The Certified Corporate Law Analyst will build a candidate’s foundation in the law analyst department as per the firm’s requirements for corporate affairs. This certification program is to educate a candidate on different areas in company incorporation, securities allotment, share capital, debentures, registration of charges, proxies, dividend, audit, independent directors, board meetings, sick companies, amalgamations and winding up, national company law tribunal and special courts as well.

Why become a Certified Corporate Law Analyst?

Certified corporate law analyst is introduced for professionals and graduates who wish to grow in their respective areas and this certification is also applicable for the practitioners who are already working and want to achieve better employment opportunities. This certification will help you create your identity in this competitive market through advanced skills and knowledge.

Who should take this certification examination?

For employees looking for job opportunities in legal or corporate affairs departments of different companies and candidates who graduate and want to make their CV stronger this certification is for them. It will help you get better employment opportunities and earning potential as well.

Roles and Responsibilities of a Certified Corporate Law Analyst

Prepare yourself by taking a look at the overview of the tasks undertaken by a Certified Corporate Law Analyst. Mentioned below are the duties of the qualified practitioners

- To undertake legal research and gather all the legal information that is related to legal matters of the firms

- To undertake deciphering laws, rulings, and regulations in legal documents while also assembling, proofreading and amending drafts of leases, contracts, licenses, policies and other legal documents.

- To keep track and study but also develop written summaries of anticipated and endorsed court decisions, legislation, trade journals, regulations, industry standards and other relevant publications.

- To undertake the primary point of contact for internal business teams that seek legal and regulatory support.

- To function the organization and take care of the matters as per the situation of the firm

Benefits of taking Vskills Certification

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and Shine.com

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1161

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Course Details

The Certified Corporate Law Analyst exam covers the following topics –

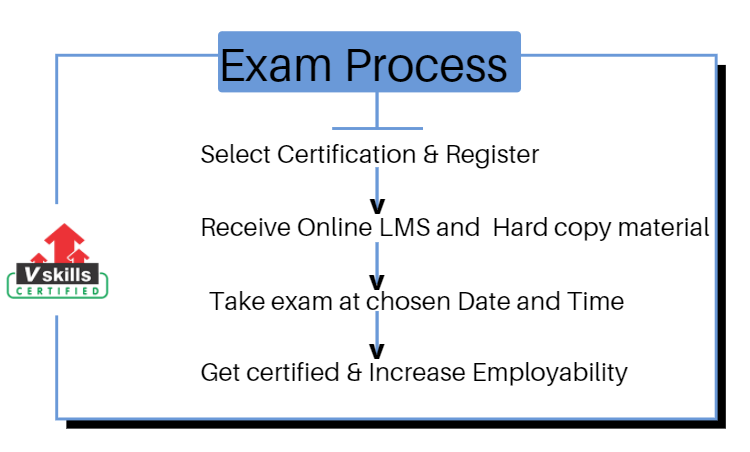

Certify and Increase Opportunity.

