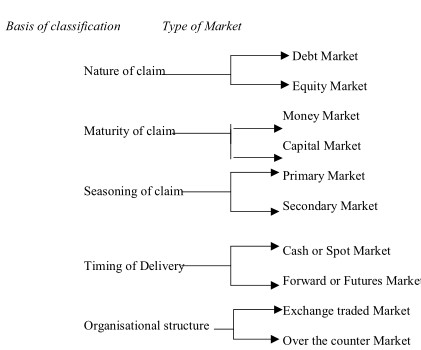

There are different ways of classifying financial markets. They are as follows:

The debt market is the financial market for fixed claims(debt instrument) and equity market is the financial market for residual claims(equity instruments)

Money market is the market for short term financial claims. Capital market is the market for long term financial claims. Since short term financial claims are almost invariably debt claims, the money market is the market for short term debt instruments and the capital market is the market for long term debt instruments and equity instruments.

Third way to classify financial markets is based on whether the claim represents new issues or outstanding issues. The market where issuers sell new claims is referred to as the primary market and the market where investors trade outstanding securities is called the secondary market.

A cash or spot market is one where the delivery occurs immediately and a forward or futures market is one where the delivery occurs at a pre-determined time in future.

An exchange-traded market is characterized by a centralized organization with standardized procedures. An over the counter market is a decentralized market with customized procedures.

A primary market is one in which an Issuer/Company enters to raise capital. They issue new securities in exchange for cash from an investor (buyer). If the Issuer is selling securities for the first time, these are referred to as Initial Public Offer (IPO). Primary Market is the means by which companies float shares to the general public in an Initial Public Offering to raise capital. For example, if the promoters of a private company ABC makes its shares available to investors, ABC is said to have entered the primary market. Once new securities have been sold in the Primary Market, an efficient mechanism must exist for their resale.

Secondary Market transactions are referred to those transactions where one investor buys shares from another investor at the prevailing market price or at a price both the buyer and seller agree upon. For example, if one of the investors who had invested in the shares of ABC sold it to another at an agreed upon price, a Secondary Market transaction is said to have taken place. Normally investors transact in securities using an intermediary such as a broker who facilitates the process.

Stocks and shares are bought and sold through the stock exchanges established within a country. Stock Exchange is a place that provides facilities to stock brokers to trade company stocks and other securities. A stock may be bought or sold only if it is listed on an exchange. Thus it is the meeting place of the stock buyers and sellers. India’s premier Stock Exchanges are the Bombay Stock Exchange and the National Stock Exchange.

In India, the Secondary Market or the Stock Exchanges are regulated by the regulatory authority called the Security and Exchange Board of India (SEBI). The Government of India established SEBI in 1988 and within a short period of time, it became an autonomous body through the SEBI Act passed in 1992. It has defined responsibilities that cover both development & regulation of the market while also giving the board independent powers. Comprehensive regulatory measures introduced by SEBI ensured that end investors benefited from safe and transparent dealings in securities.

Types of Stocks

The market value of a stock is evaluated on the basis of its capitalization or “cap” for short. This is indicative of the size of the stock available.

Formula for calculating a stock’s capitalization

Market Capitalization = Market Price of the stock x Number of the stock’s outstanding shares.

(Outstanding means the shares held by the public). For example, if Stock X has a Current Market Price of Rs 20 per share, and there are 1, 00,000 shares in the hands of public investors, then Stock X has a capitalization of 20, 00,000.

The company’s capitalization is an effective parameter to group corporate stocks.

In India, shares are classified as large-cap, mid-cap, and small-cap made on the basis of the relative size of the market.

- Small-cap Stocks: The first category, small-cap stocks, consists of shares of small companies that have the potential to grow rapidly. Normally companies that have a market capitalization up to rupees 250 crores are small cap stocks. Small-caps are the best used by an investor when he or she wants to earn good gains in the long run, but at the same time they must also not emphasis on current dividends or price stability. As many of these companies are comparatively new, it is tough to forecast how they will perform in the market. For these companies, sudden growth considerably affects their values and revenues which results in their stock prices soaring. The same may happen on the downside as well. Because small-caps are highly growth oriented, small-cap stocks can forego paying dividends to investors, which enables the profits earned to be reinvested for future growth. This is why aggressive mutual funds prefer adding small-cap stocks in the portfolios under them.

- Mid-cap Stocks: Mid-cap stocks belong to medium-sized companies. By and large the companies that have a market capitalization in the range of Rs. 250-4000 crores are mid cap stocks. The pertinent companies are usually well-known and recognized as seasoned players in the market. There are two advantages offered by trading these types of stocks. They have good growth potential as well as the stability of a larger company. A company that has shown steady growth backed by a good track record earns the title of being a “blue chip” company. They are like blue-chip stocks which are usually large-cap stocks but lack their size. These stocks tend to grow well over the long term.

- Large-cap Stocks: The stocks being traded of the largest companies in the market such as Tata, Reliance, SBI, Infosys etc. fall in the category of large-cap stocks. Being well-established companies, they have available large disposable reserves of cash to develop new business prospects. Large-cap stocks usually do not growth rapidly because of the large volumes of shares. Therefore, smaller capitalized companies and the smaller stocks tend to outperform them from time to time. Investors benefit out of possessing these stocks by availing the relatively higher dividends offered by the shares and also ensure the long-term preservation of their capital.