Competitor analysis represents a necessary adjunct to performing an industry analysis. An industry analysis provides information regarding potential sources of competition (including the possible strategic actions and reactions and effects on profitability for all companies competing in an industry). However, a structured competitor analysis enables a company to focus its attention on those companies with which it will directly compete, and is especially important when a company faces a few powerful competitors.

Competitor analysis is interested ultimately in developing a profile on how competitors might be expected to react in response to a company’s strategic moves.

A major concern too many managers are the methods that are used to gather data on competitors; a process generally referred to as competitor intelligence. The managerial challenge is to ensure that all data and information related to competitors is gathered both legally and ethically This is important because many employees may feel pressure to rely on techniques that are questionable from an ethical perspective to gather information that may be valuable to their company, especially if they perceive value to their own careers from successfully obtaining such information.

It seems obvious that information that is either publicly available (annual reports, regulatory filings, brochures, advertising and promotional materials) or is obtained by attending trade shows and conventions can be used without ethical or legal implications. However, information obtained illegally (as a result of activities such as theft, blackmail, or eavesdropping) cannot, or, at least, should not, be used as its use is unethical as well as illegal.

Most companies now have websites which provide a lot of information for the benefit of its customers, but none information is available for everyone, including the competitors.

Another indication of the importance of competitive intelligence is the emergence of “Webspying service” companies, also known as corporate intelligence companies. Dow Chemical hired one such company to determine (through studying competitor Websites) whether competitors had developed, or were in the process of developing, a particular clay/plastic composite product.

Companies need to be careful when posting information on their Websites and treat each item as carefully as though they were preparing to publish it in their annual reports. Companies should also verify information posted about their company on other companies’ Websites.

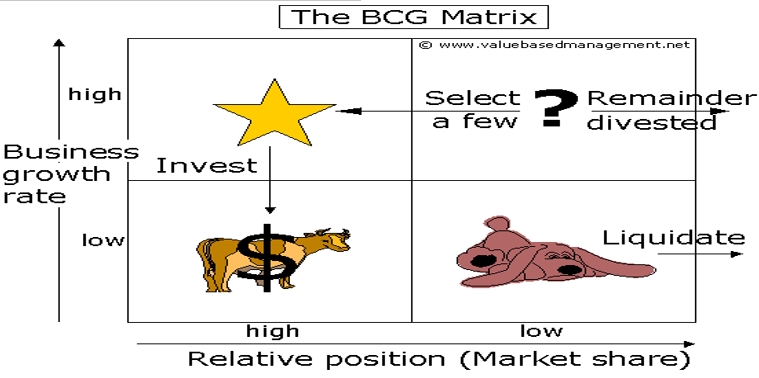

The BCG Matrix

To ensure long-term value creation, a company should have a portfolio of products that contains both high-growth products in need of cash inputs and low-growth products that generate a lot of cash. The BCG matrix is a tool that can be used to determine what priorities should be given in the product portfolio of a business unit. It has 2 dimensions: market share and market growth. The basic idea behind it is that the bigger the market share a product has or the faster the product’s market grows the better it is for the company.