Be

Govt. Certified Corporate Law Analyst

1. Incorporation Of Company And Matters

1.1 Formation of company

1.2 Memorandum and Articles

1.3 Act to override memorandum, articles

1.4 Incorporation of company

1.5 Formation of companies with charitable objects

1.6 Effect of registration

1.7 Effect of memorandum and articles

1.8 Commencement of business, etc

1.9 Registered office of company

1.10 Alteration of memorandum and articles

1.11 Alteration of memorandum or articles to be noted in every copy

1.12 Rectification of name of company

1.13 Copies of memorandum, articles, etc, to be given to members

1.14 Conversion of companies already registered

1.15 Subsidiary company not to hold shares in its holding company

1.16 Service of documents

1.17 Authentication of documents, proceedings and contracts

1.18 Execution of bills of exchange, etc

2. Prospectus And Allotment Of Securities

2.1 Public offer and private placement

2.2 Securities and Exchange Board Powers

2.3 Offer of Securities Document

2.4 Matters to be stated in prospectus

2.5 Variation in terms of contract or objects in prospectus

2.6 Offer of sale of shares by certain members of company

2.7 Public offer of securities to be in dematerialized form

2.8 Advertisement of prospectus

2.9 Shelf prospectus

2.10 Red herring prospectus

2.11 Issue of application forms for securities

2.12 Criminal liability for misstatements in prospectus

2.13 Civil liability for misstatements in prospectus

2.14 Punishment for fraudulently inducing persons to invest money

2.15 Action by affected persons

2.16 Punishment for personation for acquisition, etc, of securities

2.17 Allotment of securities by company

2.18 Securities to be dealt with in stock exchanges

2.19 Global depository receipt

2.20 Offer or invitation for subscription of securities on private placement

3. Share Capital And Debentures

3.1 Kinds of share capital

3.2 Nature of shares or debentures

3.3 Numbering of shares

3.4 Certificate of shares

3.5 Voting rights

3.6 Variation of shareholders’ rights

3.7 Calls on shares of same class to be made on uniform basis

3.8 Company to accept unpaid share capital, although not called up

3.9 Payment of dividend in proportion to amount paid-up

3.10 Application of premiums received on issue of shares

3.11 Prohibition on issue of shares at discount

3.12 Issue of sweat equity shares

3.13 Issue and redemption of preference shares

3.14 Transfer and transmission of securities

3.15 Punishment for personation of shareholder

3.16 Refusal of registration and appeal against refusal

3.17 Rectification of register of members

3.18 Publication of authorized, subscribed and paid-up capital

3.19 Power of limited company to alter its share capital

3.20 Further issue of share capital

3.21 Issue of bonus shares

3.22 Notice to be given to Registrar for alteration of share capital

3.23 Reserve share capital by unlimited company on conversion into limited company

3.24 Reduction of share capital

3.25 Restrictions on purchase by company for purchase of its shares

3.26 Power of company to purchase its own securities

3.27 Transfer of certain sums to capital redemption reserve account

3.28 Prohibition for buy-back in certain circumstances

3.29 Debentures

3.30 Power to nominate

4. Acceptance Of Deposits By Companies

4.1 Prohibition on acceptance of deposits from public

4.2 Repayment of deposits, etc, accepted before commencement of this Act

4.3 Damages for fraud

4.4 Acceptance of deposits from public by certain companies

5. Registration Of Charges

5.1 Duty to register charges, etc

5.2 Application for registration of charge

5.3 Section to apply in certain matters

5.4 Date of notice of charge

5.5 Register of charges to be kept by Registrar

5.6 Company to report satisfaction of charge

5.7 Power of Registrar in absence of intimation from company

5.8 Intimation of appointment of receiver or manager

5.9 Company’s register of charges

5.10 Punishment for contravention

5.11 Rectification by Central Government in register of charges

6. Management And Administration

6.1 Register of members, etc

6.2 Declaration in respect of beneficial interest in any share

6.3 Investigation of beneficial ownership of shares in certain cases

6.4 Power to close register of members or debenture holders or other security holders

6.5 Annual return

6.6 Return to be filed with Registrar in case promoters’ stake changes

6.7 Place of keeping and inspection of registers, returns, etc

6.8 Registers, etc, to be evidence

6.9 Annual general meeting

6.10 Power of Tribunal to call annual general meeting

6.11 Power of Tribunal to call meetings of members, etc

6.12 Punishment for default in complying with provisions of sections to

6.13 Calling of extraordinary general meeting

6.14 Notice of meeting

6.15 Statement to be annexed to notice

6.16 Quorum for meetings

