A company may raise debt in a variety of ways. It may borrow funds from financial institutions or public either in the form of public deposits or debentures (bonds) for a specified period of time at a certain rate of interest. A debenture or bond may be issued at par or at a discount or premium. The contractual or coupon rate of interest forms the basis for calculating the cost of any form of debt.

Cost of Debt is the overall average rate an organization pays on all its debts, typically consisting primarily of bonds and bank loans. Cost of debt is expressed as an annual percentage. It is important for a business to estimate it cost of debt because after-tax cost of debt which equals before tax cost of debt multiplied by (1 − tax rate), is an important input in the calculation of weighted average cost of capital.

Calculation

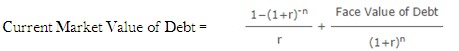

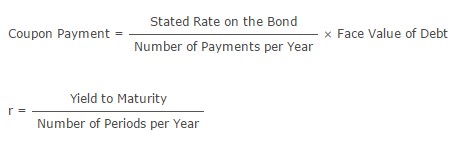

Cost of debt is estimated by calculating the yield to maturity on the debt which is calculated by solving the following equation:

Where,

n = Number of Coupon Payments = Number of Periods per Year × Maturity in Years

Cost of debt is then expressed as an annual APR i.e. cost of debt is equal to number of payments per year times r. In some situations when it is not feasible to estimate yield to maturity, current yield and coupon rate are used as estimates for cost of debt.