A business will not be able to carry on day-to-day activities without the availability of adequate working capital. All business needs working capital to:

- adequate supply of raw materials for processing;

- cash to pay for wages, power and other costs;

- creating a stock of finished goods to feed the market demand regularly; and,

- the ability to grant credit to its customers.

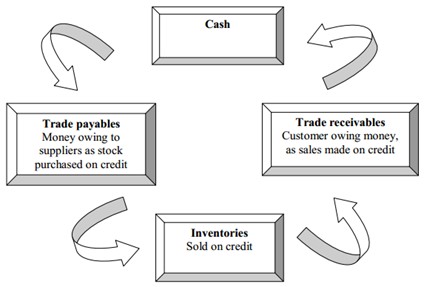

Working capital cycle involves conversions and rotation of the variables of the working capital. At first, cash is converted into raw materials. Next, with the usage of fixed assets resulting in value additions, the raw materials get converted into work in process and finally into finished goods.

Figure: Flow of Working Capital

To calculate the amount of working capital, a simple formula is used:

Working Capital = Current Assets – Current Liabilities

When sold on credit, the finished goods assume the form of debtors who give the business cash on due date. Thus cash assumes its original form again at the end of one working capital cycle but in the course it passes through various other forms of current assets too. This way, the numerous parts of current assets keep on changing their forms due to value addition. As a result, they rotate and business operations continue. Thus, the working capital cycle includes alternation of various constituents of the working capital. There are two characteristics of current assets that should be considered (i) short life span, and (ii) swift transformation into other form of current asset. The working capital has the following components that are current assets:

- Stock of Cash

- Stock of Raw Material

- Stock of Finished Goods

- Value of Debtors

- Miscellaneous current assets like short term investment loans & advances

All current assets are short term. The longevity of current assets depends on the time required in the activities of procurement; production, sales and collection. A short life span of current assets leads to swift transformation into other form of current assets.

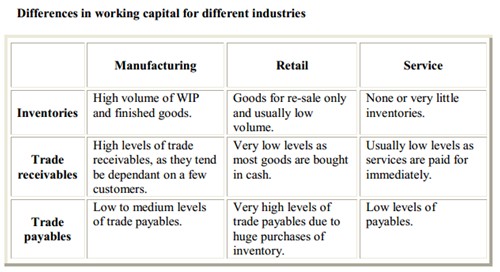

For correct assessment of the working capital requirement, the duration at various stages of the working capital cycle is estimated. Thereafter, proper value is assigned to the respective current assets, depending on its level of completion. Every industry has different needs and requirements for working capital. The particulars are listed below:

Each constituent of the working capital is valued on the basis of valuation enumerated above for the holding period estimated. The total of all such valuation becomes the total estimated working capital requirement.

The calculation of the working capital should be precise regardless of the size of the firm. Failing to do proper assessment of the working capital can affect the everyday operations of a business. It may lead to cash crisis and liquidation. An inaccurate assessment of the working capital may cause either under-assessment or over-assessment of the working capital and both of them are detrimental.

Consequences of Under Assessment of Working Capital

Growth may be limited. It will be difficult for the enterprise to undertake profitable projects due to unavailability of working capital.

Implementation of operating plans may become difficult and consequently the profit goals may not be achieved.

- Cash crisis may emerge due to paucity of working funds.

- Optimum capacity utilization of fixed assets may not be achieved due to unavailability of the working capital.

- The business may fail to honor its commitment in time, thereby adversely affecting its credibility. This situation may lead to business closure.

- The business may be required to buy raw materials on credit and sell finished goods on cash. In the process it may increase cost of purchases and reducing selling prices by offering discounts. Both these circumstances will affect profitability adversely. Unavailability of stocks due to non-availability of funds may result in production stoppage.

Effects of Over Assessment of Working Capital

Excess of working capital may result in unnecessary accumulation of inventories. It may lead to offer too liberal credit terms to buyers and ineffective recovery system and cash management.

It could lead to management complacency leading to its inefficiency. Over-investment in working capital renders capital less productive and may decrease return on investment.

Working capital is essential for success of a business and, therefore, needs efficient management and control. Each of the components of the working capital needs proper management to optimize profit.