6.17 Chairman of meetings

6.18 Proxies

6.19 Restriction on voting rights

6.20 Voting by show of hands

6.21 Voting through electronic means

6.22 Demand for poll

6.23 Postal ballot

6.24 Circulation of members’ resolution

6.25 Representation of President and Governors in meetings

6.26 Representation of corporations at meeting of companies and of creditors

6.27 Ordinary and special resolutions

6.28 Resolutions requiring special notice

6.29 Resolutions passed at adjourned meeting

6.30 Resolutions and agreements to be filed

6.31 Board of Directors Meeting and resolutions passed by postal ballot

6.32 Inspection of minute-books of general meeting

6.33 Maintenance and inspection of documents in electronic form

6.34 Report on annual general meeting

6.35 Applicability of this Chapter to One Person Company

7. Declaration And Payment Of Dividend

7.1 Declaration of dividend

7.2 Unpaid Dividend Account

7.3 Investor Education and Protection Fund

7.4 Right to dividend, rights shares and bonus shares

7.5 Punishment for failure to distribute dividends

8. Accounts Of Companies

8.1 Books of account, etc, to be kept by company

8.2 Financial statement

8.3 Re-opening of accounts on court’s or Tribunal’s orders

8.4 Voluntary revision of financial statements or Board’s report

8.5 Constitution of National Financial Reporting Authority

8.6 Central Government to prescribe accounting standards

8.7 Financial Statement, Board’s report, etc

8.8 Corporate Social Responsibility

8.9 Right of member to copies of audited financial statement

8.10 Copy of financial statement to be filed with Registrar

8.11 Internal Audit

9. Audit And Auditors

9.1 Appointment of auditors

9.2 Removal, resignation of auditor and giving of special notice

9.3 Eligibility, qualifications and disqualifications of auditors

9.4 Remuneration of auditors

9.5 Powers and duties of auditors and auditing standards

9.6 Auditor not to render certain services

9.7 Auditors to sign audit reports

9.8 Auditors to attend general meeting

9.9 Punishment for contravention

9.10 Central Government specifying audit of items of cost for certain companies

10. Appointment And Qualifications Of Directors

10.1 Company to have Board of Directors

10.2 Selection of independent directors

10.3 Appointment of director elected by small shareholders

10.4 Appointment of directors

10.5 Application for allotment of Director Identification Number

10.6 Allotment of Director Identification Number

10.7 Prohibition to obtain more than one Director Identification Number

10.8 Director to intimate Director Identification Number

10.9 Company to inform Director Identification Number to Registrar

10.10 Obligation to indicate Director Identification Number

10.11 Punishment for contravention

10.12 Right of persons other than retiring directors to stand for directorship

10.13 Appointment of additional director, alternate director and nominee director

10.14 Appointment of directors to be voted individually

10.15 Principle of proportional representation for appointment of directors

10.16 Disqualifications for appointment of director

10.17 Number of directorships

10.18 Duties of directors

10.19 Vacation of office of director

10.20 Resignation of director

10.21 Removal of directors

10.22 Register of directors and key managerial personnel and their shareholding

10.23 Members’ right to inspect

10.24 Punishment

11. Meetings Of Board And Its Powers

11.1 Meetings of Board

11.2 Quorum for meetings of Board

11.3 Passing of resolution by circulation

11.4 Defects in appointment of directors not to invalidate actions taken

11.5 Audit committee

11.6 Nomination and remuneration committee and stakeholders relationship committee

11.7 Powers of Board

11.8 Restrictions on powers of Board

11.9 Company to contribute to bona fide and charitable funds, etc

11.10 Prohibitions and restrictions regarding political contributions

11.11 Power of Board and other persons to make contributions to national defence fund,

11.12 Disclosure of interest by director

11.13 Loan to directors, etc

11.14 Loan and investment by company

11.15 Investments of company to be held in its own name

11.16 Related party transactions

11.17 Register of contracts or arrangements in which directors are interested

11.18 Contract of employment with managing or whole-time directors

11.19 Payment to director

11.20 Restriction on non-cash transactions involving directors

11.21 Contract by One Person Company

11.22 Prohibition on forward dealings in securities

11.23 Prohibition on insider trading of securities

12. Appointment And Remuneration Of Managerial Personnel

12.1 Appointment of managing director, whole-time director or manager

12.2 Maximum managerial remuneration

12.3 Calculation of profits

12.4 Recovery of remuneration in certain cases

12.5 Central Government or company to fix limit with regard to remuneration

