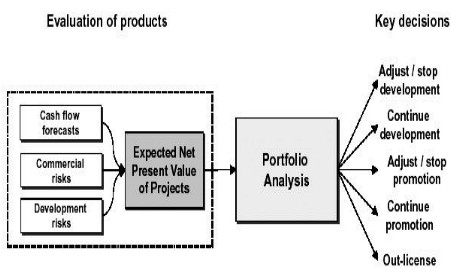

Organizations seek to match their own internal strengths with the opportunities available in their environment. A number of attempts have been made to show in the form of a portfolio position map the mix of products within a company’s portfolio. Such position maps can facilitate management thinking in the development of balanced portfolios and the allocation of strategic priorities. Evaluating the risks and potential of both pipeline and marketed products is usually the first step in portfolio analysis.

As a basis for strategy formulation, the grid focuses attention on finding strategies which match an organization’s internal strengths and weaknesses with the opportunities and threats presented by its operating environment. It must not be forgotten that market attractiveness is a dynamic measure and for planning purposes, the prime consideration is how attractive a market will appear at the time when a proposed strategy is implemented.

Planning for Growth

Most private sector organizations pursue growth in one form or another, whether this is an explicit aim or merely an implicit aim of its managers. Growth is often associated with increasing returns to shareholders and greater career opportunities for managers. Growth may be vital in order to reach a critical size at which economies of scale in production, distribution and promotion can be achieved, thereby contributing to a company’s sustainable competitive advantage. It is useful to consider the options open for growth and levels of risk and sustainability inherent in each of these.

Market / Product Expansion Choices These dimensions form the basis of the Product/ Market Expansion Grid proposed by Ans off (1957). Four growth options were identified

- Market penetration strategy

- Market development strategy

- Product development strategy

- Diversification strategy

The four growth options are associated with differing sets of problems and opportunities for a company. These relate to the resources required to implement a particular strategy, and the level of risk associated with each. It follows therefore, that what might be a feasible growth strategy for one organization may not be for another.

Organic Growth vs Growth by Acquisition The manner in which an organization grows can affect the sustainability of that growth. There are two basic means by which an organization can grow –

- Organic growth – growth is dependent upon previous success. It is a more “natural” pattern of growth, but limits the scope of a company.

- Growth by acquisition – thus may be attractive to organizations where opportunities for organic growth are low. It is sometimes almost essential in order to achieve a critical mass which is necessary in order to gain a competitive cost advantage.