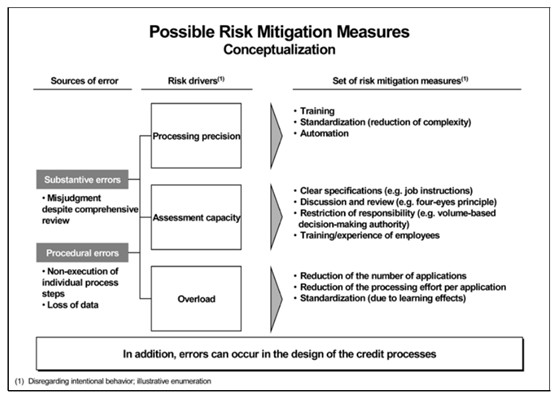

Eradicating complete risk is not possible as there are many unforeseen events which may occur or ones that businesses have no control over. Many of these risks have been discussed in Section 1.4. Though risk is unavoidable, an individual or a business can take measures to minimise the occurrence or repurcussions of credit risk. Apart from external risk, errors that ocurr in-house may also lead to a shortfall in managing risk. Hence as it can be seen in the diagram below, many internal approaches can also be taken by the management to curb risk.

In the following sections, a number of methods and tools are discussed to mitigate portfolio risk caused by external factors and counterparty risk.

Diversification

Diversification involves the spread of lending over different types of borrowers, different economic sectors and different geographical regions. To a certain extent credit limits which help avoid concentration of lending ensures minimum diversification. The spread of lending is likely to reduce serious credit problems. Size however confers an advantage in diversification because large businesses can diversify by industry as well as region.

Lending to foreign governments, their agencies or to foreign private sector companies has added a new dimension to credit risk. Country risk involving the assessment of the present and future economic performance of countries and the stability and character of the government has to supplement credit risk assessment or the creditworthiness of individual borrower. In line with the basic principles of limitation and diversification of credit risk management, credit limit have to be set for individual countries and particular regions of the world.

Methods for Reduction of Credit Risk

Companies can reduce credit risk by,

- Raising credit standards to reject risky loans

- Obtain collateral and guarantees

- Ensure compliance with loan agreement

- Transfer credit risk by selling standardized loans

- Transfer risk of changing interest rates by hedging in financial futures, options or by using swaps

- Create synthetic loans through a hedge and interest rate futures to convert a floating rate loan into a fixed rate loan

- Make loans to a variety of firms whose returns are not perfectly positively correlated

Collateral

‘Collateral’ is an asset normally movable property pledged against the performance of an obligation. A ‘pledge’ is mortgage of a movable property which requires delivery of possession whereas hypothecation does not require delivery.

Examples of collateral are accounts receivable, inventory, banker’s acceptance, time draft like post-dated cheque accepted by importer’s bank (used in foreign trade to make payments) buildings, marketable securities and third party guarantee.

Bank can sell the collateral if the borrower defaults. While collateral reduces the bank’s risk it enhances costs in terms of documentation and monitoring the collateral.

The factors that determine suitability of collateral are,

- Standardization: Standardization helps in identifying the nature of asset that is being used as collateral.

- Durability: Durability refers to useful life or ability to withstand wear and tear. Durable assets make better collateral.

- Identification: Identification is possible, if the collateral has definite characteristics like a building or a serial number (motor vehicle).

- Marketability: Marketable collateral alone is of value to the bank if it has to sell it. Marketability must be distinguished from liquidity.

- Liquidity: Liquidity refers to quick sale with little or no loss from current value.

- Stability of value: The value of collateral should remain stable during the currency of the loan.