12.6 Forms of, and procedure in relation to, certain applications

12.7 Compensation for loss of office of managing or whole-time director or manager

12.8 Appointment of key managerial personnel

12.9 Secretarial audit for bigger companies

12.10 Functions of company secretary

13. Inspection, Inquiry And Investigation

13.1 Power to call for information, inspect books and conduct inquiries

13.2 Conduct of inspection and inquiry

13.3 Report on inspection made

13.4 Search and seizure

13.5 Investigation into affairs of company

13.6 Establishment of Serious Fraud Investigation Office

13.7 Investigation into affairs of company by Serious Fraud Investigation Office

13.8 Investigation into company’s affairs in other cases

13.9 Security for payment of costs and expenses of investigation

13.10 Firm, body corporate or association not to be appointed as inspector

13.11 Investigation of ownership of company

13.12 Procedure, powers, etc, of inspectors

13.13 Protection of employees during investigation

13.14 Power of inspector to conduct investigation into affairs of related companies, etc

13.15 Seizure of documents by inspector

13.16 Freezing of assets of company on inquiry and investigation

13.17 Imposition of restrictions upon securities

13.18 Inspector’s report

13.19 Actions to be taken in pursuance of inspector’s report

13.20 Expenses of investigation

13.21 Voluntary winding up of company, etc, not to stop investigation proceedings

13.22 Legal advisers and bankers not to disclose certain information

13.23 Investigation, etc, of foreign companies

13.24 Penalty for furnishing false statement, mutilation, destruction of documents

14. Compromises, Arrangements And Amalgamations

14.1 Power to compromise or make arrangements with creditors and members

14.2 Power of Tribunal to enforce compromise or arrangement

14.3 Merger and amalgamation of companies

14.4 Merger or amalgamation of certain companies

14.5 Merger or amalgamation of company with foreign company

14.6 Power to acquire shares of shareholders

14.7 Purchase of minority shareholding

14.8 Power of Central Government for amalgamation of companies in public interest

14.9 Registration of offer of schemes involving transfer of shares

14.10 Preservation of books and papers of amalgamated companies

14.11 Liability of officers

15. Prevention Of Oppression And Mismanagement

15.1 Application to Tribunal for relief in cases of oppression, etc

15.2 Powers of Tribunal

15.3 Consequence of termination or modification of certain agreements

15.4 Right to apply under section

15.5 Class action

15.6 Application of certain provisions to proceedings under section or section

16. Registered Valuers

16.1 Valuation by registered valuers

17. Removal Of Names Of Companies From The Register Of Companies

17.1 Power of Registrar to remove name of company from register of Companies

17.2 Restrictions on making application under section in certain situations

17.3 Effect of company notified as dissolved

17.4 Fraudulent application for removal of name

17.5 Appeal to Tribunal

18. Revival And Rehabilitation Of Sick Companies

18.1 Determination of sickness

18.2 Application for revival and rehabilitation

18.3 Exclusion of certain time in computing period of limitation

18.4 Appointment of interim administrator

18.5 Committee of creditors

18.6 Order of Tribunal

18.7 Appointment of administrator

18.8 Powers and duties of company administrator

18.9 Scheme of revival and rehabilitation

18.10 Sanction of scheme

18.11 Scheme to be binding

18.12 Implementation of scheme

18.13 Winding up of company on report of company administrator

18.14 Power of Tribunal to assess damages against delinquent directors, etc

18.15 Punishment for certain offences

18.16 Bar of jurisdiction

18.17 Rehabilitation and Insolvency Fund

19. Winding Up

19.1 Modes of winding up

19.2 Winding up by the Tribunal

19.3 Circumstances in which company may be wound up by Tribunal

19.4 Petition for winding up

19.5 Powers of Tribunal

19.6 Directions for filing statement of affairs

19.7 Company Liquidators and their appointments

19.8 Removal and replacement of liquidator

19.9 Intimation to Company Liquidator, provisional liquidator and Registrar

19.10 Effect of winding up order

19.11 Stay of suits, etc, on winding up order

19.12 Jurisdiction of Tribunal

19.13 Submission of report by Company Liquidator

19.14 Directions of Tribunal on report of Company Liquidator

19.15 Custody of company’s properties

19.16 Promoters, directors, etc, to co-operate with Company Liquidator

19.17 Settlement of list of contributories and application of assets

19.18 Obligations of directors and managers

19.19 Advisory Committee

19.20 Submission of periodical reports to Tribunal

19.21 Power of Tribunal on application for stay of winding up

19.22 Powers and duties of Company Liquidator

