Weaker brand manufacturers, particularly those lacking a long- term planning horizon, were unable to find a convincing argument to counter retailers’ demands for extra discounts. They were worried about being de-listed and saw no other alternative but to agree to disproportionately large discounts. Many erroneously viewed this as part of their promotional budget and failed to appreciate the implication of biasing their promotion budget to the trade at the expense of consumers.

Weak manufacturers’ brands were not generating sufficient returns to fund either maintenance programmers or investments in new products. At the next negotiating round with retailers, it was made clear that their sales were deteriorating and again they were forced to buy shelf space through even larger discounts. In the vicious circle shown in the figure, they were soon on the spiral of rapid decline. From the vicious circle of deteriorating brand position, it can be appreciated that own labels are particularly strong in markets where –

- There is excess manufacturing capacity

- Products are perceived as commodities – inexpensive and low risk purchases;

- Products can be easily compared by consumers;

- Low levels of manufacturer investment are common and the production processes employ low technology;

- There are high price gaps in the market and retailers have the resources to invest in high-quality own label development;

- Variability in quality is low and distribution is well- developed; the credibility of a branded product is low because of frequent and deep price promotions as opposed to the increasing credibility of own labels;

- Branded products are offered in few varieties and with rare innovations, enabling the own label producer to offer a clear alternative.

By contrast, strong brand manufacturers such as Unilever, Heinz and Nestle, realized that the future of strong brands lies in a commitment to maintaining unique added values and communicating these to consumers. They ‘bit the bullet’, realizing that to succeed they would have to support the trade, but not at the expense of the consumer. Instead, they invested both in production facilities for their current brands and in new brand development work. With strong manufacturers communicating their brands’ values to consumers, these were recognized and choice in these product fields became more strongly influenced by quality and perceptions of brand personality. Retailers recognized these manufacturers’ commitment behind their brands and wanted to stock them, Distribution increased through the right sorts of retailers, enabling brand sales and profits to grow, and Healthy returns enabled further brand investment and, as Figure 7.4 shows, strong brands thrived.

The confectionary market in the UK is a good example of a sector where strong manufacturers’ brands dominate. The major players Mars, Nestle and Cadbury are continually launching new brands and heavily advertising their presence. Interestingly, the power of multiple retailers is also dissipated by virtue of a significant proportion of sales going through confectioners, tobacconists and newsagents, along with vending machines and garage forecourts. The same circumstances apply to Coca-Cola and Pepsi-Cola, who are less dependent on the multiple retailers.

In the broadest terms, retail outlets can be classified as being convenience or non-convenience outlets, for which two different types of brand strategies are appropriate. Convenience outlets have a geographical coverage, making it easy for consumers to access them. The goods sold are not specialty items and consumers generally feel confident making brand selections. Consumers do not need detailed pack information to make a choice between alternatives. In convenience outlets, retailers strive for volume efficiencies. They typically include retailers of grocery and home improvement products.

In convenience outlets, manufacturers’ brands will thrive only if they are strongly differentiated. This necessitates having added values that consumers appreciate, a strong promotional commitment and packaging that rapidly communicates the brands’ added values. Displaying a lot of information on the packaging may well be ineffective, since consumers want to make fast brand selections with minimal search effort. Brand manufacturers need to ensure that they gain listings in retailers with the broadest coverage, ensuring minimal travel difficulties for consumers.

In non-convenience outlets, such as jewelers and electrical retailers, consumers will be more likely to seek more information and may well be prepared to spend time visiting a few retailers. To thrive in these outlets, manufacturers need to ensure that clear information is available at point of purchase. In particular, retailers’ staff needs to be fully aware of the brand’s capabilities, since consumers often seek their advice. Unless sales assistants display a positive attitude about the brand and correctly explain its capabilities, they will not help it sell.

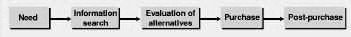

While a number of psychological variables are useful in obtaining a glimpse of the consumers’ psyche, it would be worthwhile to probe specific aspects of consumer decision- making (CDM) to formulate marketing strategies. CDM could enable marketers to visualize a broad framework made up of stages and apply psychological or/and group variables to a specific product/market/brand situation. The process of decision-making could provide several trigger points on a conceptual level, especially when a brand wants to position itself in a crowded product category or when it wants to enter a ‘new- concept’ product category or when it attempts to reposition itself. There are a number of dimensions that could be associated with the consumer’s decision-making process. The following are some –

What kind of approach (strategy) should a brand adopt when it enters a crowded category with which consumers are familiar? (Soaps, shampoos, two-wheelers, and so on)

- How should a brand promote a ‘new-concept’ product and how are the stages in the CDM framework useful?

- What strategies other than advertising may be useful in specific stages of consumer decision-making?

- How could celebrities be used at different stages in the decision-making process?

- What are the different kinds of decision-making consumers indulge in?

- What are specific differences in CDM between FMCG products and durables?

- Can needs be differentiated based on what a brand offers?

- Do consumers have different kinds of ‘sets’ from which they select brands?

- What kind of strategies could a brand use when consumers search for information?

- How do consumers use evaluative criteria to take a decision across brands?

- What kinds of factors influence the selection of retail outlets when a decision is taken to buy a product?

The dimensions mentioned have strong links with one another and also play a significant role in CDM. They focus the attention of any marketer in consumer product categories towards the consumers’ perception of a category, a brand and their own needs.

The chart above shows the several stages involved in consumer decision-making. It is useful to understand the basic model of CDM and its implications for marketers before considering its other aspects. Whenever a new product category is introduced by marketers with a new concept, concept selling would have to be done at the need stage, examining the actual and desired states of the consumer. Ceasefire, the mini fire-extinguisher which kick-started a new wave of demand among households, was able to market the concept using primary advertising (The brand no longer retains the same hold over the market now due to a variety of reasons.) Though the fire extinguisher concept was not new to the market, a mini version was. It was able to trigger a perception very different from the huge and heavy traditional ones that were widely used in cinema halls. The primary advertising mentioned the fact that different kinds of fires (with an overtone of fear appeal) required different kinds of extinguishing gases and that Ceasefire was the ideal solution for the need. Concept selling has to discuss in detail the benefits of the product and how these solved the existing problem of consumers or how they helped consumers to reach a ‘desired state’.

While primary advertising concentrates more on the benefits of the product, with the objective of creating a market for the product, secondary advertising has a focus on the brand. In case of a pioneering brand bringing in a new concept, primary advertising has to be supplemented simultaneously with secondary advertising to ensure the pioneering brand gets the competitive advantage of having marketed the concept. Titan may not have been a pioneering brand in quartz watches but it is currently a leading brand because of the brand-building efforts undertaken by the brand though it was a ‘follower’ brand.