The financial executives must decide the most advantageous level of current assets so that the worth of shareholders is maximized. A company requires fixed and current assets to maintain a pre-decided level of output. However, to maintain the same level of production, the company is able to contain various levels of current assets. As the company’s production and sales increases, the requirement for current assets also goes upward.

Generally, current assets does not increase in direct proportion to production level, current assets may increase in inverse proportion to production level. This relationship is based upon the concept that it takes a larger relative outlay in current assets when only a small number of units of production are manufactured than it does afterward when the company can utilize its current assets more efficiently and effectively.

The level of the current assets can be computed by dividing amount of current assets by amount of fixed current assets which gives CA/FA ratio. Keeping high level of CA/FA ratio shows conservative current assets practices and a lesser CA/FA ratio means aggressive current assets practices assuming other factors to be unchanged. A conservative policy depicts high level of liquidity and lesser risk; whereas an aggressive policy depicts higher risk and low level of liquidity. The current assets practices of the majority of companies possibly will fall between these two extreme policies.

Working capital requirement of a firm is determined by considering two questions in mind.

- What should be the level of current assets in relation to sales?

- What should be the ratio of long term and short term financing?

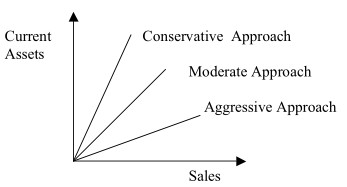

Question 1 tell us what should be the level of current assets to be maintained by the firm and hence it gives rise to three types of current asset policy namely

- Conservative approach : is carrying more amount of current assets in relation to sales which results in more carrying costs, relaxed credit terms and period and hence less turnover.

- Moderate approach : is always maintaining required amount of current assets depending upon sales.

- Aggressive Approach :is managing with less current assets in relation to sales and hence may result in more turnover, stringent credit terms and may lead to loss of customer goodwill and low liquidity.

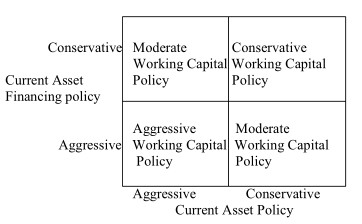

Question 2 is about how the currents should be financed, either long term or short term financing. Current assets being financed using long term funds namely Equity shares, Debentures results in more costs of capital and relatively less profits whereas short term financing namely short term loans from banks and financial institutions, overdrafts, trade credit, commercial paper etc. results in more profits and relatively less costs A judicious mix of Current Asset policy and Current Asset Financing Policy gives rise to an integrate Working Capital policy.

Thus we arrive at the following:

- Aggressive Working capital is a mix of Aggressive Current Asset policy and Aggressive Current Asset Financing Policy. Firms with short operating cycle can adopt this policy generally.

- Conservative Working capital is a mix of Conservative Current Asset policy and Conservative Current Asset Financing Policy. Firms having long operating cycle namely manufacturing companies can adopt this policy to decouple production and distribution.

- Moderate Working capital is a mix of Aggressive Current Asset policy and Conservative