19.23 Provision for professional assistance to Company Liquidator

19.24 Exercise and control of Company Liquidator’s powers

19.25 Books to be kept by Company Liquidator

19.26 Audit of Company Liquidator’s accounts

19.27 Payment of debts by contributory and extent of set-off

19.28 Power of Tribunal to make calls

19.29 Adjustment of rights of contributories

19.30 Power to order costs

19.31 Power to summon persons suspected of having property of company, etc

19.32 Power to order examination of promoters, directors, etc

19.33 Arrest of person trying to leave India or abscond

19.34 Dissolution of company by Tribunal

19.35 Appeals from orders made before commencement of Act

20. Voluntary winding up

20.1 Circumstances in which company may be wound up voluntarily

20.2 Declaration of solvency in case of proposal to wind up voluntarily

20.3 Meeting of creditors

20.4 Publication of resolution to wind up voluntarily

20.5 Commencement of voluntary winding up

20.6 Effect of voluntary winding up

20.7 Appointment of Company Liquidator

20.8 Power to remove and fill vacancy of Company Liquidator

20.9 Notice of appointment of Company Liquidator to be given to Registrar

20.10 Cesser of Board’s powers on appointment of Company Liquidator

20.11 Powers and duties of Company Liquidator in voluntary winding up

20.12 Appointment of committees

20.13 Company Liquidator to submit report on progress of winding up

20.14 Report of Company Liquidator to Tribunal for examination of persons

20.15 Final meeting and dissolution of company

20.16 Power of Company Liquidator

20.17 Distribution of property of company

20.18 Arrangement when binding on company and creditors

20.19 Power to apply to Tribunal to have questions determined, etc

20.20 Costs of voluntary winding up

21. Provisions applicable to every mode of winding up

21.1 Debts of all descriptions to be admitted to proof

21.2 Application of insolvency rules in winding up of insolvent companies

21.3 Overriding preferential payments

21.4 Preferential payments

21.5 Fraudulent preference

21.6 Transfers not in good faith to be void

21.7 Certain transfers to be void

21.8 Liabilities and rights of certain persons fraudulently preferred

21.9 Effect of floating charge

21.10 Disclaimer of onerous property

21.11 Transfers, etc, after commencement of winding up to be void

21.12 Certain attachments, executions, etc, in winding up by Tribunal to be void

21.13 Offences by officers of companies in liquidation

21.14 Penalty for frauds by officers

21.15 Liability where proper accounts not kept

21.16 Liability for fraudulent conduct of business

21.17 Power of Tribunal to assess damages against delinquent directors, etc

21.18 Liability under sections

21.19 Prosecution of delinquent officers and members of company

21.20 Company Liquidator to exercise certain powers subject to sanction

21.21 Statement that company is in liquidation

21.22 Books and papers of company to be evidence

21.23 Inspection of books and papers by creditors and contributories

21.24 Disposal of books and papers of company

21.25 Information as to pending liquidations

21.26 Official Liquidator to make payments into public account of India

21.27 Company Liquidator to deposit monies into scheduled bank

21.28 Liquidator not to deposit monies into private banking account

21.29 Company Liquidation Dividend and Undistributed Assets Account

21.30 Liquidator to make returns, etc

21.31 Meetings to ascertain wishes of creditors or contributories

21.32 Court, Tribunal or person, etc, before whom affidavit may be sworn

21.33 Powers of Tribunal to declare dissolution of company void

21.34 Commencement of winding up by Tribunal

21.35 Exclusion of certain time in computing period of limitation

22. Official liquidators

22.1 Appointment of Official Liquidator

22.2 Powers and functions of Official Liquidator

22.3 Summary procedure for liquidation

22.4 Sale of assets and recovery of debts due to company

22.5 Settlement of claims of creditors by Official Liquidator

22.6 Appeal by creditor

22.7 Order of dissolution of company

23. Companies authorized to register under this Act

23.1 Companies capable of being registered

23.2 Certificate of registration of existing companies

23.3 Vesting of property on registration

23.4 Saving of existing liabilities

23.5 Continuation of pending legal proceedings

23.6 Effect of registration under this Part

23.7 Power of Court to stay or restrain proceedings

23.8 Suits stayed on winding up order

23.9 Obligation of Companies registering under this Part

24. Winding up of unregistered companies

24.1 Winding up of unregistered companies

24.2 Power to wind up foreign companies although dissolved

24.3 Provisions of Chapter cumulative

24.4 Saving and construction of enactments conferring power to wind up partnership firm, association or company, etc, in certain cases