Other Attention Areas for Working Capital Management

Inventory Management: Inventory includes all types of stocks. The level of inventory should be such that the total cost of ordering and holding inventory is minimum. At the same time, stock out costs should also be minimised as well. Therefore, a minimum safety stock level, re-order level and ordering quantity should be fixed so that the inventory cost is low.

Receivables’ Management: In situations such as changes trade policies, prevailing marketing conditions, etc., businesses are obliged to sell their goods on credit and may deliberately extend credit as a strategy of increasing sales. Extending credit helps creating a current asset in the form of ‘Debtors’ or ‘Accounts Receivable’. Investment in this type of current assets needs proper and effective management as it gives rise to costs like as cost of carrying receivable (payment of interest etc.) and cost of bad debt losses.

Thus the objective of any management policy pertaining to accounts receivables would be to ensure that the benefits arising due to the receivables are more than the cost incurred for receivables and the gap between benefit and cost increases resulting in increased profits. An effective control of receivables helps a great deal in properly managing it.

Monitoring of credit days is necessary to determine whether the average credit offered to clients is exceeding the budgeted period. Otherwise, the requirement of investment in the working capital will increase and operations will get hindered.

Cash Management: Cash is the most vital and liquid current asset. The small amount of cash held is crucial to the solvency of the firm. Hence, managing cash helps with very important tasks. Cash budgeting is a useful device for this purpose.

Cash Budget: Cash budget aids estimates for future cash inflows and outflows over a projected short period of time (may be a year, a half or a quarter year). Effective cash management is made easier if the cash budget is segregated into month, week or on a daily basis.

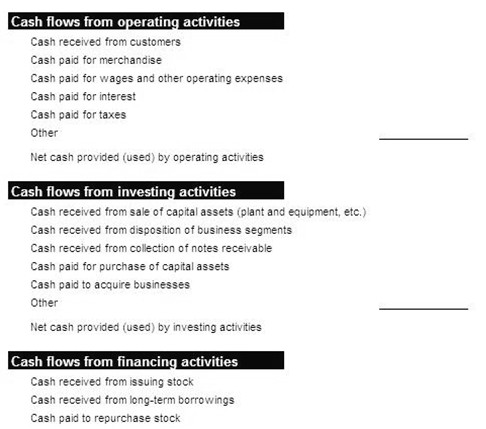

There are two components of cash budget: (i) cash inflows and (ii) cash outflows The main sources for these flows are given hereunder:

Cash Inflows:

(a) Cash sales

(b) Cash received from debtors

(c) Cash received from loans, deposits, etc.

(d) Cash receipt of other revenue income

(e) Cash received from sale of investments or assets.

Cash Outflows:

(a) Cash purchases

(b) Cash payment to creditors

(c) Cash payment for other revenue expenditure

(d) Cash payment for assets creation

(e) Cash payment for withdrawals, taxes

(f) Repayment of loans, etc.

Sample of a Cash Flow Statement

Financing Working Capital

Working capital or current assets are those assets, which change their forms rapidly. Due to this, they need to be financed through short-term funds. Short-term funds are also called current liabilities. The following are the major sources of raising short-term funds:

Supplier’s Credit: At times, business gets raw material on credit from the suppliers. The cost of raw material is paid after completion of the credit period. Thus, without having an outflow of cash the business is in a position to use raw material and continue the activities. The credit given by the suppliers of raw materials is for a short period and is considered current liabilities. These funds should be used for creating current assets like stock of raw material, work in process, finished goods, etc.

Bank Loan for Working Capital: This is a major source for raising short-term funds. Banks extend loans to businesses to help them create necessary current assets so as to achieve the required business level. The loans are available for creating the following cur- rent assets:

- Stock of Raw Materials

- Stock of Work in Process

- Stock of Finished Goods

- Debtors

Banks give short-term loans against these assets, keeping some security margin. The advances given by banks against current assets are short-term in nature and banks have the right to ask for immediate repayment if they consider doing so. Thus bank loans for creation of current assets are also current liabilities.

Promoter’s Fund: It is advisable to finance a portion of current assets from the promoter’s funds. They are long-term funds and, therefore do not require immediate repayment. These funds increase the liquidity of the business.