25. Companies Incorporated Outside India

25.1 Application of Act to foreign companies

25.2 Documents, etc, to be delivered to Registrar by foreign companies

25.3 Accounts of foreign company

25.4 Display of name, etc, of foreign company

25.5 Service on foreign company

25.6 Debentures, annual return, books of account and their inspection

25.7 Fee for registration of documents

25.8 Interpretation

25.9 Dating of prospectus and particulars to be contained therein

25.10 Provisions as to expert’s consent and allotment

25.11 Registration of prospectus

25.12 Offer of Indian Depository Receipts

25.13 Application of sections to and Chapter XX

25.14 Punishment for contravention

25.15 Company’s failure to comply

26. Government Companies

26.1 Annual reports on Government companies

26.2 Annual reports where one or more State Governments are members of companies

27. Registration Offices And Fees

27.1 Registration offices

27.2 Admissibility of certain documents as evidence

27.3 Filing of applications, documents, inspection, etc, in electronic form

27.4 Inspection, production and evidence of documents kept by Registrar

27.5 Electronic form to be exclusive, alternative or in addition to physical form

27.6 Provision of value added services through electronic form

27.7 Application of provisions of Information Technology Act,

27.8 Fee for filing, etc

27.9 Fees, etc, to be credited into public account

28. Companies To Furnish Information Or Statistics

28.1 Central Government power to furnish information or statistics by companies

29. Nidhis

29.1 Power to modify Act in its application to Nidhis

30. National Company Law Tribunal

30.1 Constitution of National Company Law Tribunal

30.2 Qualification of President and Members of Tribunal

30.3 Constitution of Appellate Tribunal

30.4 Qualifications of Chairperson and members of Appellate Tribunal

30.5 Selection of Members of Tribunal and Appellate Tribunal

30.6 Term of office of President, Chairperson and other Members

30.7 Salary, allowances and other terms and conditions of service of Members

30.8 Acting President and Chairperson of Tribunal or Appellate Tribunal

30.9 Resignation of Members

30.10 Removal of Members

30.11 Staff of Tribunal and Appellate Tribunal

30.12 Benches of Tribunal

30.13 Orders of Tribunal

30.14 Appeal from Orders of Tribunal

30.15 Expeditious disposal by Tribunal and Appellate Tribunal

30.16 Appeal to Supreme Court

30.17 Procedure before Tribunal and Appellate Tribunal

30.18 Power to punish for contempt

30.19 Delegation of powers

30.20 President, Members, officers, etc, to be public servants

30.21 Protection of action taken in good faith

30.22 Power to seek assistance of Chief Metropolitan Magistrate, etc

30.23 Civil court not to have jurisdiction

30.24 Vacancy in Tribunal or Appellate Tribunal not to invalidate acts or proceedings

30.25 Right to legal representation

30.26 Limitation

30.27 Transfer of certain pending proceedings

31. Special Courts

31.1 Establishment of Special Courts

31.2 Offences triable by Special Courts

31.3 Appeal and revision

31.4 Application of Code to proceedings before Special Court

31.5 Offences to be non-cognizable

31.6 Transitional provisions

31.7 Compounding of certain offences

31.8 Mediation and conciliation penal

31.9 Power of Central Government to appoint company prosecutors

31.10 Appeal against acquittal

31.11 Compensation for accusation without reasonable cause

31.12 Application of fines

32. Miscellaneous

32.1 Punishment for fraud

32.2 Punishment for false statements

32.3 Punishment for false evidence

32.4 Punishment where no specific penalty or punishment is provided

32.5 Punishment in case of repeated default

32.6 Punishment for wrongful withholding of property

32.7 Punishment for improper use of “Limited” or “Private Limited”

32.8 Adjudication of penalties

32.9 Dormant company

32.10 Protection of action taken in good faith

32.11 Non-disclosure of information in certain cases

32.12 Delegation by Central Government of its powers and functions

32.13 Powers of Central Government or Tribunal to accord approval

32.14 Condonation of delay in certain cases

32.15 Annual report by Central Government

32.16 Power to exempt class or classes of companies from provisions of this Act

32.17 Power of court to grant relief in certain cases

32.18 Prohibition of association or partnership of persons exceeding certain number

32.19 Repeal of certain enactments and savings

32.20 Dissolution of Company Law Board and consequential provisions

32.21 Power of Central Government to amend Schedules

32.22 Powers of Central Government to make rules relating to winding up

32.23 Power of Central Government to make rules

32.24 Power to remove difficulties

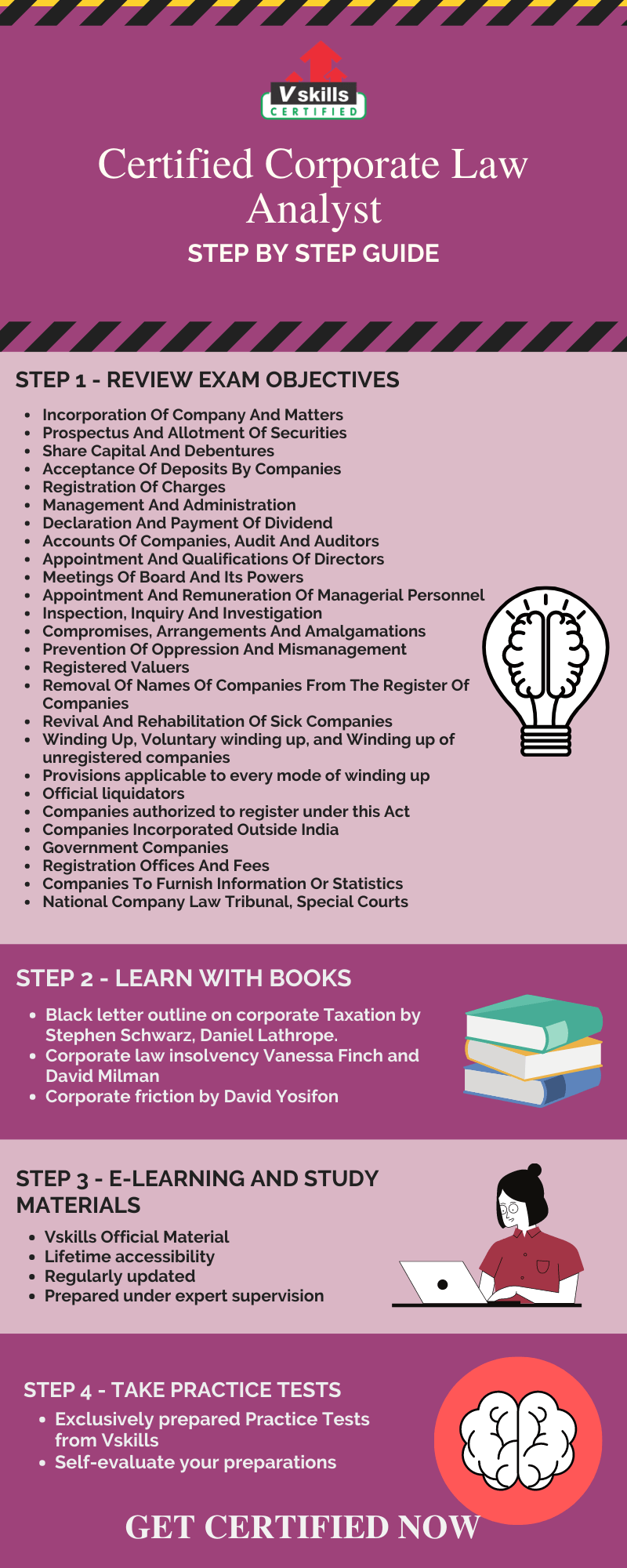

Preparation Guide for Vskills Certified Corporate Law Analyst

If you want to prepare well for this certification exam, you must take support of a reliable and quality preparation guide which consists all you need for the preparation. It will keep your mind active and make your study schedules easy. Below are some important resources that you must follow for this examination preparation.

Step 1 – Review Exam Objectives

Every exam objective will showcase what you are about to learn and what needs to be improved according to your weaknesses. Preparation gets a little easy after you know the syllabus which you are supposed to prepare and brings improvement in your performance.

- Incorporation Of Company And Matters

- Prospectus And Allotment Of Securities

- Share Capital And Debentures

- Acceptance Of Deposits By Companies

- Registration Of Charges

- Management And Administration

- Declaration And Payment Of Dividend

- Accounts Of Companies, Audit And Auditors

- Appointment And Qualifications Of Directors

- Meetings Of Board And Its Powers

- Appointment And Remuneration Of Managerial Personnel

- Inspection, Inquiry And Investigation

- Compromises, Arrangements And Amalgamations

- Prevention Of Oppression And Mismanagement

- Registered Valuers

- Removal Of Names Of Companies From The Register Of Companies

- Revival And Rehabilitation Of Sick Companies

- Winding Up, Voluntary winding up, and Winding up of unregistered companies

- Provisions applicable to every mode of winding up

- Official liquidators

- Companies authorized to register under this Act

- Companies Incorporated Outside India

- Government Companies

- Registration Offices And Fees

- Companies To Furnish Information Or Statistics

- National Company Law Tribunal, Special Courts

Refer: Certified Corporate Law Analyst Brochure

Step 2 – Learning with Books

Books are always our reliable method to gain knowledge. It has myriads of concepts mentioned in different ways which makes out learning easy and effective. There are many books written by different authors and they showcase their experiences in those books which gives you detailed knowledge about the topic. The books mentioned below are the top 3 books which you can consider for this certification.

- Black letter outline on corporate Taxation by Stephen Schwarz, Daniel Lathrope. The book has highlighted courses in corporate taxation at both the J.D. and LL.M. levels and adding transactions affecting C and S corporations and their shareholders and includes numerous illustrative examples as well.

- Corporate law insolvency Vanessa Finch and David Milman. This book is all about the knowledge regarding corporate Insolvency Law builds on the unique and influential analytical framework established in previous editions and examines insolvency law in the fast-evolving commercial world.

- Corporate friction by David Yosifon. The book holds rich insights on how to manage firms in the interests of shareholders, which means never sacrificing profits in the service of other stakeholders or interests.

Step 3 – E-learning and Study material

E-learning helps you improve your grasping skills and teaches your time management as well. Online learning motivates you to study better as the learning process turns easy through the visual method which is one of the advantages of online learning. Vskills offers you its E-Learning Study Material and its hard copy as well, to supplement your learning experience and exam preparation. Moreover, this online learning material is available for a lifetime and is updated regularly.

Refer: Certified Corporate Law Analyst Sample Chapter

Step 4 – Check your Progress with Practice Tests

Last step after any preparation is to evaluate your progress. Before you take a practice test make sure you have learned all the topics properly. Practice tests will help you to acknowledge your weaker areas and the areas you have already mastered. Attempt multiple practice tests to prepare yourself for the real examination; it will improve your answering skills as well.